JaguarConsumer Weekly Callouts – September 17 (AAP, COTY, JWN, KVUE, PLNT, POOL, SHW, TJX)

**PDF Version is also available HERE**

-BMO Capital utilizes Placer.ai data to help frame sector traffic performance, and in their recent note, highlighted the trailing 13-week aggregate sector traffic levels on a Y/Y basis. Across their coverage universe, they saw the greatest Y/Y traffic gains from Lululemon (LULU), T.J. Maxx (TJX), and Marshalls (also TJX). Meanwhile, the worst readings came from Nordstrom (JWN), Nordstrom Rack, and Old Navy (GPS). Approximately 56% of the brands/companies they track saw Y/Y traffic increases the week ending 9/3, a deceleration from the 63% in the prior week.

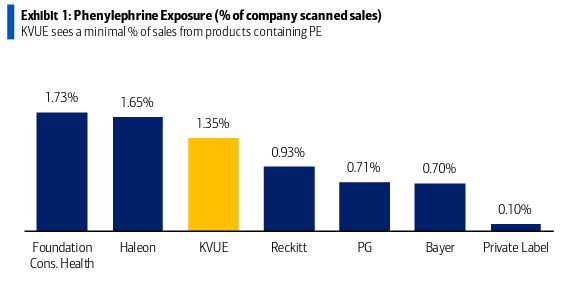

-In Conversations recently, we discussed the outcome of the Tylenol litigation for shares of Kenvue (KVUE), the spin-off from Johnson & Johnson (JNJ). Apparently, the fun isn’t stopping for shares of KVUE as on 9/12, the Nonprescription Drugs Advisory Committee (NDAC) of the FDA concluded that phenylephrine (PE), a common ingredient in OTC cold and allergy medications to relieve nasal congestion, is safe but ineffective at standard or higher doses. Medical professionals say that oral phenylephrine is metabolized in the gut and liver and does not reach the bloodstream in sufficient levels to be effective. This ingredient is used in a variety of brands, such as certain product lines of Sudafed (a Kenvue product), Mucinex (a Reckitt Benckiser product), NyQuil/DayQuil (a Procter & Gamble product), and Robitussin (a Haleon product). Shares of Kenvue initially reacted negatively to the announcement, despite having minimal sales risk (See chart below).

BofA was out with a note saying, “Kenvue and the Consumer Healthcare Products Association (CHPA) view phenylephrine as an effective treatment, stating that consumers rely on the medications. The CHPA refers to older research which suggests the ingredient is effective. With their declaration, the FDA could ask manufacturers to reformulate their products or submit new applications as drugs. Currently, PE is the only oral nonprescription medicine for nasal decongestion available without purchase restrictions. There are behind the counter alternatives containing pseudoephedrine (PSE), but this must be filled at the pharmacy due to DEA restrictions. KVUE would have limited PSE capacity due to DEA restrictions.”

-Shares of Advance Auto Parts (AAP), for as long as I can remember, have always lagged its peers AutoZone (AZO) and O’Reilly Automotive (ORLY). Morgan Stanley believes the AAP transformation under newly announced CEO Shane O’Kelly may become more difficult following S&P’s downgrade of AAP’s credit rating from BBB- (investment grade) to BB+ (speculative grade). “This downgrade could have a direct effect on AAP’s supplier financing program. Per the latest 10-Q, as of July 15th, 2023, ~$3.1B of AAP’s accounts payables are to suppliers participating in financing arrangements (~80% of total payables).”

One possibility that Morgan Stanley raises is the potential for selling Worldpac to raise cash and increase financial flexibility. Per their previous estimate, they think Worldpac may be worth between $1B and $2B. If this downgrade results in reduced cash flow and/or impairs the vendor financing program, a Worldpac sale could become a higher probability outcome.

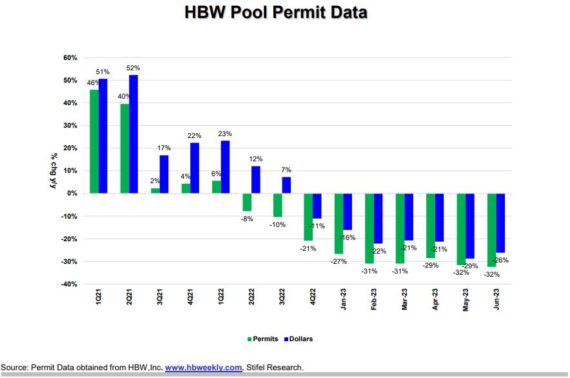

-Two weeks ago on September 4th, I discussed permit data from HBW, which provides construction permit data for 93 counties in Alabama, Florida, Georgia, and Texas. Using this data, Stifel analyzes single-family residential pool permits and commercial pool permits (new, additions, attachments). They estimate these markets accounted for over 50% of new in-ground residential pool construction over the past three years and 28% of 2022 new single-family housing permits.

