Ritchie Bros. Auctioneers (RBA) – Waiting on September

Through its auctions and online marketplace, Ritchie Bros. sells industrial equipment and other assets to construction, agriculture, transportation, energy, mining, forestry, material handling, and marine industries.

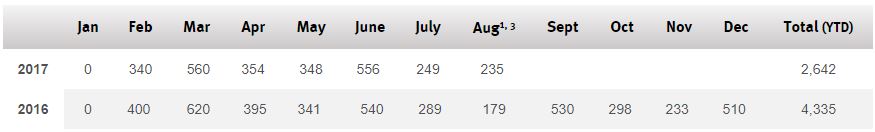

On September 11th, the company released its monthly Gross Transaction Value (GTV) of $235M for August, which was up 31% Y/Y (As Shown Below). August is seasonally the weakest month of the year for auction transactions. BAML was out saying that they believe the strong growth was partly driven by the addition of the IronPlanet acquisition**, which was not included in the 2016 figure. They also pointed out that on a quarter-to-date basis, GTV is only up 3% Y/Y, tracking below their forecast of +10% for Q3.

**IronPlanet was another auction service that conducted its sales primarily through online-only platforms. It was acquired in mid-2016 for $758.5M.

Upcoming Auctions

The company, as posted on their website, has an abundant amount of auctions coming up just this month alone. Auctions will be taking place in Dubai, Nashville, Montreal, Sacramento, Atlanta, Kansas City, and Los Angeles just to name a few. In a note from BAML, analyst Michael Feniger says:

“All eyes will turn to auction trends in September as it is the most critical month for the quarter. Historically, September contributes roughly 50-60% of auction proceeds to Ritchie’s third quarter. Ritchie’s core business faces a difficult comparative (September 2016: +14% YoY). Last year, Ritchie benefited from a large two-day auction in Columbus, Ohio ($76M of GAP), partly driven by $31M of proceeds from pipeline construction equipment. This year, Columbus is scheduled to be a one day auction and is unlikely to match last year’s strong result.”

Hurricane Impact

Texas and Florida are key U.S. markets for Ritchie and the company is hosting a two-day auction in Fort Worth on September 27th – 28th. Looking back at Q3 2005, Ritchie highlighted on its earnings call that Hurricane Katrina had little impact on pricing or supply of equipment in Gulf Coast auctions. In Q3 2012, Ritchie highlighted that the company was not sure Hurricane Sandy would have a major effect one way or the other. As BAML put it, “While there could be some equipment finding its way to auctions in areas impacted by the recent storm events and the consequent rebuild activity, it is difficult to see if this can really alter the fundamental challenges Ritchie is facing with the auction market.”

CAT Read-Through

On September 13th, BAML hosted meetings with Empire CAT, Caterpillar’s largest dealer in Arizon and Southeastern California. Empire would cite machine availability issues with CAT, a problem it expects to persist for the next several years. The used equipment market is already tight and the lack of machine availability could prolong this issue. Lead times appear extended on virtually all key classes of equipment. Empire and other dealers, in its view, would like to build more inventories but CAT is carefully managing the situation. In BAML’s view, this could suggest that many of the headwinds weighing on the auction backdrop could linger into 2018.

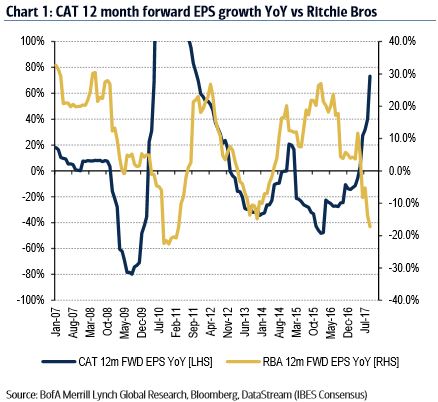

Finally, in a backdrop where global machinery demand is accelerating, RBA’s EPS growth tends to lag the broader Machinery sector, particularly Caterpillar, as shown in the chart below: