Unlock: Mentor Graphics (MENT) – M&A Note From Early September

It pays to do fundamental research. This M&A piece was sent to clients on September 6. News out tonight Siemens nearing a deal to acquire MENT for up to $4.6 billion, valuing the stock ~$40 per share. To learn more about our approach and how you can become a successful trader, sign up for 2 week trial and test drive live chat room with some of the best traders: SUBSCRIBE

September 6, 2016

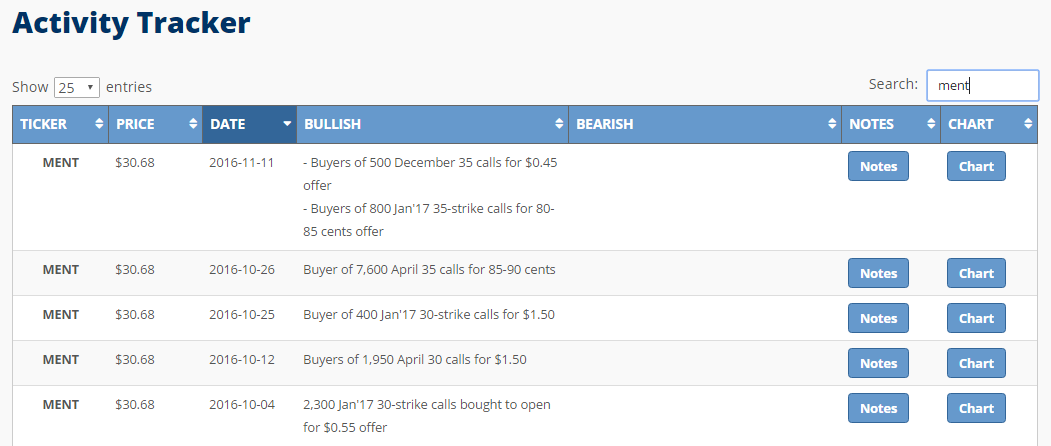

Mentor Graphics (MENT) – Unusual buyer of 780 October 25 calls for $0.50 offer on bid/ask spread of 0.35 x 0.50. Small $39,000 bullish bet on average day trades only 74 contracts and total open interest in entire option chain is only 761. Implied volatility sharply higher by +19.6%.

Fundamentals – MENT is $2.64 billion semi. Not a lot of coverage on this. Stock sharply gapped higher after last earnings as reported on August 18. Highlights:

– Q2 EPS $0.42 vs. $0.41 estimate, beat

– Q2 Revenues $254M vs. $245M estimate, beat

– Q2 Gross margins 81.5% vs. 79% estimate, beat

– Q2 Bookings flat year over year

– FY2016 EPS Guidance $1.68 vs. $1.68 estimate, in line

– FY2016 Revenue Guidance $1.21B vs. $121 estimate, beat

The main positive of the quarter was the strength in the emulation (networking) business, which tripled management’s prior guidance (booked more than 20 customers in Q2). The company now carries leading market share in networking emulation and growing sales 3x the rate of competitors. Synposis (SNPS) which is closest peer in this category is also performing well followed by 3rd competitors Cadence Design (CDNS). Despite being the market leader, MENT is trading at discount to peers at just 13x forward FY2017 estimates vs. industry at 17x.

M&A Mania – While I don’t always issue buy recommendations on purely M&A speculation, when chances are high it is at least worth mentioning. In networking emulation space in past two years: SNPS bought rival Magma Design for $507 million, CDNS bought Sigrity for $80 million, MENT bought XS Embedded for undisclosed amount, SNPS bought Codenomicon for undisclosed amount. What are chances MENT is a buyout target? I believe it is just the matter time.

Litigation with SNPS – On a separate note, back in April 2015, an Oregon federal judge granted an injunction in favor of MENT and against SNPS which was asked to pay $36 million in penalty for violating MENT patents. Since then SNPS has been trying to find a work around it. SNPS appealed the court to lift the injunction recently but was denied. What are chances SNPS goes after MENT to acquire and consolidate the industry?

Follow up note on October 16, 2016

All option activities recorded in Activity Tracker