Med-Tech Mash-Up (DXCM, EW, SWAV)

This week’s Med-Tech Mash-Up report covers the following companies:

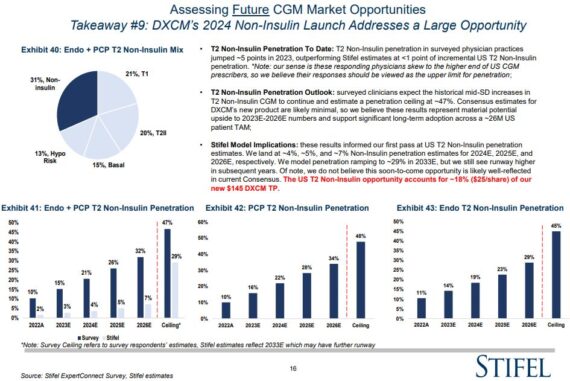

DexCom (DXCM) – Stifel analyst Mathew Blackman conducted an expansive CGM survey capturing 125 US Physicians (Endocrinologists/Primary Care) treating over 90,000 diabetics. According to the analyst, new findings from the survey included:

• Yes, physicians expect GLPs to accelerate CGM installed base attrition, but the reported annual 150-200 bps expected uptick in annual patient “drop-off” is modest and does not comport with the significant decline in DXCM shares. Away from patient attrition, physicians in this survey anticipate an UPTICK in annual concomitant CGM+GLP use, in the +10-15% range, suggesting a potential tailwind, similar to what we’ve recently seen in recent DXCM and Abbott Labs (ABT) claims data. “Note: in our new DXCM and Diabetes market models, we include the anticipated annual uptick in attrition, but do NOT include the potential new patient start tailwind, leaving that as upside. In fact, we moderated our US T2 new patient start growth by mid-SD% points each year for conservatism.”

• Also new in this year’s survey were questions regarding DexCom’s new, non-insulin product first introduced at this year’s analyst day and expected to launch in 2024. This is a massive U.S. opportunity, with totals approaching 26M patients…suggesting even the slightest penetration rates could sustain or inflect CGM market and DXCM growth. “Physicians here were much more optimistic than we expected, with peak penetration approaching 50% and utilization rates in the mid-20 days/per month. This was, in our view, the most bullish headline from this year’s survey and gives us confidence, along with all the other key growth drivers that DXCM’s near, medium, and long-term growth profile is likely underappreciated/ under-estimated.”

Edwards Lifesciences (EW) – From October 23rd – 26th, the Transcatheter Cardiovascular Therapeutics (TCT) Conference kicks off. While Abbott Labs (ABT) and Medtronic (MDT) will be presenting, this is a big conference for Edwards, according to JPMorgan, as all eyes will be on the company’s 5-Year PARTNER 3 TAVR data readout slated for release on the 24th. As a recap, PARTNER 3 is a randomized controlled trial to evaluate the safety and effectiveness of Sapien 3 in patients with severe aortic stenosis who are at low surgical risk vs. SAVR.

Based on their investor conversations, JPMorgan notes that expectations have skewed slightly negative into the readout given the convergence in death or disabling stroke between the two groups at 24 months. While this is clearly meaningful, it’s worth noting (1) This was one of the best clinical SAVR performances on record, or in other words, a good result for TAVR was masked by a really good result from SAVR. (2) The study’s primary endpoint of composite death, stroke and rehospitalization remained significantly lower with TAVR vs. SAVR (11.5% TAVR vs. 17.4% SAVR; p=0.007) at 24 months, and just missed the prespecified superiority margin of 6 points (was 6.6 points at 12 months). Elsewhere in the Edwards portfolio, expectations for the company’s planned 6-month interim data from TRISCEND II for EVOQUE in tricuspid replacement to look very similar to TRISCEND I data presented in 2019, and show at a minimum a clinically significant quality of life improvement vs. the control arm.

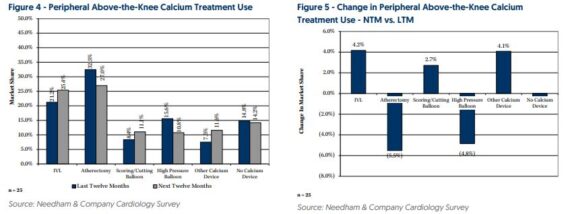

Shockwave Medical (SWAV) – Needham surveyed 25 interventional cardiologists about their use of products for thrombectomy and for treating calcified vascular lesions.

Over the next 12 months, when treating calcified lesions in above-the-knee arteries, respondents expect to increase their use of IVL by 4.2% from 21.2% of cases to 25.4% of cases at the expense of atherectomy and high pressure balloons. Conversely, over the NTM, when treating calcified lesions in below-the-knee peripheral arteries, respondents expect to decrease their use of IVL by 1.8% from 22.4% of cases to 20.6% of cases while increasing their use of high-pressure balloons and other devices. However, as Needham points out, below-the-knee procedures are a smaller part of Shockwave’s peripheral business, and they expect to learn more about its below-the-knee plans and pipeline at its October 23rd Investor Meeting.