JaguarConsumer Weekly Callouts – September 24 (BBW, CHD, CLX, COST, GIS, SKX, SMPL, Temu)

**PDF Version is also available HERE**

-Evercore ISI out this past week with an industry note highlighting how web traffic has done over the summer what it has done over the last four years (including during the pandemic): Drift lower. And they expect this trend to continue for another 3-4 weeks. The Retail composite, which tracks approximately 1 trillion weekly visits to retail websites remains at very similar levels to last year. Analyst Oliver Wintermantel expects the seasonal downtrend to remain intact for another 3-4 weeks before increasing into the Holiday season. Auto Parts continue their online traffic strength – especially O’Reilly Automotive (ORLY) and AutoZone (AZO) – while the pet segment is heading lower.

Interestingly the analyst would point out how Temu is the most downloaded free app on the Google Play store and the App Store. The app was downloaded 100M times over the last 12 months. As a result, they have been receiving questions if Temu can have an impact on other U.S. Retailers. “Looking at cross-visitations (which indicate potential substitution risk over time) shows that Dollar Stores appear to have the biggest risk in our coverage.”

-Placer.ai’s Shira Petrack out on September 21st with an article on Costco Wholesale (COST) saying that the company seems to have recovered from the headwinds facing the wider retail space earlier in 2023, with monthly visits to the wholesale giant up between June and August 2023 up relative to the equivalent months in 2022. And while some of the growth in foot traffic is due to the company’s ongoing expansion, same-store visits are also on the rise with average visits per venue metrics seeing increases year-over-year between June and August 2023 as well. “Costco’s ability to open new stores without cannibalizing traffic from its existing venues speaks to the strong demand for the concept – and suggests that the chain has not yet maximized its expansion potential.”

–The Clorox Company (CLX) issued a press release this past week warning investors that the previously announced cybersecurity attacks identified on August 14th are now expected to have a significant or “material” impact on Q1 results especially given the delays in order processing and elevated levels of manufacturing outages. Management refrained from commenting on any specifics of the financial impact at this time as CLX is still evaluating the impact on its financials and business operations. CEO Linda Rendle forewarned regarding this incident recently at a competitor’s conference with her comment, “And then just one note, we had provided guidance on August 2 at our call and, of course, we had a set of assumptions around that. And I just wanted to be clear that what is not contemplated in that is that we announced on August 14 through an 8-K that we had a cybersecurity incident and that was not factored in. Obviously, it happened after. We don’t know if there’s a material impact yet and we don’t have an update for financials, but I wanted to make sure that was clear before we got started.”

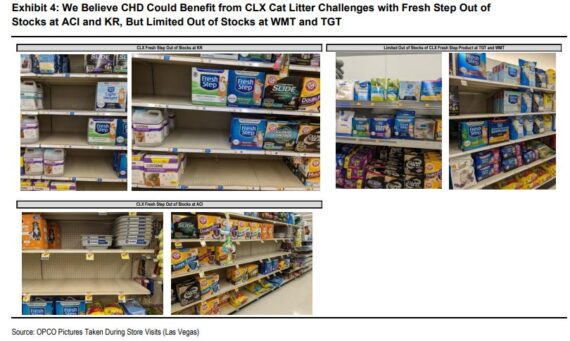

In a note on September 21st, following store checks in Las Vegas, Oppenheimer said they believe Church & Dwight (CHD) could benefit in the litter category from CLX’s challenges, at least shorter term. As they highlight in Exhibit 4, they observed out-of-stocks of the company’s Fresh Step product at Alberton’s and Kroger, but these were limited at Target and Wal-Mart.

-In a note on September 20th, Piper Sandler analyst Michael Lavery points out that General Mills (GIS) management doesn’t expect student loan repayments to have a meaningful impact on growth and is not factoring this into their full year guidance. However, in Piper Sandler’s survey of student loan holders, 55% said they had increased grocery spending as a result of savings from suspended payments – more than any other type of spending. From the survey, 34% planned to cut spending on groceries once payments resumed. Of these, 75% expect overall spending cuts greater than the amount of their resumed payments (~$400/month on average). These recipients had approximately $100K average income. “We estimate ~$9K annual grocery spend. Resuming loan payments is ~6% hit to disposable income for the respondents who plan to cut back. If we assume a ~6.5% average cutback evenly across categories the hit to grocery spending is ~$575 per loan holder on average. If we assume 34% of the 26.3M loan holders with payments resuming (i.e. ~9M) all cut back by that much, there is a potential $5B hit in aggregate to 2024 grocery spending.”

