Twitter (TWTR) 3Q16 Earnings Takeaways – Easy Comps Next Year

Better Than Last Quarter – Management deserves some credit for improvement in Daily Active Usage (DAU) which accelerated to +7% YoY in Q3 vs. +5% in Q2. Still not enough to change the street narrative given only +1% increase in Monthly Active Users (MAU) despite strong political activity. But the company continues to take baby steps to improve the platform including key initiatives like tweet rankings, notifications aiding activity and better user onboarding, while taking excess cost out of equation which includes announced 9% layoff.

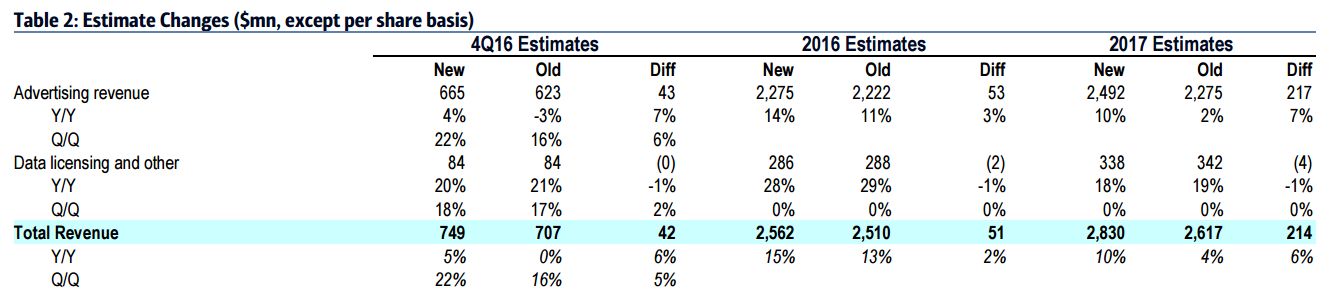

FY2017 Easy Comps while Growth Accelerates – As standalone, Twitter remains a “show-me” story that justifies valuation discount compared to internet media peers. But it should also be noted, the way math works from here shows consensus estimates for FY2017 are low after accounting for stabilization in user trends and projected cost cuts. We believe Wall Street models will adjust upwards and the move will appear more profound given easy YoY comps next year. So far only BAML has made such adjustments, we see others joining down the road. FY2016 Revenue/EBITDA goes to $2.56B/$724M from $2.51B/$713M. For 2017, Revenue/EBITDA increases to $2.83B (+10% y/y)/$852M from $2.62B (+4% y/y)/$766M.

This would signify an acceleration by more than twice the projected growth rate and would warrant higher valuation multiple.