Tile Shop Holdings (TTS) – Strong Housing Data Supports Further Upside

Tile Shop Holdings (TTS) is a US-based specialty retailer of manufactured and natural stone tiles, setting and maintenance materials and accessories operating through 120 stores in 31 states as well as an online segment. Their catalogue of over 4,000 products includes ceramic, porcelain, glass, marble, granite, quartz and other types of tiles produced in the USA and imported from all over the world.

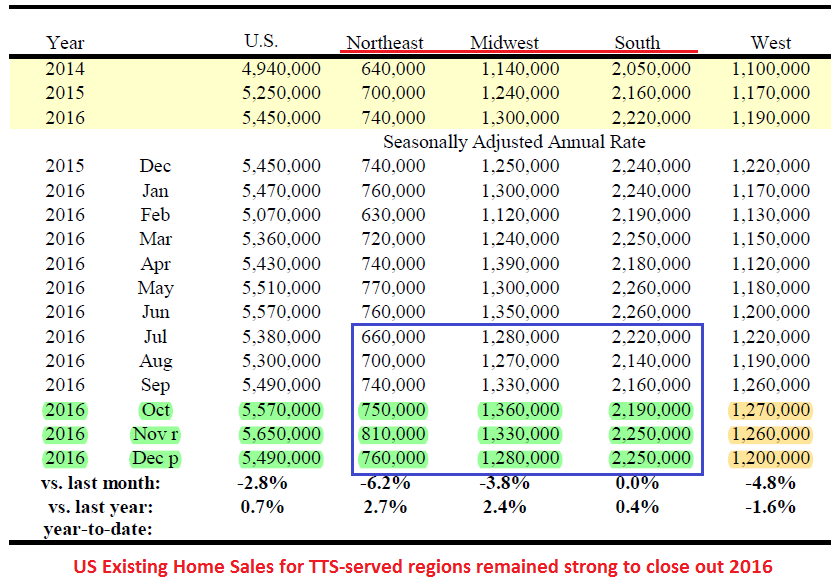

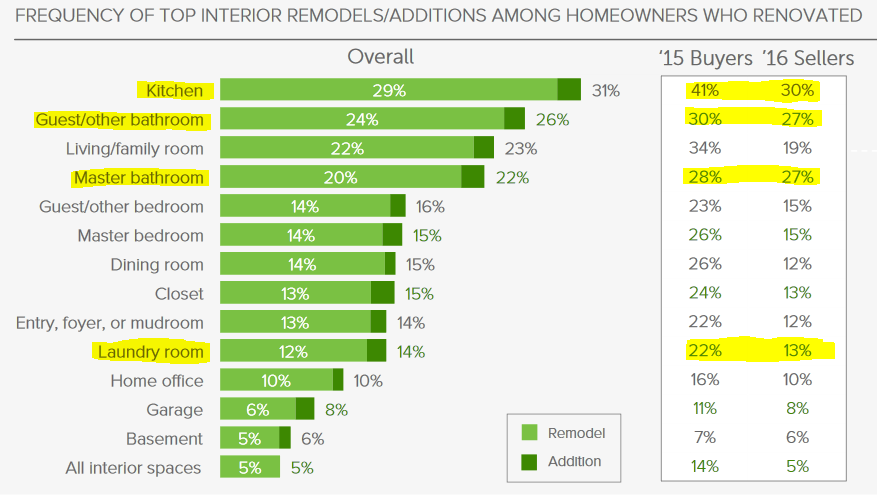

The majority of Tile Shop locations are in the Midwestern, Eastern and Southern part of the country, the same geographical areas that saw a steady upward trend in existing home sales from which the company could stand to benefit. Surveys and studies have constantly shown the two most popular home improvement areas are the kitchen and bathroom, with respectively 41%/30% of new buyers and 30%/27% of future sellers are apt to do, according to the Houzz & Home 2016 survey. The company does not have any presence on the West Coast.

