JaguarConsumer Weekly Callouts – March 26 (BUD, COST, DNUT, LULU, SFM)

![]()

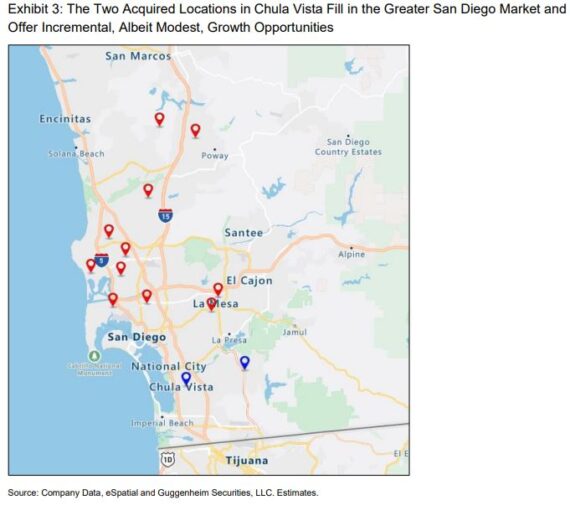

RBC Capital recently visited some stores in Mexico City with Anheuser-Busch InBev (BUD). Apparently, it was the first time they saw the BEES digital platform in action.

For AB InBev, this platform removes much of the mechanical, low value-added elements of the salesperson’s job while providing vast amounts of incremental data on customers’ business. It’s also opened up the prospect of distributing non-AB InBev products through the BEES marketplace which had sales of $850M in 2022.

“We did find the AB InBev people we spoke to were universally fervent in their admiration for BEES. Here’s why there might be more to it than we had appreciated.”

• It gives customers greater flexibility to replenish stock when they need it rather than when a sales-person visits.

• It enables AB InBev to extract much more detailed data about each customer’s business with corresponding opportunities to refine its sales and marketing offer or even tweak credit terms.

• There’s a BEES loyalty program. Customers earn points depending on how much they order.

• Using the BEES marketplace can also be seen as a means of enhancing loyalty by making life easier for customers by reducing the number of counterparts they need to place orders with.

• It plays to AB InBev’s scale and is difficult to replicate. AB InBev has 2,000 software engineers working on BEES.

• Regulatory restrictions around the distribution of beer, though they differ by market, might provide an obstacle to non-alcoholic-beverage companies getting involved.

