Service Corp International (SCI) – Doing Business With Death

Service Corporation International provides death care products and services in the United States and Canada. The company operates through Funeral and Cemetery segments. A more complete breakdown, according to BAML research, is shown below. Its funeral business provides professional services and merchandise for both burial and cremation customers. Its cemetery business provides professional services, merchandise, and cemetery property interment rights. The company sells these services at the time of need and on a pre-need basis:

At-Need (46% of SCI Revenues) – In an At-Need sale, a death has occurred and the family of the deceased makes arrangements for merchandise, services, and/or cemetery property interment rights on behalf of the deceased.

Pre-Need (44% of SCI Revenues) – In a Pre-Need sale, an individual makes arrangements for merchandise, services, and/or property prior to their death or the death of a loved one.

The death care industry is highly fragmented with several independent operators across North America. The top 5 operators, SCI being the leader at 16% market share, control approximately 21% of the market. The other notable competitors are Arbor (private), Carriage Services (CSV), Northstar (private), and StoneMor Partners (STON). In North America, the death care industry is estimated to be $19B with 22,000 funeral homes and 4,000 cemeteries. The funeral segment is estimated at $15B and is motivated by a caregiver attitude, which means to cater to the needs of the respective cultures. There are also relatively low barriers to entry to the funeral segment with the exception of the high-end market. However, in the cemetery segment, there are high barriers to entry due to government zoning restrictions and capital investments. The cemetery segment is estimated at $4B and is mainly driven by a sales mindset. According to the National Funeral Directors Association (NFDA), in the United States, there were 19,391 funeral homes in 2015, which is down from 21,528 funeral homes in 2004. The median cost of a funeral with burial has gone up from $6,580 in 2004 to $8,508 in 2014, representing a 29.3% increase.

Service Corp is already seeing a lift to sales due to the favorable demographics with the more meaningful wave coming once Baby Boomers reach their late 70’s/early 80’s. The Baby Boomer population is now 52-70 years old, and people in their early 60’s are buying cemetery properties to secure a preferred location. People in their 70’s are pre-arranging funerals to take the burden off of survivors. According to the United States Census Bureau, the current number of Americans that are 60 and older is approximately 67 million. This number is expected to grow to more than 77 million by 2020, resulting in growing interest in pre-need options. Trends also indicate that those aged 80 years old or more is projected to increase at 5x the national average over the long term, boding well for at-need services. Also, based on the December 2014 U.S. Census Bureau, deaths are projected to increase at an average rate of 1.2% from 2014 to 2016, accelerating slightly to 1.7% over the next decade with the aging of Baby Boomers.

Additionally, earlier this year, the National Center for Health Statistics (NCHS) released preliminary estimates for the 2015 mortality rate in the United States. For the first time in 10 years, age-adjusted mortality for all causes complied by the CDC increased to 729.5 from 724.6 per 100,000 people. The NCHS called out increases in Alzheimer’s, chronic liver diseases and cirrhosis, and chronic lower respiratory diseases and other factors as drivers of the increase.

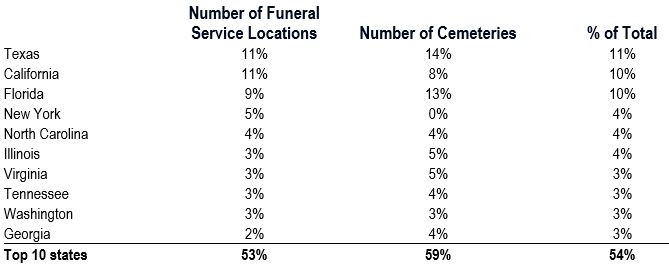

Over the last decade, the company has been able to make tuck-in acquisitions that ultimately build out its geographic footprint in the most attractive locations. As a result, the company has been able to strategically place its properties in the most populous states.

In terms of acquisitions, the company has made the following deals:

• Acquired Alderwoods Group in 2006, then the 2nd largest death care company in North America

• Acquired Keystone North America in 2010, then the 5th largest company in North America

• Acquired a 70% share in The Neptune Society in 2011, the nation’s largest direction cremation organization. It would acquire the remaining 30% in 2013 and 2014

• Acquired Stewart Enterprises in 2013, then the second largest operator of funeral service locations and cemeteries in North America

However, one risk that investors must keep in mind is that the stock can react to market selloffs due to its exposure to Trust Fund Income. Service Corp. is required by state laws and regulations to give pre-need consumers financial assurance that the monies they are placing with the company today will be available at the time of need. This is achieved either in the form of a trust investment or insurance policy. The company deposits all or a portion of the funds collected from customers on pre-need contracts into merchandise ad service trusts. Those trusts are invested and managed by about 25-30 professional investment managers. About 65% of assets are invested in equities, exposing the trust funds to market risk.

Lastly, the company’s 90-day average option volume currently sits at only 136. On 12/13, there were some small buyers of 250 June 25 Calls for 3.30 and buyers of 970 June 30 Calls for 0.60.