1-800-FLOWERS (FLWS) – The Perfect Experience

“We’re obsessed with providing a terrific experience. If not, we’ll make it right – guaranteed.” -Chris McCann, CEO & Jim McCann, Founder

1-800-FLOWERS (FLWS) is the leading provider of gourmet and floral gifts for all occassions. It provides products through a number of brands, such as fresh flowers and gift-quality fruits from Harry and David, popcorn from The Popcorn Factory, cookies from Cheryl’s, gift baskets and towers from 1-800-Baskets, breakfast treats from Wolferman’s, and steaks and chops from Stock Yards.

What led me to first highlighting this stock in Jaguar Conversations recently was a KeyBanc note where they went over recent consumer spending checks. More specifically, there was a category labelled “Florist Supplies, Nursery Stock, and Flowers” in which it showed growth M/M. Beginning with July, the category was up 13.3%, followed by August up 16.5%, and finally September showing an impressive 31.6% growth rate. The company already posted a strong Q4 number back in late-August (breakdown shown below), and these numbers tell me Q1 should be more of the same.

Q4 Breakdown

-EPS of $0.23 vs $0.18 estimate – Beat

-Revenue of $418M vs $379.53M estimate – Beat

-Total Revenues increased 61.1%, fueled by a surge in e-commerce and strong demand for gifting in a social distancing environment.

Its Consumer Floral segment increased 46.5%, an incredible sequential improvement from the 5.4% growth in Q3. This business benefited from strong growth for the Easter and Mother’s Day holiday periods, combined with increasing demand for occasions, such as birthday, anniversary, sympathy, and get well. Management indicated that the momentum is expected to continue into the fiscal first and second quarter, supported by a long tail of e-commerce driven revenue. In addition, management indicated that momentum will be sustained by growth in new customers and the behavior of the new customers in multi-brand usage and repeat usage.

Its Gourmet Food & Gift Basket revenue surged 112.3%, 11.5% better than analyst estimates. Products from Harry & David, Cheryl’s Cookies, Shari’s Berries, and Simply Chocolate were called out positively on the earnings call.

Finally, its Bloomnet revenues increased 10.7% but management said that results were affected by their decision to waive membership fees and to provide support services to its Florist network during the pandemic.

CEO Christopher McCann would add, “As we move ahead into fiscal 2021, the strong momentum built throughout the past year has continued through the first two months of our Q1 and it bodes well for this key holiday season in Q2.”

In a post-earnings note, Noble Financial analyst Michael Kupinski highlighted that the bump the company saw in e-commerce appears to have a long tail, as they thought it might. Certainly, the strong ecommerce trends are a function of consumers wariness of shopping centers and potential crowds in a Covid environment. But, they believe that the strong momentum may also indicate that shopping habits have dynamically shifted toward the convenience and comfort of the home. The pace of its e-commerce business is better than their expectations. Management indicated that revenues in the upcoming fiscal first quarter is expected to increase a solid 40% to 45%, which is a nice surprise for a typical seasonally unprofitable quarter. The revenue growth guidance includes the recent acquisition of PersonalizationMall.com (PMall). Nonetheless, revenue growth is expected to be a strong 30% to 35% excluding the acquisition.

In addition, the company seems to be managing other headwinds, including possible seasonal labor shortages and strains on delivery services, including FedEx and the US Postal Service. Notably, delivery services indicate that August deliveries have been more than a typical Holiday season. It is quite possible that continued growth in e-commerce demand will put significant pressure on Holiday deliveries. In response, the company has not marketed its same day delivery options or its price promoted due to its current strong demand.

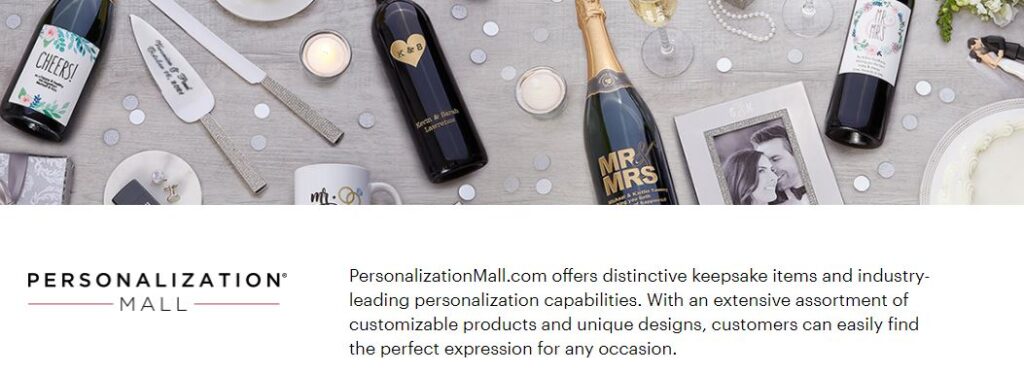

Personalization Mall

On July 22nd, FLWS and Bed Bath & Beyond (BBBY) announced they settled their lawsuit and proceeded with FLWS’s acquisition of PMall for $245M, $7M less than previously agreed upon.

PMall is a leading online retailer of personalized products that offers thousands of items available with a broad range of innovative personalization options. PMall sells about 10,000 different SKUs, including mugs, glassware, plaques, holiday cards, kitchenware, picture frames, doormats, clothing, and jewelry. The business is backward integrated, in that it performs the sublimation, embroidery, digital printing, engraving, and sandblasting itself. About 50% of PMall’s revenue comes in the December quarter (compared with ~65% for FLWS’ Gourmet Food & Gift Baskets business), and the business is EBITDA positive in each quarter of the year

DA Davidson was out with a note following the announcement saying they view the deal positively and expect it to add annual revenue of >$150M and EBITDA of $25M. Fast forward to earnings, where management said that its Q1 guidance reflects the acquisition of PMall, Notably, PMall will be included in the company’s Consumer Floral segment. Noble Financial believes that PMall has now completed its backlog of orders after being shut down during the depth of the Covid mitigation efforts.