Behind The Numbers – Silvergate Capital (SI)

**This is one of the many write-ups discussed in our upcoming Weekend Research report, delivered to clients every Sunday.

On January 20th, after the market closed, Silvergate Capital not only announced its Q4 earnings but also launched a $200M Class A common stock offering. Ultimately, shares would trade lower the next day coupled with the fact that the stock has been moving in tandem with the price of bitcoin, which was also down for the week. On Thursday morning, in Conversations, I provided a brief overview of the results, highlighting these specific data points from the press release:

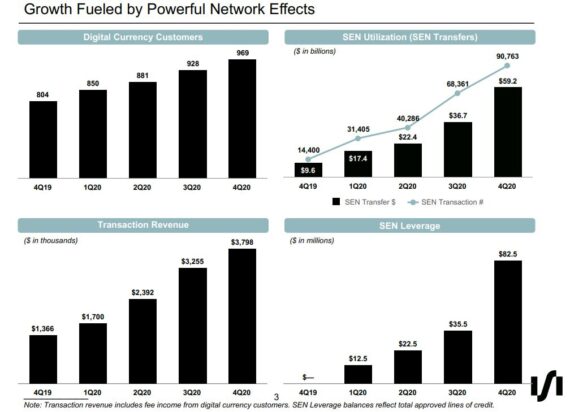

-The Silvergate Exchange Network (SEN) handled 90,763 transactions in the fourth quarter, an increase of 33%, compared to 68,361 transactions in Q3, and an increase of 530% compared to 14,400 transactions Y/Y.

-The SEN handled $59.2B of U.S. dollar transfers in the fourth quarter, an increase of 62% compared to $36.7B in Q3, and an increase of 516% compared to $9.6B Y/Y.

-Digital currency customer related fee income for the quarter was $3.8M, compared to $3.3M for Q3, and $1.4M for the fourth quarter of 2019.

-Digital currency customers grew to 969 as of December 31st compared to 928 at the end of September, and 804 in December 2019.

-Digital currency deposits grew to $5B at the end of December vs $2.1B Q/Q.

In his post-earnings note, Keefe Bruyette & Woods analyst Michael Perito would reiterate his Outperform Rating and raise his price target to $90 from $75 highlighting that the capital raise was partly in response to the staggering balance sheet growth experienced in Q4 but also their continued bullish growth outlook for their business, in particular the newer SEN Leverage product which exited its pilot phase in Q4 (more on this below).

He would add that the bank’s strong Q4 results point to a very favorable outlook, in their view, with untapped revenues coming on from SEN leverage in 2021, a strong pipeline of new customers (38% CAGR over last 3 years), and a favorable competitive landscape including a total addressable market that remains almost too big to quantify.

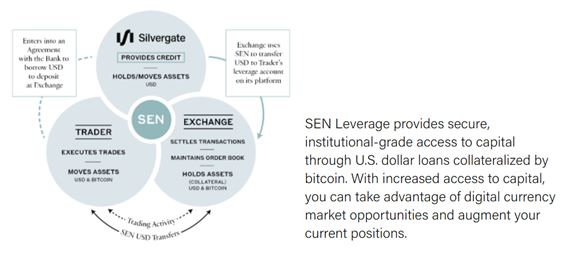

SEN Leverage

CEO Alan Lane, on the conference call, said he was excited to provide an update on SEN Leverage, which allows Silvergate customers to obtain U.S. dollar-denominated loans collateralized by their investment in bitcoin. “We were prudent in the rollout of the product and tested it over the past year through our pilot program. At the end of the third quarter, we exited the pilot program, making SEN Leverage a more integral part of our growth and monetization of the platform.”

At the end of 2020, the company said it had approved lines of credit totaling $82.5M versus $35.5M at the end of Q3. “We are in the early stages of scaling SEN Leverage and are confident that we have a significant runway for platform revenue growth in the coming years.”

KBW views this as a multi-billion dollar type of opportunity for Silvergate over the next handful of years, with management suggesting on the conference call that less than 5% of their clients are utilizing the product today (they have over 600 institutional investor clients that could use the product). “If we assume that 5% of their 607 institutional clients make up the $83M of 4Q20 balances, that would suggest $2.8M average balances per client. If all of SI’s >600 institutional investor clients utilize the product (which management suggested was possible) that would imply between $1.5-$2.0B of balances. Currently, our model incorporates $623M of SEN Leverage balances in our 2023E, every additional $100M of balances held on balance sheet represents nearly $0.20 or 5% accretion to our model.”

Custody Solution

The company also announced its recent product with the launch of a bitcoin custody solution for the growing institutional investor community, many of which are already customers of Silvergate and participants in the SEN. They see this offering as a natural next step for the business and one that will provide critical financial infrastructure for customers and their product road map.

EVP of Corporate Development Benjamin Reynolds would add, “So the custody product is something that we’ve been looking at and really studying for the last couple of years. We really introduced it this quarter because some of our existing clients had asked us to provide an institutional-grade solution because they were looking to diversify from some of their other custodial service providers. So the idea there is by kind of custodying your bitcoin at several different locations. It minimizes the risk to a certain extent. So we’re doing this.”

Customer Pipeline

In the Q&A session, Canaccord Genuity analyst Joseph Vafi commented on the recent move in bitcoin and would ask about the pipeline and what it looks like for new institutions wanting to come on to the SEN.

EVP Benjamin Reynolds would respond saying that the pipeline of customers has remained robust at over 200. What they tend to see is that firms that are looking to make an allocation to the asset class or looking to launch a fund, it takes them 3 to 6 months to really get their funds set up, get their investor base, etc.

“So we still — we have seen high-quality institutional investors come into the pipeline. And without naming any customer names, I mean, if — there’s a number of hedge funds out there that have been public about coming into the space. And just because of the SEN and the liquidity and all the folks that are already participating in it, those folks really do need to open accounts at Silvergate. And so we feel good about the pipeline. We’re continuing to stick to our compliance and risk framework for evaluating those clients, and we’re not loosening up there at all. But feel good overall about the market expansion and the opportunity that creates for Silvergate.”

Bitcoin Volatility

Finally, in terms of risks or potential downside, KBW summed it up well by saying that the Silvergate story should remain a volatile one with its historical correlation to the price of Bitcoin likely continuing to be relevant over the near-term. While they believe this correlation will weaken over time as their business becomes more mature, it’s not unreasonable to believe that a significant drop in Bitcoin could result in material compression in SI’s earnings multiple. However, they don’t envision SI’s share price falling 1:1 with bitcoin so to speak, although they would caution investors in order to be prepared for volatile swings in SI’s stock price potentially in either direction.