YTD Staples (XLP) +8.2% versus S&P +1.8% – My Views from 2016 Outlook

At the beginning of each year we send out our annual outlook. Below is an excerpt from December 28, 2015.

Expect Dividend Paying Stocks to Rally Next Year – As we have been discussing repeatedly in daily chat sessions over past two months, I believe the best performing sector next year will be dividend paying stocks. This is counter intuitive to broad consensus view that is looking for financials and growth stocks to outperform next year. My reasons are following:

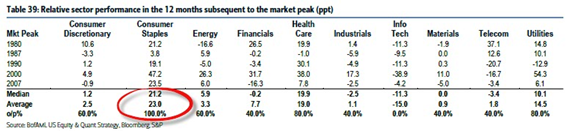

- Historically, Consumer Staples is the best performing group in the 12 months subsequent to market peak. This was evident before last 4 bull market ended with average gain of 23%, highest of any other sector and 3x the outperformance of Financials (which many pundits in market today are proposing to get long after Fed rate hike in December). The worst performing sector was Tech (taking a shot directly at all those people who are piling into “FANGs” of the world):

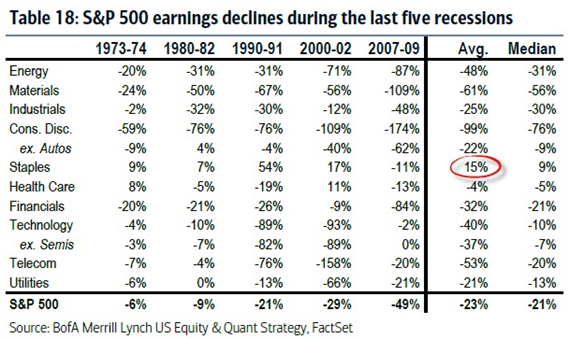

- Historically, Consumer Staples is the best hedge against recessions. It will likely surprise you to note that in last 5 recessions since early 1970s, Staples was the only sector that DID NOT see earnings decline with exception of 2008-2009 which was global total meltdown. That says something that people most of the time overlook:

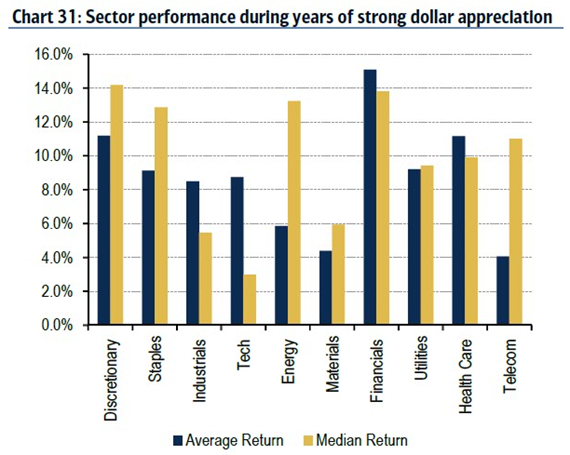

- The next question you are probably pondering is…. but, but Fahad what about rising US Dollar (due to rate hike) taking a bite out of Staples growth rate? Quite the contrary! I have long maintained and discussed under Market Internals charts: Strong Dollar = Strong America! Historically, Staples is one the best performing sectors during years of dollar appreciation.