NetApp (NTAP) – Checking In

This leading provider of storage systems, software, and services will be reporting Q3 results after the bell on Wednesday. Ahead of the print, let’s take a look at recent analyst commentary and VAR checks on what we can expect:

JPMorgan – Analyst Paul Coster said he expects NTAP to post Q3 results in-line with expectations. Read-throughs from IT distributors and EMS firms suggests IT spend remains robust relating to AFA storage, converged infrastructure and cloud-based workflows. The analyst does point out that we are lapping tough comps in the 2HFY19, memory prices are easing, and FX headwinds should cause an expected slowdown in the back half. That being said, he believes management has accounted for these risks with conservative guidance, and therefore expect the firm to hit EPS growth targets of mid 20%.

BAML – Analyst Wamsi Mohan is positive on the Jan-Q results for NetApp after checks point to bullish results in the value-added-reseller channel, with the weighted performance score at a solid +3.85%. Expectation for C2019 at +6.9% Y/Y is the highest score in our five-year survey history. NetApp’s wallet share in Flash was a solid 20%, and it appears to be having traction in Artificial Intelligence and benefits from its ONTAP Cloud solution. We keep our revenue estimates unchanged at this time as we expect a tough FX environment, and lower Flash pricing to offset strong organic demand.

VAR Checks – BAML’s quarterly survey of VARs is designed to provide a closer look at storage channel dynamics. For C4Q18, BAML surveyed 20 VARs, which ranged in size and scope from a few million to several hundred million in annual sales, with total annual revenue of roughly $20.3B (all storage). Here were some of the key takeaways:

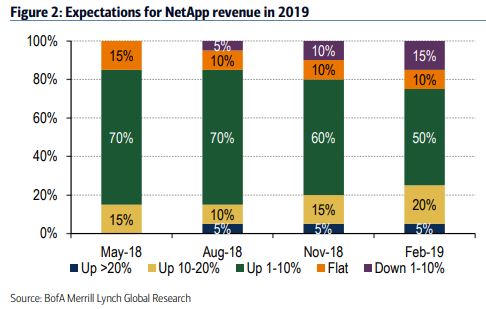

• Looking at full year C2019, survey respondents on average expect their NetApp storage revenue to grow +6.9% Y/Y vs. 6.5% growth expectation (for 2018) noted in the previous survey. The trend is highly positive and is now the highest revenue growth outlook in all our prior surveys in the last five years. 25% of the respondents expect their storage revenue from NetApp to grow in double digits, 50% expect single digit growth, 10% expect no growth/flat revenues and 15% of the respondents expected a decrease in revenue.

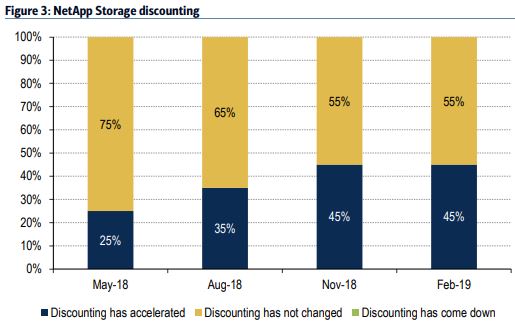

• When queried on whether NetApp Storage discounting has changed this quarter compared to the prior quarters, 55% of the respondents replied that discounting has not changed while 45% noted that discounting has accelerated (i.e. pricing is lower). No respondents noted that discounting has come down (i.e. pricing is higher). Compared to the prior survey, discounting has remained unchanged.

Stifel – Analyst Matthew Sheerin expects results to be in-line to modestly above their estimates, driven by continued all-flash-array adoption and share gains. They point to positive results and commentary from key distributors and resellers, as well as their own proprietary VAR checks. They also believe incremental ELA (licensing agreement) revenue could provide upside. Stifel is modeling 6.6% topline growth in FY19 and FY20, which should be driven by strong strategic sales (AFA, software, hyperconverged infrastructure), partially offset by weakness in legacy HDD.

• VAR Checks – Based on our preliminary checks with managed resellers specializing in external storage, resellers on average saw an 11% sequential increase in external storage sales for the December quarter, with 37% seeing greater than 10% Q/Q increase. For the upcoming Mar-Q, resellers on average expect similar momentum to continue, expecting on average a 10% sequential increase. For FY19 as a whole, resellers are optimistic for external storage sales expecting 20% Y/Y growth, with no reseller expecting negative growth.

• Enterprise License Agreements – ELAs represent negotiated contracts between a customer and NetApp for consultative projects such as on-prem-to-cloud data migration and software. ELAs are a harbinger for further hardware spend, and present incremental high-margin revenue opportunity as well as further hardware and service sale growth potential, especially with new clients. Stifel points out that earnings results in the last two quarters saw sales results and guide impacted by enterprise licensing agreements, which have been lumpy yet a growing contributor to profitability. Although NetApp has not changed its FY19 revenue growth assumptions, ELAs have already contributed $120M in the first two quarters of FY19, and our forward estimates reflect no additional ELA sales.