Aris Water Solutions (ARIS) – Handling the Permian

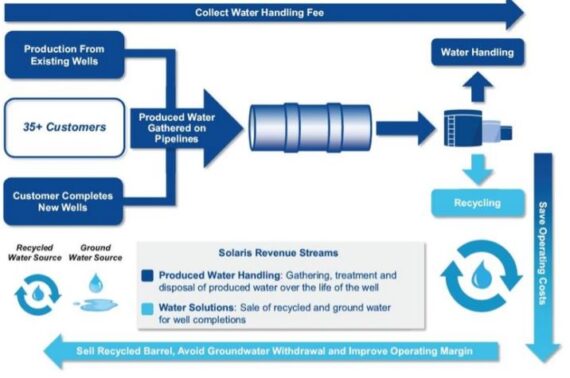

Aris Water Solutions (ARIS) is a water management company that services areas of the Permian Basin. It currently operates through two segments: Produced Water Handling, which gathers, transports and, unless recycled, handles produced water generated from oil and natural gas production, and Water Solutions, which develops and operates recycling facilities to treat, store and recycle produced water.

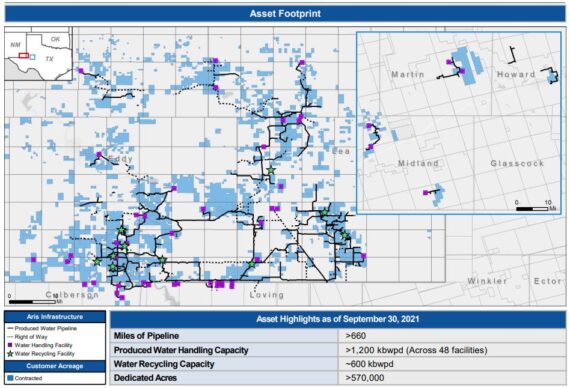

The company’s pipeline and water handling assets are comprised primarily of pipelines, pumps and handling and recycling facilities in the core of the Delaware and Midland Basins. Their pipeline network consists of approximately 680 installed miles of gathering pipelines, which includes approximately 468 miles of larger diameter (12- to 24-inch) pipelines.

According to the company’s 10-K filing, as of December 31st, 2021, the company’s five largest customers were affiliates of ConocoPhillips (COP), OXY USA, Chevron (CVX), XTO Energy, and Mewbourne Oil Company. These five customers represented approximately 74% of revenue for the year ended December 31st.

Before getting into specific fundamentals, one risk that constantly comes up is regarding seismic events. According to the company, federal and some state agencies are investigating whether wells have caused or contributed to increased seismic activity, and some states have restricted, suspended, or shut down the use of disposal wells within the vicinity of seismic events. In response to these concerns, regulators in some states have imposed, or are considering imposing, additional requirements in the permitting of produced water disposal wells. Aris currently operates in the states of New Mexico and Texas, where the New Mexico Oil Conservation Division and the Texas Railroad Commission, respectively, have the authority to regulate disposal activity, including the authority to address seismic activity in their respective states.

Aris noted recently it continues tracking seismic activity in the Permian and is in close contact with regulators. Specifically, regulatory attention is focused on limiting injection into deeper wells and designated seismic response areas, generally defined as formations below the base of the Wolfcamp. That said, management noted the company has not had a material impact thus far, and less than 1% of its volumes (~3Mbpd) have been impacted. In addition, Aris highlighted its large-scale water system and recycling capabilities, which reduces down hole injection, can help mitigate seismic exposure and offer customers flexibility.

New Mexico Growth

As mentioned previously, the company operates in both New Mexico and Texas, and according to the company, it expects approximately 28% Y/Y EBITDA growth based on the midpoint of 2022 guidance. Based on the EIA’s New Mexico crude oil production data, Stifel estimates a 5-year CAGR of approximately 26% and would highlight that New Mexico saw double-digit growth in 2020, despite bearing the brunt of the COVID-19 pandemic. Furthermore, New Mexico production has outpaced Permian production, with New Mexico producing 28% of Permian crude totals at YE21, compared to under 20% in early 2017. The rig count in the New Mexico Permian also continues to significantly outperform Permian and U.S. totals. Specifically, the NM Permian rig count is at 90% of early 2020 levels (pre-COVID), compared to Permian and U.S. totals of 78% and 77%, respectively. Stifel notes Lea County, New Mexico rigs are approximately 10% above pre-COVID levels. For more details see Exhibit 2.

Virtual NDR

On March 17th, Stifel analyst Selman Akyol was out with a note following meetings with Aris CEO William Zartler and CFO Brenda Schroer. A few notable takeaways included:

Capex – Management noted of their $80M to $90M of FY22 capex that nearly $15M should be considered sustaining capex, or capex to keep volumes flat. The remaining ~$70M should be viewed as growth.

Customers – The company’s largest customers are accelerating whether they are discussing it or not. Clearly several majors have increased the number of rigs they are running and the private companies have been for a while. That said, there are still bottlenecks around completion, where the company did highlight completion crews and in basin sand as being challenges. “We do believe the acceleration will become evident in the back half of 2022 and into 2023.”

Going Beyond Water – Aris highlighted other potential uses for produced water other than well completions. The company highlighted it could be used for irrigation for non-consumptive crops such as switch grass which would be a carbon sink or potentially soybeans to be used in bio diesel. Aris is part of several experiments underway and noted they have interest from customers to help fund the projects.