JaguarConsumer Weekly Callouts – October 15 (Retail Traffic, Beer, E-Cig, Macau, RVs)

**PDF version is also available HERE**

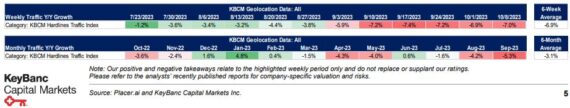

-KeyBanc’s Consumer/Retail team, highlighted that for data through Sunday, October 8th, the KBCM Hardlines Traffic Index declined 7.0% Y/Y, slightly decelerating from -6.9% in the prior week. The Electronic Stores category was one of the weakest constituents in the Index, with indexed traffic down 12.7% Y/Y, sequentially decelerating compared to -10.9% in the prior week. Within Electronic Stores, Best Buy (BBY) indexed traffic decreased 12.3% Y/Y, sequentially decelerating compared to -9.9% in the prior week. Home Improvement remains one of the weakest categories in the Index, with indexed traffic falling 12.4% Y/Y. Within Home Improvement, Home Depot (HD) and Lowe’s (LOW) traffic decreased 11.1% Y/Y and 15.3% Y/Y, respectively. Discount & Dollar Stores indexed traffic increased 0.7% Y/Y, but sequentially decelerated compared to the prior week. This category remains one of the most resilient within our coverage, demonstrating some of the strongest traffic trends among all constituents within the Index. On a six-week average basis, Discount & Dollar Stores indexed traffic increased 1.4% Y/Y (vs. -7.0% for the Index). Within this category, Five Below (FIVE) traffic increased 10.8% Y/Y, Dollar Tree (DLTR) traffic increased 4.9% compared to Dollar General (DG) traffic decreasing 2.9%. Finally, within Broadlines, Wal-Mart (WMT) and Target (TGT) traffic declined 7.8% and 5.2% Y/Y, respectively.

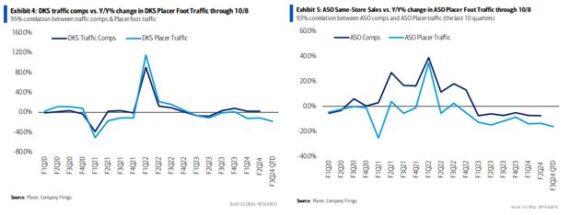

-Per BofA on October 12th, Placer.ai geolocation data suggests a deceleration in Dick’s Sporting Goods (DKS) foot traffic Q3-QTD to -17.8% from -11.3% in Q2 (95% correlated with DKS reported traffic comps since Q1 2020). Academy Sports Outdoor (ASO) foot traffic (93% correlated with ASO comps the last 10 quarters) decelerated to -16.2% QTD from -13.6% in Q2. Finally, Hibbett Sports (HIBB) foot traffic (95% correlated with HIBB comps the last 10 quarters) decelerated to -10.5% QTD from -7.5% in Q2.

-Beer Business Daily reported the beer business in the U.S. is in sorry shape. Off-premise scans are showing beer volume down 3% so far this year, with domestic premium (including lights) down 5.8%, below-premium down 2.9%, super-premium down 4%, and craft down 3.9%. The only segments that are up are imports, up 4.8%, and FMBs, up 14%. The category has lost drinkers—perhaps permanently according to BBD and is not gaining new young drinkers either, as Gen Z chooses other forms of alcohol; or increasingly, declining to drink at all.

Related Tickers: Anheuser-Busch (BUD), Heineken (HEINY), Constellation Brands (STZ)

-On October 12th, The FDA ordered Reynolds American, an independent U.S. subsidiary of British American Tobacco (BTI), to stop selling menthol-flavored versions of its Vuse Alto e-cigarette. “Today’s actions are among many the FDA has taken to ensure any tobacco products that are marketed in the U.S. undergo science-based review and receive marketing authorizations by the agency,” said the FDA in a press release. Stifel would highlight that BTI released a strong rebuttal noting its plans to challenge the FDAs issued marketing denial orders in hopes of seeking a stay of enforcement for the menthol variety. “The company believes appropriately regulated flavored e-vapor products are critical to assist the transition of adult smokers and noting a year-long data package that was presented at a symposium attended by FDA that addressed long-term consumer switching for these products.”

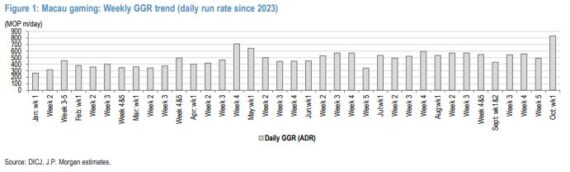

-According to JPMorgan analyst DS Kim, Golden Week turned out to be pretty golden for Macau companies. Based on their channel checks, gross gaming revenue for the first eight days of October is estimated at MOP6.65B, or c.MOP830m/day, which is by far the best print since the reopening and well above May Day week’s (MOP645m/day). “An apples-to-apples comparison isn’t easy (note the period covered both G/W holidays and slow-days), but the print implies the holidays probably generated >MOP930m/day GGR (Oct 1-6), followed by >MOP500m run rates for the last two days (Oct 7-8).”

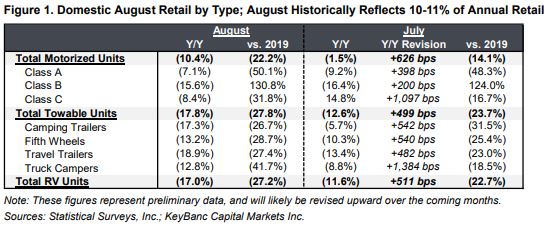

–According to preliminary data from Statistical Surveys, August North American RV retail registrations declined -17% Y/Y to 35,275 units. North American towable registrations declined -17% Y/Y in August, Fifth Wheel registrations declined -13.2%, Travel Trailers declined -18.9%, Motor Home registrations declined -11%, Class A retail registrations declined -7.1%, Class B declined -15.6%, and Class C dropped -8.4%.

KeyBanc would say, “Looking ahead, while we continue to like the prudent inventory rationalization by OEMs and dealers ahead of the broader MY24 rollout, sentiment and confidence in out-year estimates will likely remain pressured until retail regains momentum (i.e., better trends vs. 2019 relative to the recent -20%+ trendline) and/or the dated inventory hurdle is fully cleared (i.e., our checks highlight heavy MY23 discounting, potentially more price relief required); further, with peak season in the rearview, we think the next major catalysts will be dealer order/MY24 pricing evolution post-Open House and consumer sentiment into fall/winter shows.”

Related Tickers: Camping World Holdings (CWH), Thor Industries (THO), Winnebago Industries (WGO)