Unlock: Thor Industries (THO) – RVIA Industry Checks Pay Off Handsomely

It pays to do fundamental research. Here is bullish view we presented to clients yesterday before earnings. Stock is +12% today after strong quarter with beat and raise. To learn more about our approach and how you can become a successful trader, sign up for 2 week trial and test drive live chat room with some of the best traders: SUBSCRIBE

November 28, 2016

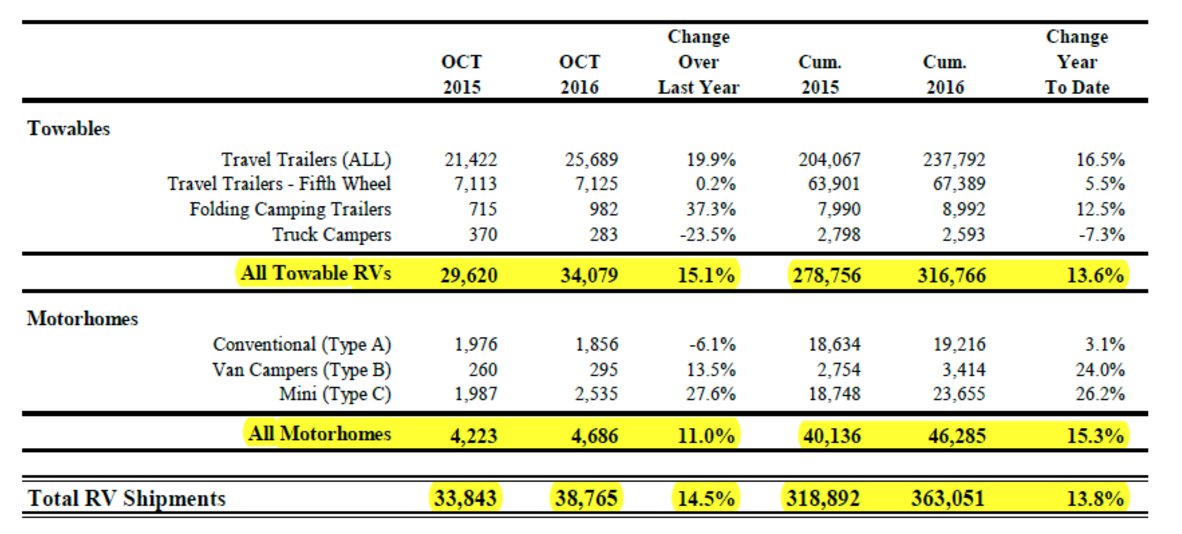

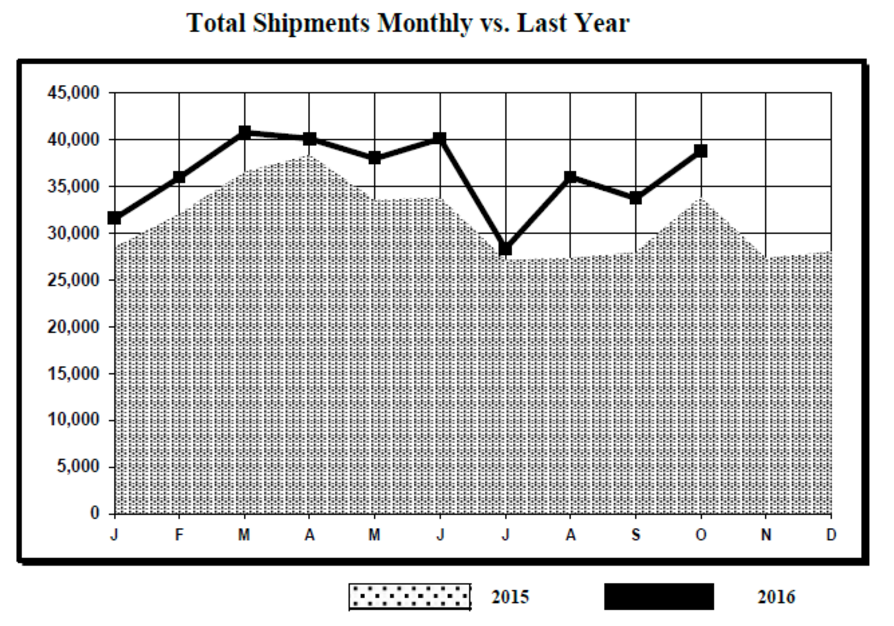

Thor Industries (THO) – Recreational vehicle manufacturer reports 1Q2017 earnings tonight after the close. On Friday, while everyone was nursing a full stomach, RVIA released October vehicle shipment data which showed yet another YoY increase by +14.5% and cumulative increase at +13.8%. Five of the seven vehicle categories improved in October compared to last year, with conventional travel trailers rising by the largest unit total and folding camping trailers rising by the largest percentage gain. Motorhome shipments increased +11.6% YoY to 4.7 in October. Importantly, lower price towable RVs increased +15.1% YoY to 34.1 in October. Towables have higher margins than motorhomes and carry higher attachment rates for high margin finance and insurance. 2016 shipments have remained above 2015 for entire year. So far, all peers have released their earnings reports and both sides; the manufacturers and the retailers, have seen increased sales as well as profits:

- Patrick Industries (PATK) – Q3 EPS $0.79 vs. $0.76, Revenue $304.2M vs. $280.6M

- Winnebago (WGO) – Q3 EPS $0.53 vs. $0.45, Revenue $272.1M vs. $270.5M

- Camping World (CWH) – Q3 EPS $0.94 vs. $0.49, Revenue $1.01B vs. $970.94M

Last quarter, THO reported EPS at $1.57 vs. $1.33, and Revenue $1.29B vs. $1.27B, also guided FY2017 revenue up double digits. There is definite data showing the RV market being alive and healthy. A 2014 Demographic study revealed that it isn’t solely the domain of retired wealthy couples. 77% of RV Association members were couples, with 50% being over 65 years of age, followed by the 50-64 age groups at 32%. True, two-thirds were retired; however the income brackets were almost equally distributed throughout above $50k/yr threshold.

The question is, is Thor’s valuation at a fair level here? With most recent analyst median target at $92.50, an exceptional report may see revisions to higher target and PE multiples.