Increased home improvement activity is expected to continue during 2017 reaching its highest level in over ten years according to Harvard University’s Joint Center for Housing Studies, who also forecasts spending to reach $325 billion in the first quarter.

3Q Data

Last quarter The Tile Shop reported an 8.5% YoY growth in sales to $78.6 million, with comparables up by 5.7%. Their online store was reported to have shown double-digit growth, and overall gross margin was up to 70.2%. EPS at $0.10 was up 25%, also for YoY time period. Free cash flow was $31 million with which the company paid down $5.8 million in debt. Management expects to generate $30 million in FCF annually on top of expenditures for new stores and expects to be debt-free “sometime in 2017”, wiping the remainder of its $18 million long-term debt off the balance sheet.

The Tile Shop also took possession of a distribution center in New Jersey during 3Q which should increase efficiency in re-supplying their stores in the Northeast. Inventory control improvements already have helped gross margin performance, contributing 20bps for the same quarter.

Concerning Energy-related headwinds, management did not have any concerns as there aren’t any stores in Houston, and added that the Texas locations are actually doing well.

Employee Retention

During their post-earnings conference call, CEO Chris Homeister expanded on their prior issues regarding high associate and manager turnover rates. Acknowledging that there still remains work to be done, Homeister did highlight ongoing improvements over the past two years with overall tenure increase, specifically those in managerial positions, and attributed stable staffing and leadership as significant contributors to financial and operational improvements over the same time frame.

Pro Mix

While their clientele is primarily the home consumer, The Tile Shop has made headway into the Pro market with the mix now standing at 34% and business continuing to be “very robust”. The Pro business segment, which Stifel rates as “the single largest opportunity “for the company, is representative of contractors, renovators, home builders and designers, which could eventually rival or exceed the DIY crowd.

CapEx

In the next couple of years, TTS expects to add 25 new locations to their roster while lowering capital expenditures by 20%. In part, this lower cost is due to the smaller footprint of the square footage of new stores, but mostly this seems to be from the company’s optimization of associated costs. It also doesn’t appear that smaller stores are detrimental to sales figures.

Analyst Coverage and Options Chain

The Tile Shop is not extensively covered and of the analyst firms that do provide coverage, only Stifel has recent research, albeit from last quarter with a Hold rating and $18 price target.

Options are available but not overly active. There have not been any recent trades of note.

Final Observations

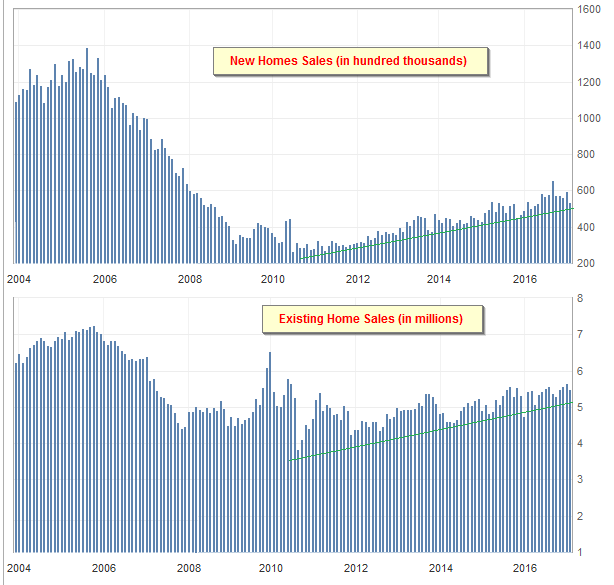

There is plenty of positive research and data pointing to increasing existing home sales, renovation and remodeling spending increases and house price appreciation returning near the past decade’s highs in many areas throughout the country. There are also all the homeowners who were in the penalty box from 2008-2009 when their homes were foreclosed: these consumers are now technically able to apply for mortgages and become homeowners once again, the number of which incidentally has now fallen to near 50-year lows. With all this in mind, and the fact that The Tile Shop is successfully taking market share makes a reasonable case for a longer-term Bull case for an increasingly improving and better run company.