Defense Wins Championships Part 2 (BWXT, HII)

Back on September 19th, I wrote a Home Page article (See HERE) titled “Defense Wins Championships.” The reason why I did that was because the day before in JaguarLive, the Defense sector was showing relative strength. In conjunction with that, outlay data for August had just come out and the RBC Capital Industrials Conference was going on. Between all of that, I highlighted shares of AAR Corp (AIR), Leonardo DRS (DRS), Leidos (LDOS), Parsons (PSN), and V2X (VVX). In Part 2 today, I’m highlighting the following two companies:

BWX Technologies (BWXT) – A 4.3% weighting in the XAR ETF, this company operates through a Nuclear Operations Group, where it manufactures manufactures naval nuclear reactors and fuel for every new submarine and aircraft carrier in the U.S. Navy’s fleet. Today, BWXT reactors power the Navy’s Ohio, Virginia, Seawolf, and Los Angelese-class submarines as well as its Nimitz and Ford-class aircraft carriers. From a high-level, on its last earnings call, management would outline the bull case for the remainder of the decade:

“Let me note that the U.S. government strategy to bulk up on our strategic force capabilities, including a recapitalization of the U.S. naval nuclear fleet is in direct response to this geopolitical reality. We have supported this strategy with investment in BWXT’s Navy plants to enable a greater level of naval nuclear shipbuilding, especially in the second half of this decade and beyond, something the industry required, given its aging infrastructure. The current 30-year shipbuilding plan calls for 10 years of serial procurement of Columbia class submarines beginning in 2026 and the potential for the Ford-class aircraft carrier to move to 4-year centers beginning in 2028.”

Separately, BWXT also operates through a Medical division, where their goal is to become a global leader in Nuclear Medicine, meaning to develop, manufacture, and supply products for diagnostic imaging and radiotherapeutic treatments. Similarly, from a high level, management would say on the last earnings call:

“At BWXT Medical, we had another solid quarter positive EBITDA. We faced the nuclear medicine market as a full-service player in radioisotopes with a base of diagnostic isotopes, additional layers of therapeutic isotopes and contract drug manufacturing. We are enjoying strong demand for diagnostic isotopes such as strontium and germanium, that are used in cardiac and cancer image studies as well as in therapeutics where we expect significant growth opportunities in the manufacturing of active pharmaceutical ingredients, like lutetium and actinium that support innovators and pharmaceutical companies engaged in late-stage clinical trials of products that will change the face of cancer therapy.”

In the near-term, BofA pointed out that the Medical business received formal consent from the FDA to pivot its target delivery system (i.e. Tech-99) to its OPG Darlington station, expanding the breadth of solutions (including full suite of Tc-99m generator options) that BWXT can begin offering. The company is still targeting market entry in 2024.

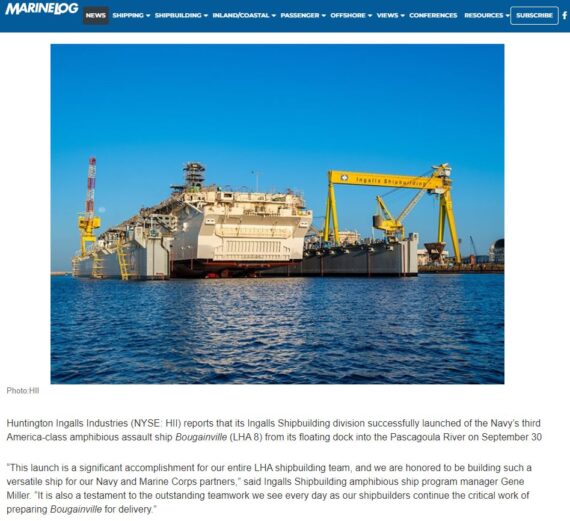

Huntington Ingalls (HII) – A 4.27% weighting in the XAR ETF, this company engages in the shipbuilding process. Last quarter, the company reported Q2 Revenue of $2.8B with Shipbuilding revenue growing 3.9% Y/Y driven by increased volumes on Aircraft carriers, Columbia & Virginia-class submarines, and delivery of the DDG-125. Meanwhile, Mission Technologies Revenue increased 7.5% Y/Y driven by mission solutions in C5ISR, Cyber/EW, and LVC.

In JPMorgan’s upgrade note on September 28th, they highlight that with a shipbuilding backlog of $42B, or 5x this year’s shipbuilding sales, the visibility in HII’s core shipbuilding operations is quite high. It is one of only two major Navy shipbuilders and its ships are at the center of U.S. national security strategy, especially submarines. “We see this in DoD’s recent investments into the shipbuilding industrial base and especially in the nearly 40% increase in the shipbuilding budget over the past two years.”

More recently, Wolfe Research analyst Myles Walton called out HII as a top pick for them going into the quarter given their view on strong bookings (major DDG 51 contract in the quarter) as well as a turn in positive FCF, opportunity for 2023 revision, and a fairly low hurdle on margins for the quarter. “Shipbuilding margins are typically in sharp focus for investors every quarter, and these margins are largely driven by risk releases related to milestones in a ship’s lifecycle. The surprise under-the-wire (happened on the last day of the quarter) announcement of the LHA 8 launch**– which was on our radar given a fire on the ship this summer– was an exciting development for Ingalls shipyard against a backdrop of an otherwise relatively quiet 3Q.”

**MarineLog reported on October 6th that the Ingalls Shipbuilding division successfully launched the Navy’s third America-class amphibious assault ship Bougainville (LHA 8) from its floating dock into the Pascagoula River on September 30th. Ordered at Ingalls under a $3B contract placed June 2016, Bougainville is the first ship in the America class to be built with a well deck. The ship will retain aviation capabilities while adding the surface assault capability of a well deck and a larger flight deck configured for F-35B Joint Strike Fighter and MV-22 Osprey aircraft.

In addition, as we look to Q4, Wolfe Research says that the delivery of SSN 796 is expected then — one of the few, but major, milestones for Newport News this year– and the ship’s commissioning committee recently released the ship’s commissioning date as April 6, 2024. Finally, the delivery of NSC 10 has been in focus given the late-July announcement of completion of acceptance trials for the ship– the final milestone before delivery of Coast Guard cutters. “Given the historical timeline between acceptance trials and delivery for NSC class ships at Ingalls, we were expecting the delivery of the ship before the end of 3Q– which would’ve been a nice margin pop for Ingalls– but the delivery of the ship remains elusive (and may engender a question on the upcoming earnings call) and a watch item for us for 4Q.”