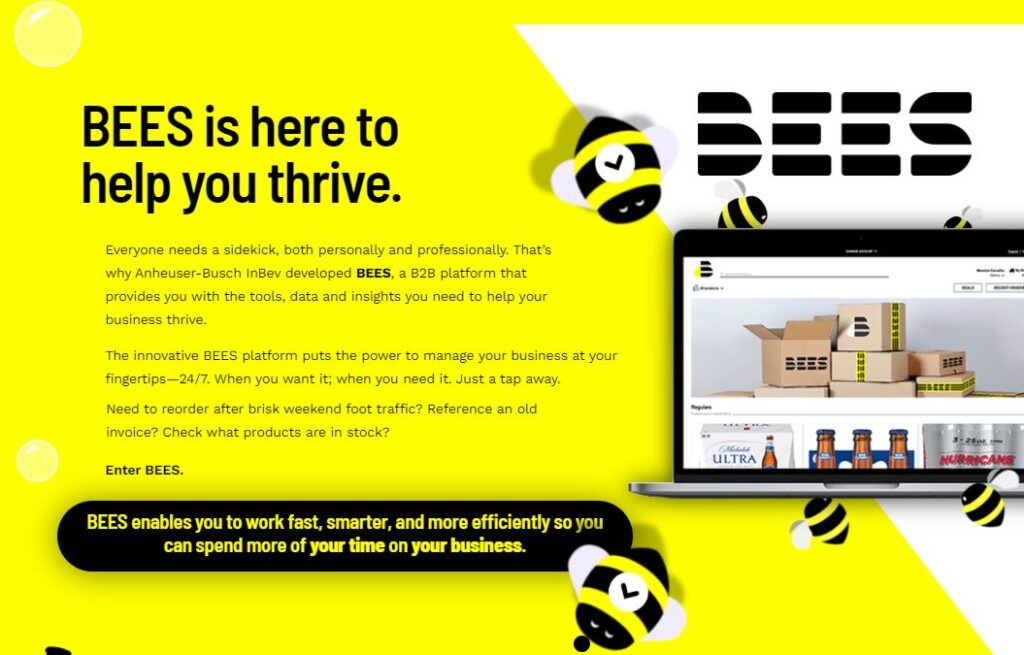

BMO Capital analyst Kelly Bania leveraged his proprietary Costco Wholesale (COST) U.S. warehouse location database and conducted an urban area analysis utilizing recently released 2020 U.S. Census Bureau data. Based on this analysis, he estimates Costco’s U.S. whitespace potential at an additional ~200 fill-in market locations, 35+ new market locations, and 50+ business center locations.

Under the title, “Another Potential Growth Lever,” BMO points out that Costco currently operates 23 business centers in the U.S., primarily located in major cities. These business centers are designed to cater towards small business and restaurants supplying beverages, candy & snacks, disposables, grocery, janitorial supplies, office, and restaurant supplies and there is no specific business membership needed to shop there. Average tickets here tend to be significantly higher than those at a traditional Costco, which may push the drive radius/addressable market farther than a typical warehouse. While still a small part of Costco’s business, BMO believes management is very bullish on the prospects of business centers.

“For arguments sake, if we assume San Diego at 1.5mm/business center is a good saturation point we see 50 opportunities. On the higher end, the average population/business center ex-New York/Tri State Area is closer to 3.3mm suggesting ~13 opportunities. We estimate Costco builds less than 1 business center a year. This assumes that business centers are not cannibalistic to standard consumer-focused clubs, which based on the SKU offering, we believe is the case. It’s possible this analysis is conservative, as Costco’s business center strategy may simply be early stage enough that Costco has not yet identified the minimum population threshold for a business center.”

Shares of Krispy Kreme (DNUT) have been on a blistering pace to start the year, currently up 52%. One of the reasons for this outperformance has been due to the collaboration it has with McDonald’s (MCD). As I wrote back in the November 6th Weekly Callouts note:

“McDonald’s will start selling three varieties of Krispy Kreme doughnuts at nine locations in the Louisville, Kentucky area. According to Restaurant Business’ Jonathan Maze, McDonald’s will not be making the doughnuts. Rather, Krispy Kreme will make the doughnuts at one of its large doughnut-making shops and will deliver them daily to those locations.”

Fast forward to February 27th when CNBC reported that McDonald’s is expanding its test with Krispy Kreme to more than 150 restaurants in Louisville and Lexington, Kentucky.

In a note this past week, Truist analyst Bill Chappell said he would not be surprised to see McDonald’s expand the program at least regionally over the coming months. In terms of the direct impact:

“If we estimate that 100 doughnuts per store per day at a $0.50 sale price (our estimated sale price from DNUT to MCD), then each store added could add at least $3M from all 160 doors. What we do not believe is well understood, is the potential halo impact a MCD expansion can have on the brand. Consumers love the Krispy Kreme brand, as noted by many surveys provided by the company over the year. However, we believe most consumers’ perception of the product is still tainted by the days old, sometimes stale, product that was sold in grocery stores for a decade before new management arrived. The power of expanded distribution points is the ability to increase the availability of freshly made doughnuts, created that day. (As a side note, this is one of the reasons we did not like DNUT’s Sweet Treats line of packaged products because they are not made fresh daily and, in our opinion, hurt the perception of the brand). Krispy Kreme likes to say they “are the dozens business” meaning they focus on selling cases of doughnuts for home, work, special occasions etc. We believe the expansion of the MCD program can accelerate trial of the fresh doughnut offering, improve the perception of products and drive future sales of dozens. Granted, this will be more of a 2024 driver, but it gives us greater comfort, along with the direct revenue from sales at MCD, that the company can sustain a high level of VOLUME growth in 2024 and beyond.”

