MorphoSys (MOR) – A Case of Jekyll and Hyde

If one takes a look at the German-based biotech company Morphosys (MOR), they will see that the stock is up nearly 100% YTD. But now, zoom the chart out a few years and you will see that the stock has gone from $35 to $7. Certainly, a “Strange Case of Jekyll & Hyde.” I can summarize this stock up by focusing on two of its drugs:

Pelabresib – This is defined as a small molecule inhibitor of BET proteins with a novel mechanism of action and potential for disease-modifying effects in myelofibrosis, a rare blood cancer. Morphosys has this drug due to its 2021 acquisition of Constellation Pharmaceuticals.

On its last earnings call, the company announced that they completed enrollment of their Phase III MANIFEST-2 study of pelabresib in MF ahead of schedule. As a result, the top line data from the trial is now expected by the end of 2023, months earlier than previously anticipated.

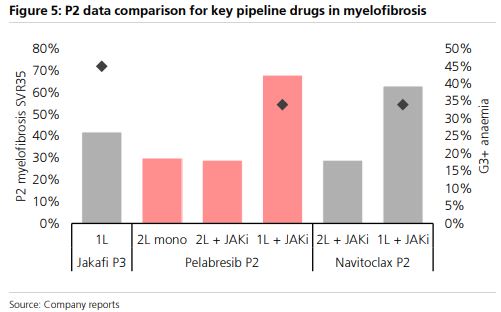

I should reference that a year ago, the company highlighted positive Phase II data on the safety and efficacy of pelabresib in combination with ruxolitinib in patients who were not previously treated with a JAK inhibitor and in those with suboptimal response to ruxolitinib. “The findings show that the combination was generally well tolerated and offered reductions in spleen volume and symptom burden, with disease-modifying activity as measured by reduced levels of pro-inflammatory cytokines and improved bone marrow morphology. Over two-thirds (68%; n=57) of JAK inhibitor-naïve patients treated with the combination achieved at least a 35% reduction in spleen volume (SVR35) from baseline at week 24. Notably, 80% of patients achieved SVR35 at any time on study. Most patients also saw their symptoms reduced, with 56% (n=46) achieving at least a 50% reduction in total symptom score (TSS50) from baseline at week 24.”

On May 30th, UBS initiated coverage of MorphoSys with a Buy Rating saying they are positive about the prospects for pelabresib. “The impressive P2 data gives us confidence about its P3 trial readout. We forecast $1.1bn peak sales for pelabresib, representing an NPV per share value of EUR35, which is more than the current share price. With pelabresib P3 data due end of 2023, we believe this valuation disparity makes Morphosys highly attractive.”

Besides the Phase III readout at the end of the year, MorphoSys will be hosting an Investor Call with Key Opinion Leaders focused on pelabresib next week on Wednesday, June 21st. Separately, investors will be paying attention to upcoming competitor data from AbbVie (ABBV), who will be presenting their own Phase III data any day now for its asset Navitoclax. According to Morgan Stanley, “If successful, Navitoclax will be a competitor to pelabresib and could create a high commercial bar for MorphoSys. Failure would be a sentiment positive for MOR.”

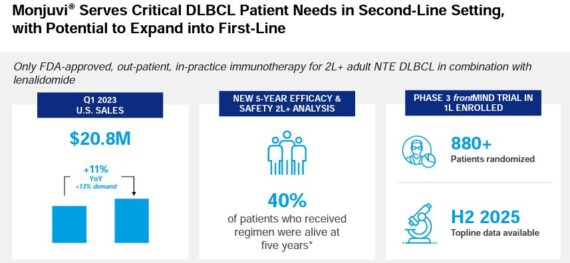

Monjuvi – This is a prescription medicine given with lenalidomide to treat adults with certain types of diffuse large B-cell lymphoma (DLBCL) that has come back (relapsed) or that did not respond to previous treatment and who cannot receive a stem cell transplant. MorphoSys received FDA approval of this drug back in July 2020.

The drug would have a soft launch in 2020, but due to COVID-19 restrictions, the company’s newly formed salesforce would suffer a setback, ultimately culminating with the company cutting full year Monjuvi sales guidance several times in 2020 and 2021. Not only that, but more and more competitors came into the mix. Management is well aware of these issues, saying, “So long story short. It’s a great product even in the drug indication, but the opportunity probably not what we were thinking some time ago because of the competitive pressure.”

UBS also acknowledges the intensifying competition in DLBCL with multiple bispecific antibodies and CAR-Ts in the race, but they believe Monjuvi is differentiated through its safety profile. Unlike its competitor drugs, Monjuvi does not cause cytokine release syndrome, a key safety concern for competitor drugs. This could be highly attractive to niche segments such as elderly/frail patients, who have low tolerability for side effects.

On June 13th at the Goldman Sachs Healthcare Conference, management would reiterate, “But the fact is that the main opportunity we see with Monjuvi is in the future indication, its first-line DLBCL, larger indication with a high unmet need, actually the most prevalent form of lymphoma. And we also here announced that our Phase III trial in first-line DLBCL has completed recruitment with almost 900 patients ahead of time.”