Simon Property (SPG) 3Q16 Earnings Takeaways – Operating Metrics Worst in 5 Years

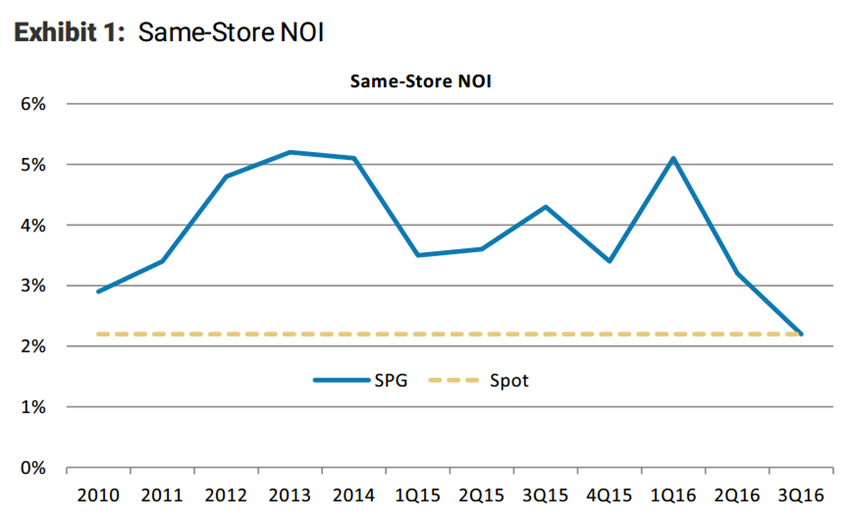

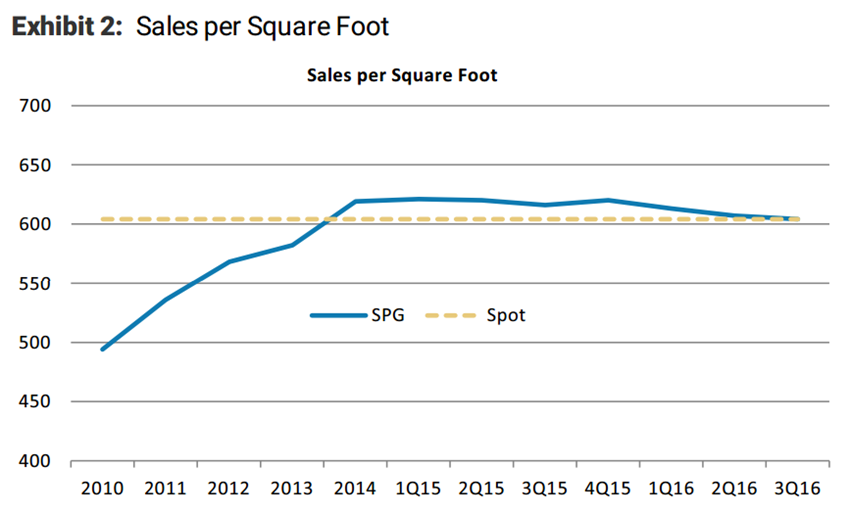

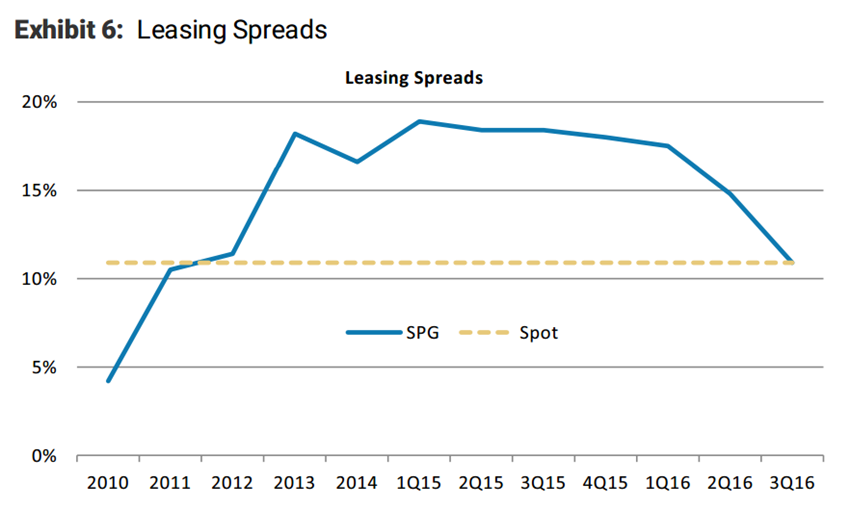

If you go by headlines, the company easily beat Revenue and EPS estimates and raised guidance. But scratch the surface further and troubling picture emerges on operating metrics compared to historical context. Re-leasing spreads were 10.9% compared to 14.8% last quarter and now stand at lowest level since 4Q12. Comparable property NOI growth was 2.2% compared to 3.2% last quarter and now stand at the lowest level since 1Q10. Sales per square foot declined to $604 the lowest level since 1Q14. Lastly Occupancy costs increased to 13%, the highest level in the last 3-years.

Lease Amendments Piling Up – Lease amendments are becoming increasing headaches and main driver of lower lease spreads. A secular trend playing out nationwide in malls and outlets that can perhaps be justified by simple logic of loss of market share to online retailers. Most notable item in earnings conference call? SPG stated that they expect to keep upon 500 Aeropostale stores and noted that there may be only 1 Macy’s store closure within their portfolio. Somehow we find that a major understatement. A reminder: on August 11 Macy’s announced 100 store closures nationwide. See HERE.