Separately, CL King made no change to its Buy rating or $16 price target on shares of Krispy Kreme following the expansion. The firm believes the test went very well, including strong results with respect to key operational metrics, including drive-through speed, employee touch points and ease of use, and thinks sales results were strong. If Krispy Kreme were to end up expanding at McDonald’s, current capacity would allow for 2,000-2,500 McDonald’s restaurants, the firm says.

![]()

Lululemon (LULU) will be reporting earnings on Tuesday, March 28th after the close. While most analysts have a Buy Rating on the stock, Jefferies analyst Randal Konik reiterated his Underperform Rating on March 22nd after finding that the company informed members of its Sweat Collective, a discount program for current coaches, professional trainers, and athletes, that the program’s 25% discount will no longer apply to markdowns or “We Made Too Much” product.

“To us, this move suggests that the company is attempting to reign in promotional selling. We believe this is a tacit acknowledgement by mgmt that the company is facing an issue of rising markdowns, increased mix of promotional selling, and potentially gross margin pressure as a result. Further, we view this as a signal that customer demand for regular priced items might be softening, which could be a potentially meaningful headwind to top-line and margin performance ahead.”

Jefferies also points out that the average discount in January came in at 19.7%, nearly 100bps higher than it was in January 2022. Notably, this represents the fourth straight month of deepening promotions and compares to 15.8% in December, 14.0% in November, and 13.4% in October. Meanwhile, the percent of items on sale increased significantly in January, coming in at 53.6% compared to 43.5% in December, 41.0% in November, and 40.1% in October

Finally, after reviewing U.S. web traffic trends to lululemon.com, they found that Y/Y growth to the website slowed for the third consecutive month in February. To this end, web visits grew approximately 33% Y/Y in February, down from 40% in January, 47% in December, and 50% in November.

![]()

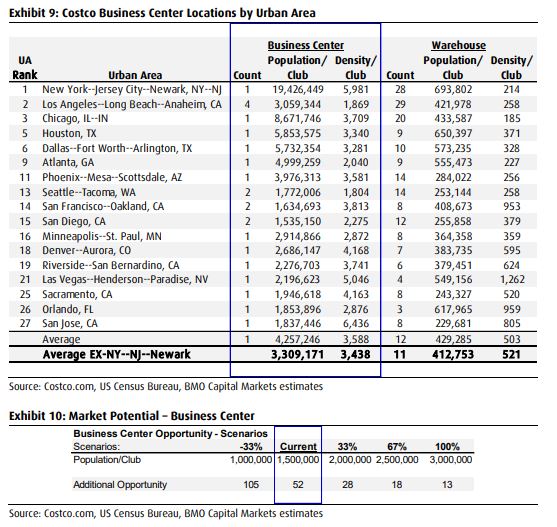

On March 20th, Sprouts Farmers Market (SFM) announced that it acquired two independently owned stores in Chula Vista, California, operating under the Sprouts Farmers Market name pursuant to a legacy trademark license arrangement. Acquiring these stores will allow complete control of the Sprouts brand and open further expansion possibilities in Southern California. “We are pleased to bring these two high-volume stores into the Sprouts fold, allowing us to serve more customers in the San Diego market,” said Chip Molloy, Chief Financial Officer.

Following the news, Guggenheim analyst John Heinbockel said that this acquisition is very slightly accretive to EPS. Given the stores’ longstanding presence in a population-dense legacy market, they estimate a current AUV in the $22M – $23M million ballpark or 30-40% above the company average of $17M. In light of these volumes, they also believe that the four-wall EBIT margin is perhaps 50-100 basis points above average. However, they are making adjustments to both AUV and four-wall margin to reflect a pull-back on promotions, similar to core SFM—AUV would drop but this would be more than offset by stronger gross margins. This would translate into $2.5M of incremental EBIT.

“Although this is not material, the acquisition was not incorporated into initial 2023 guidance, perhaps suggesting directional upside when the 1Q is reported in May. It highlights SFM’s ongoing balance sheet strength, which, we believe, supports both high-SD unit growth and mid-SD share repurchases.”