Unlock: National Beverage (FIZZ) – What a Ridiculous Run!

It pays to do fundamental research. We take pride in what we do in Jaguar, because we don’t always let a technical price action force our opinion about fundamental outlook of the company. Thus, often welcoming pullbacks and giving us an opportunity to postion in spots where others are panicking. This bullish view on FIZZ was presented to clients on September 25, 2016 with stock at $44. Now at $78. One of many of our favorite calls in past 6 months. To learn more about our approach and how you can become a successful trader, sign up for 4 week trial and test drive live chat room with some of the best traders: SUBSCRIBE

September 25, 2016

FIZZ is a $2.35B beverage company that develops, produces, markets, and sells a portfolio of flavored beverage products primarily in North America. The company offers beverages geared toward the active and health-conscious consumers, with brands such as LaCroix, Faygo, Everfresh, and Shasta.

While the company has a handful of different brands, the star and leader of the portfolio is LaCroix. Sales of the drink have increased from $65 million in 2010 to $226M at the end of 2015, according to data from Euromonitor. As of today, LaCroix makes up 51% of total sales and it is driving more than 100% of the company’s growth. In terms of performance, shares of the stock are up 71% YoY and up 10% year to date.

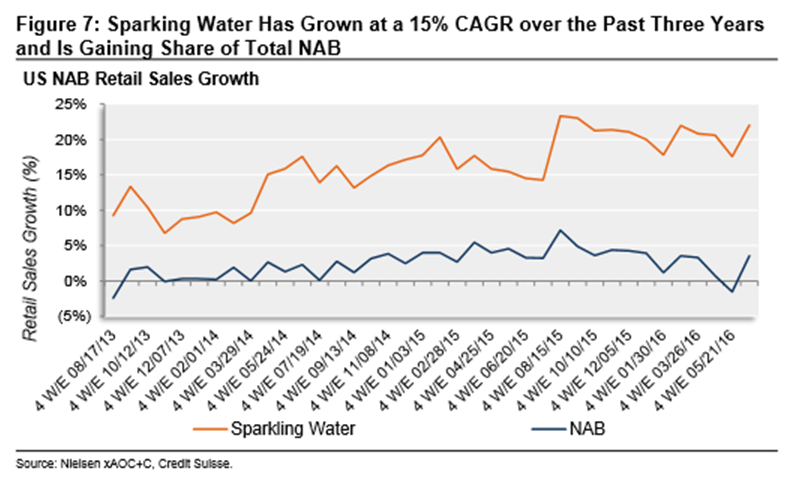

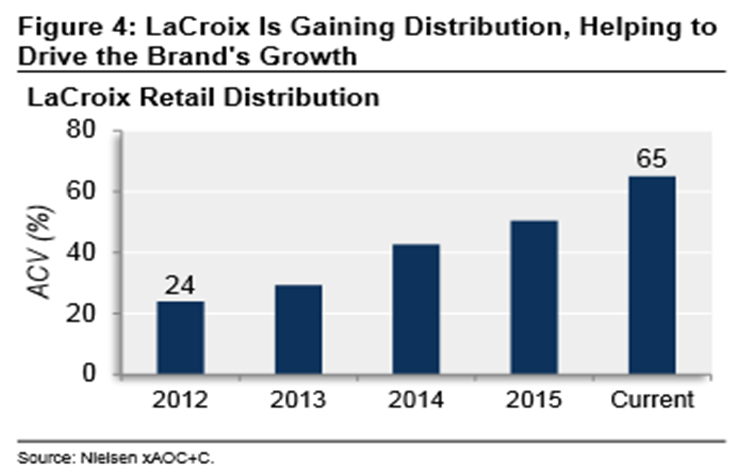

The non-alcoholic beverage market (or NAB) has been experiencing large disruptions due to the fact that consumers are more interested in healthy alternatives rather than popular soft drinks. In a recent research note from Credit Suisse, they highlight this trend as well as the fact that LaCroix itself continues to gain distribution growth.

With National Beverage depending solely on 1 brand, can the performance continue to be strong? Analysts have laid out a handful of potential opportunities:

- The company can enter new retail channels, such as convenience stores. Given such high velocity of the product, c-store operators would be pleased to offer LaCroix. But, the company would have to develop a single-serve format, departing from its usual six-pack and 12-pack formats.

- The company can distribute to the on-premise channel, such as restaurants, bars, hospitals, schools, and college campuses. National Beverage is currently exploring this opportunity.

- The company could improve its merchandising and in-store shelf space. Channel checks indicate that LaCroix tends to be merchandised toward the bottom of shelves. This is probably because the company doesn’t have the same salesforce scale and is not benefiting from the direct store distribution (DSD) system its largest competitors have.

Lastly, there have been occasions where the idea of “a takeout” has presented itself. For example, Credit Suisse made the case in their 9/15 research note that the brand would fit well in the Dr. Pepper Snapple Group (DPS) portfolio because, “like many of the Allied Brands, it is relatively small but it is on-trend and has significant potential. While Coca-Cola (KO) or PepsiCo (PEP) could be interested, we also believe LaCroix would benefit better from Dr. Pepper Snapple’s DSD system that has already demonstrated success in managing smaller brands.”

Since the beginning of this month, we have seen the following option trades:

- Buyer of 199 March (2017) 60 Calls for 2.65 on 9/9

- Buyer of 590 October 60 Calls for 1.35 – 1.50 on 9/13

- Buyer of 675 October 50 Calls for 3.60 on 9/23