Defense Wins Championships (AIR, DRS, LDOS, PSN, VVX)

In yesterday’s JaguarLive session (Subscribe HERE), a comment was made regarding the defense industry: “Something to note, there is unusual relative strength in all defense contractors today with many 2% to 3% moves (NOC, LMT, KTOS, AVAV, VVX, MOG/A, DRS, WWD).” Over the past week, a number of industry-related and company-specific data has come out that paints a bullish picture for the entire group:

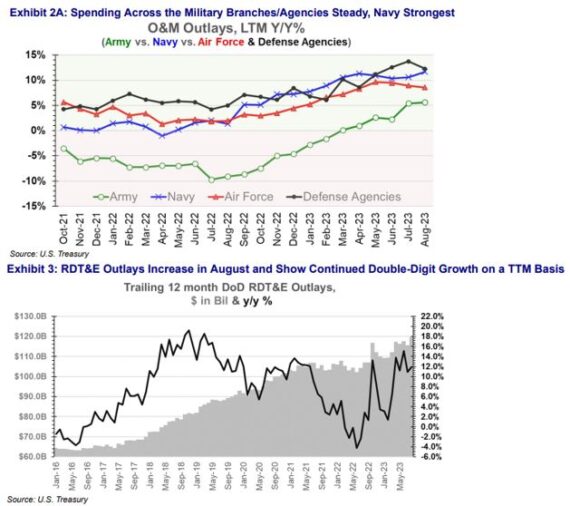

Treasury Outlays – In a Defense Update note on September 14th, BofA would call out all-time highs, saying last twelve months Investment Outlays were up 9.5% Y/Y as of August 2023, mainly driven by a 11.8% increase in RDT&E, which I’ll get to shortly.

Similarly, Stifel was out with a note calling out Operations & Maintenance (O&M) outlays rising 7.6% Y/Y in August after rising 5.9% in July, which signals continued strength in the main funding account for the sector. “We would expect a strong spending month in September given typical budget flush dynamics and the impending budget negotiations that are casting more uncertainty over early FY24 spending trends.”

They would also break down TTM O&M outlays by military branch pointing out how in August, Navy spending increased +15% Y/Y, USAF was +6%, Army was +5%, and Defense Agencies were +5%. Defense Agencies include the DHA, DLA, DISA, DCSA, MDA and a variety of other agencies are included as a separate spending bucket.

Going back to RDT&E, Exhibit 3 shows this type of spending. This tends to be most applicable for stocks like Parsons (PSN), CACI International (CACI), and Leidos (LDOS).

Switching to individual companies, a number of them presented last week at the RBC Capital Global Industrials Conference. Here were a few callouts:

AAR Corp (AIR) – This company provides products and services to commercial aviation, government, and defense markets worldwide. Through its Aviation Services segment, it engages in lease and sale of new, overhauled and repaired engines, and airframe parts and components, as well as aircrafts. When this company presented, the most recent issue with the RTX geared turbofan (GTF) engine indicates that the supply of material and parts is likely to remain constrained through much of fiscal 2024.

Management indicated the industry is now back to the 2nd inning of the supply-demand balance (demand is expected to continue to be stronger than supply). “In this market AAR is benefiting from both a source of CFM56 material (FTAI Aerospace) and customer agreements with Delta TechOps and MTU. Further, management noted that they are not seeing excess inventory levels at airlines, and do not view destocking as a near-term risk. The recent issues with the GTF will also support higher pricing for CFM56 and V2500 spare parts as airlines now look to utilize these engines more than anticipated.”

AAR Corp also continues to see upside to order activity from airlines as its Trax acquisition can help them streamline aircraft maintenance and fleet management schedules. Trax is the only next-generation ERP system that lives within the cloud. Data will no longer just be localized, and could be a powerful tool with operator buy-in. At their conference, RBC Capital said that management took the time to highlight the overall digitization efforts of the company, as some legacy systems are incredibly reliable on paper forms.

Leonardo DRS (DRS) – Even though the company has limited direct exposure to Ukraine, it should benefit longer term from the greater focus on counter-UAS funding. RBC believes the synergy opportunities from the recent RADA acquisition are looking stronger as a result of the Ukraine war. The company is platform agnostic in terms of ground systems, so should be well positioned to benefit as the recapitalization of ground vehicles gains momentum.

Separately, the typical contract length for the company is 3 years, so into FY24 the majority of its revenues will be under more favorable contract conditions. The company is also in a position to benefit from the supply chain issues at the shipyards as there are potentially more outsource opportunities, intended to relieve some pressure in the shipyards. For DRS, approximately 90% of revenues are under firm-fixed price contracts, and the impact of inflation in 2023 should be a tailwind into 2024.

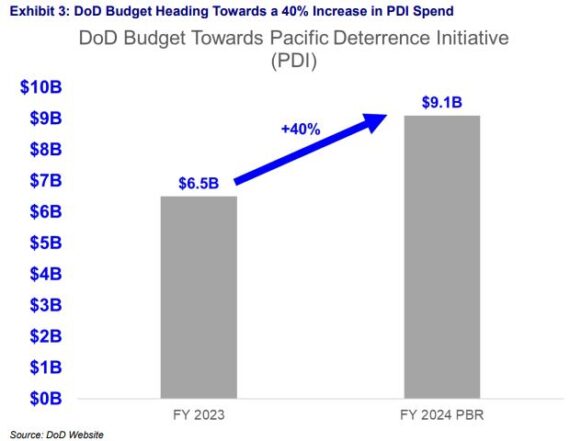

V2X Inc. (VVX) – The company continues to see opportunities to cross-sell across their legacy Vertex and Vectrus businesses now that they have merged. INDOPACOM continues to be a significant program with increased opportunities in the Indo-Pacific region (up 41% in the most recent quarter). This program was discussed in our August 23rd Conversations recording in which we showed the FY23 DoD budget toward the Pacific Deterrence Initiative (PDI) compared with the FY24 President’s Budget Request (PBR), pointing to a potential 40% increase in spending.

Lastly, the company reminded everyone that they ended the most recent quarter with $13B in backlog. It would also call out a potential pipeline of nearly $19B over the next 12 months as well as $5B in bids under current evaluation. RBC would say, “We continue to view top-line growth and margin expansion as the most important catalysts for the stock. As debt reduction in 2024 accelerates, this should also be a tailwind for sentiment.”