For the latest four weeks ended 7/1/2023, pool permits declined 31% on a unit basis while permit dollars declined 25%. “We believe the data reflects weaker underlying demand which drives our cautious outlook for 2023 residential inground pool construction (-30% units, -24% dollars) and incremental scrutiny for the category recovery’s amplitude.” In addition, they point out that for the latest four weeks, $80,000+ permits declined 22% against a 34% decline for all other permits. This validates industry commentary that the weakness is concentrated at the lower end of the category.

Related Tickers include: Hayward Holdings (HAYW), Leslie’s (LESL), Pool Corp (POOL), Latham Group (SWIM)

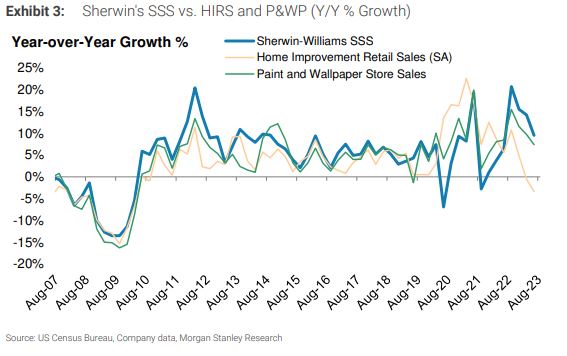

-On September 14th, Morgan Stanley was out with read-through note for shares of Sherwin Williams (SHW), highlighting that August Home Improvement Retail Sales (HIRS – i.e., generally a DIY proxy) decreased -4.9% Y/Y (vs. +11.8% comp). They would point out that this number reflects the 6th consecutive month of year-over-year declines for HIRS (after an impressive positive comp streak that started in November 2019) and corroborates that retail takeaway remains soft. In addition, July Paint and Wallpaper sales (i.e., DIFM proxy) increased +4.1% Y/Y (vs. +11.1% comp).

-Raymond James attended Inter Parfum’s (IPAR) annual shareholder meeting and came away with increased confidence in continued strength in the fragrance category, a positive for IPAR but also for shares of Coty (COTY). “With Fragrances accounting for 60% of COTY’s sales, mostly in prestige, and the key holiday period approaching, we see opportunity for continued upsides for COTY. Management raised its sales guide four times during FY23 and we see potential for another positive announcement when the company reports F1Q24 results, or possibly earlier. Better than expected fragrance demand has been a key driver of COTY’s upsides in recent quarters and with industry fill rates now back in the mid 90s again, fragrance houses can also return to gift sets to support the category, particularly important heading into the holiday season.”

-Back on March 12th, a bearish W/E Research write-up was presented in shares of Planet Fitness (PLNT). Shares are down 34.5% since that write-up. Admittedly, when I wrote about the name, my concern stemmed from potential issues related to online cancellations. Well, this past Friday, the company announced that Craig Benson, a member of the company’s Board of Directors, has been appointed Interim CEO, effective immediately. Mr. Benson’s appointment follows the decision by the Board to transition to new leadership, resulting in Chris Rondeau’s departure as the company’s CEO.

TD Cowen was out saying that they now expect shares to remain range-bound until a new CEO is named and an updated growth strategy is laid out, arguing that the CEO departure increases uncertainty around franchise health, the opening outlook, and the company’s competitive position.

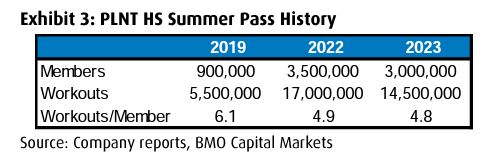

Separately, on September 7th, the company had announced that it had more than 3M teens signed up for its high school summer pass initiative. Unfortunately, as you can see from the image below, this metric was down from the more than 3.5M teens that joined last year. In addition, engagement also saw a slight downtick with workouts dropping from 17M to 14.5M and workouts per member going from 4.9 last year to 4.8 this year.