JaguarConsumer Weekly Callouts – June 11 (BOWL, CELH, CHDN, Hotels)

Back on May 31st, Bowlero (BOWL) announced it will acquire all assets of Lucky Strike Entertainment, the bowling company with 14 locations across 9 U.S. states. After hosting Bowlero’s President and Vice Chairman Brett Parker, Stifel would go into detail about the recently announced Lucky Strike acquisition, which they believe was massively overlooked by investors. This acquisition isn’t just about the 14 properties BOWL is acquiring from Lucky Strike. Most investors probably looked at an additional 14 properties across a base of 330 existing properties and shrugged this acquisition off. However, BOWL is acquiring the best-known bowling brand in North America. Lucky Strike will become their premier/upscale brand, and it is yet to be determined how many existing Bowlero centers could get transformed into the Lucky Strike brand.

“As we think about the acquisition math, we believe this deal will end up being massively accretive to BOWL over time. Lucky Strike was doing ~$89M in revenues and ~$18M in EBITDA. Their center EBITDA margins were running around 36%. So as we think about this, the ~$18M probably gets knocked down to ~$17M when BOWL layers in additional labor/corporate expenses. However, at a minimum, BOWL believes they can quickly get Lucky Strike’s center EBITDA margins up to ~50%. Again, this is a minimum. So right there would add an additional ~$12M in EBITDA. Lucky Strike centers were averaging around $6M in revenues per center versus BOWL which is around $3M. Management noted though that their centers that do north of ~$5M in revenues typically have margins in the 55%-60% range. So over time they could be pulling another $4M-$8M out of this acquisition. And again, this is just on the cost side. This doesn’t even assume any revenue uplifts/synergies. Putting this all together, we believe BOWL could be generating $29M in EBITDA from this acquisition over time, at a minimum, and possibly get closer to $35M-$40M. BOWL essentially then just paid 2.5x-3.5x to take out their largest competitor and a competitor that possibly could have gotten PE backing over time. Another way to think about this acquisition is BOWL is essentially getting 14 new builds given the Lucky Strike model is very similar to what new build Bowlero’s look like (except Lucky Strike centers typically have less bowling lanes). One of the bigger revenues opportunities from this deal is the fact Lucky Strike centers have historically ignored the family/kids side of the equation. BOWL sees a massive opportunity to drive more daytime revenues out of these centers by starting to focus on family/kids events which wouldn’t impact the lure of the property for young adults/adults at nighttime.”

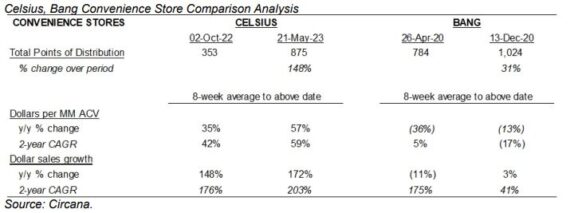

This past week at the Cross Sector Insight Conference, Stifel analyst Mark Astrachan hosted Celsius Holdings (CELH) CEO John Fieldly and EVP Toby David. Some key takeaways from the meetings include that overall sales trends remain robust driven by significant increases in total distribution points, with sales velocities continuing to grow strong double-digits. Near-term, Stifel sees upside to Q2 consensus sales growth – 89% growth is reasonable, compared to consensus of 76%, based on an analysis of sales by segment, comprising U.S. scanner data, Amazon, Costco, North America untracked channels, and International.

Meanwhile, Stifel believes that the convenience store (c-store) channel remains a significant opportunity. Despite meaningful distribution expansion, Celsius currently has 15% less distribution points in convenience stores than Bang Energy at similar periods. Equally important, Celsius’ sales growth and sales velocities in convenience stores have accelerated over the last eight-week period, up 172% and 57%, respectively, despite 148% growth in TDP since the October 2022 changeover to PepsiCo (PEP) distribution. “We think this shows strong repeat purchase rates while minimally cannibalizing Celsius’ sales in grocery and club channels. Convenience stores are important given they account for ~70% of Monster and Red Bull’s sales, compared to ~54% YTD for Celsius.”

![]()

Churchill Downs (CHDN) had previously announced a temporary suspension of races at its Churchill Downs Race Track (CDRT) to investigate recent horse fatalities. Racing operations at Churchill Downs Racetrack would be suspended, beginning June 7th, through the remainder of the Spring Meet, scheduled to run to July 3rd. The remainder of the race meet will be relocated to Ellis Park Racing & Gaming in Henderson, Kentucky, beginning on Saturday, June 10th.

With shares declining last Monday, Truist had the chance to catch up with management. While EBITDA contribution from live racing (ex-Derby weekend) is relatively immaterial, management is taking the fatalities and potential for reputational risk very seriously – already enacting new safety measures with further investigations underway. “We think a sell-off relating to the CDRT closure could be short-lived, while there’s ~11 months to work on any issues until the historic 150th Kentucky Derby.”

They add that following 2023’s record setting Kentucky Derby (+14-16M Y/Y EBITDA gains), next year’s running will be the sesquicentennial Derby. The company will debut the $185M – $200M Paddock Project, we believe a sub-8 year payback that will generate a +10% ROI. The company is focused on a successful running of the 150th Derby, and Truist believes the new initiatives should drive confidence in management’s commitment to the safety of the race participants. “We note that the temporary CDRT closure may actually allow construction of the Paddock Project to progress without potential disruption from live racing.”

Separately, JMP Securities believes there is no impact to the venue change, and the races being conducted allow for retail, and online wagering through the TwinSpires app. As a reminder, no spectators at the tracks during the pandemic was a positive for online horse wagering. Additionally, there is no impact at this point to ticket sales for the fall racing schedule at the track, or the 150th Derby next May. “We believe the company losing ~$360M in value between last week and mid-day is not justified, and recommend buying the dip.”

![]()

RBC Capital’s Digital Intelligence Strategy shows weaker U.S. hotel bookings even as website activity rises. “Our hotel booking data shows three consecutive months of negative Y/Y growth, while click activity on popular hotel websites is positive, Y/Y, since Nov’22. This divergence suggests potential demand destruction for U.S. hotel bookings. While travel interest is high, given strong website activity, actual bookings are slowing. Our proprietary hotel pricing data offers a predictable conclusion: hotel prices are high and rising. Y/Y changes in both bookings and website hits peaked in Jan’23 when nightly rates fell by an average of 16% vs Dec’22. Since then, prices have risen by an average of 5% each month. In context, our pricing data shows that a mid-tier hotel (3-4 stars) charged around $290 USD per night in Jan’23. Now, that same hotel charges over $350 per night, representing an increase of over 20% in just five months.”