–The Simply Good Foods Company (SMPL) develops, markets, and sells snacks and meal replacements. It offers protein bars, ready-to-drink shakes, sweet and salty snacks, cookies, pizzas, protein chips, and recipes, as well as licensed frozen meals under the Atkins and Quest brand names. In Morgan Stanley’s upgrade from Equal-Weight to Overweight, analyst Pamela Kaufman believes Atkins challenges are appreciated by the market as retail takeaway are -4.5% and -1% in the last 12 weeks/52 weeks, respectively. The analyst is not incorporating a recovery in Atkins, but sees opportunity for SMPL to turn Atkins around as the company steps up marketing, launches innovation in spring 2024, and has hired a new brand manager. “Moreover, we believe Atkins can benefit from growing adoption of GLP-1 drugs as our AlphaWise survey of 300+ AOM users highlights that patients on these drugs consume more weight management foods like protein bars and shakes. Atkins recovery is not incorporated into our base case, but is reflected in our bull case.”

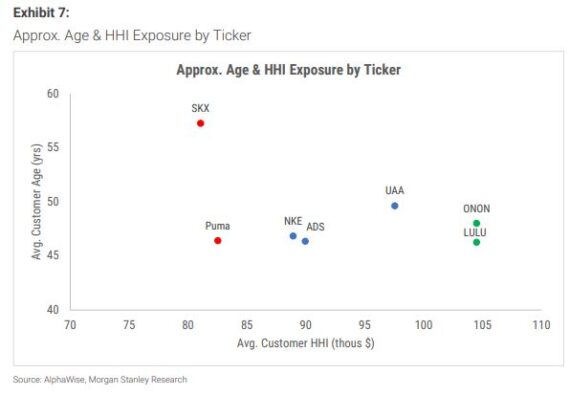

-Morgan Stanley’s latest U.S. Activewear Survey shows that approximately 30% of respondents anticipate spending less on athletic footwear & apparel in the next 12 months, compared to approximately 18% who expect to spend more. Taken together, this implies -12% net spending on activewear in the NTM. This result stands in contrast to their Spring ’21 survey, where data showed +40% net athletic apparel spend intentions & +30% net for athletic footwear. In addition, demographic data shows the youngest, oldest, & lowest HHI consumers are pulling back their NTM activewear spending most, which screens somewhat negatively for Skechers (SKX) & Puma, but positively for On Holding (ONON) and Lululemon (LULU).

“The youngest & oldest consumer cohorts (16-24, 55-64, & 65+ yrs old) expect to see the greatest declines in activewear spending in the next 12M (-17%, -17%, & -19% net, respectively), while 25-34 & 35-44 yr olds show more muted declines (-7% & -5% net, respectively). Additionally, lower HHI cohorts expect the greatest declines in activewear spending in the next 12M (for example, -20% net for under $25k, & -15% avg. for under $100k), while those earning over $100k reflect slight increase. This aligns with what we learned in our June sportswear channel checks & recent earnings results – there’s been a clear bifurcation between higher HHI/performance sportswear categories (still strong), & lower HHI/mass categories (incremental weakening). Based on these factors, our screening analysis suggests SKX & Puma could face outsized demand pressure in the next 12M (given low HHI exposure & SKX’s older age group exposure), while ONON & LULU could be relatively well-insulated (given high HHI exposure; Exhibit 7).”

-Finally, I have to give a shout out to shares of Build-A-Bear Workshop (BBW). While plenty of apparel, footwear, and specialty retailers are down considerably this year, BBW is up a respectable 26.75%. DA Davidson initiated coverage this past week with a Buy Rating and $42 price target calling it an “underappreciated small cap growth idea.” Separately, Small Cap Consumer Research analyst Eric Beder was out on Tuesday with his own Halloween store checks saying, “Before the end of back-to-school, Build-A-Bear launched their Halloween collection on August 29th. The offering, which was the biggest Halloween collection in recent history, focused on a number of key themes: 1) 30th anniversary of Nightmare Before Christmas, with additional characters, commemorative “furry friends,” the return of fan favorites in new costumes/looks (Oogie-Boogie now glows in the dark!); 2) the next round of Frogs, with the Zomb Frog; 3) new exclusive characters, including the Fangtastic Bat Witch and Pumpkin Glow Bear; 4) numerous themed Build-A-Bear Buddies, including the first triple set, for Lock, Shock and Barrel (from Nightmare Before Christmas) and 5) multiple new costumes, from licenses such as Hocus Pocus and Stitch to spider gift sets and tee shirts. Demand has already been strong, with store selling out of the retro Pumpkin Kitty (originally introduced in 2008) in three days.”