Behind The Numbers – AngioDynamics (ANGO)

We recently covered this name in the June 21st W/E Research (See HERE) with a bull case surrounding the company’s AURYON product. This past week, the company reported their Q4 earnings and the stock dropped by 11%. With that, I wanted to provide an update as we started to get questions on it. First off, here is a quick earnings breakdown:

-EPS of ($0.06) vs ($0.06) estimate – In-Line

-Revenue of $58.3M vs $64.3M estimate – Miss

-Net Sales decreased 18.1% Y/Y

-Oncology Net Sales decreased 18% Y/Y

-Vascular Interventions and Therapies Net Sales decreased 28.8% Y/Y

-Vascular Access Net Sales decreased 4.6% Y/Y

-Gross Margin decreased 630bps Y/Y

CEO Jim Clemmer, in the press release and to no one’s surprise, noted that their Q4 sales were impacted by the deferral of elective procedures associated with COVID-19. However, since that time, management stated that they have seen a steady improvement in procedure volumes and with it a corresponding improvement in sales. “Our revenue has not yet returned to pre-COVID levels, but I can report to you that this positive trend continued throughout June, and the first half of July, and we are seeing encouraging trends in our marketplace.”

Management also mentioned on the conference call that during the quarter, overall results were negatively impacted by a recall initiated by Bard that is related to a component in their VA kits that they provide. The full net impact inclusive of costs incurred was roughly $750,000 during the fourth quarter. Lastly, their first quarter revenue will include a one-time order in the UK from NHS. “During the fourth quarter, a distributor partner reached out to us on a one-time stocking order related to pandemic planning. Our team did a great job in addressing this order and working urgently to fill the order. $1 million was shipped in the fourth quarter, and we expect to ship $5 million during the first quarter of FY 2021.”

Product Pipeline

On the R&D front, the company continues to see strong interest in NanoKnife 3.0 and AngioVac 3.0 and remain focused on further developing these platforms. Regarding AngioVac, management remains on track to deliver two new products next calendar year, and look forward to sharing these developments in future quarters. “We also continue to advance the AURYON technology. And as we told you last quarter, we focused our investment in three primary areas; ensuring a robust and efficient supply chain, introducing physician and sales training programs and developing a dedicated selling and marketing channel to take this unique product to market. We are planning a full launch early in the second quarter of this fiscal year, and we currently anticipate Auryon generating $7 million to $10 million in revenue in fiscal 2021. We are excited to see what this product does in the hands of physicians.”

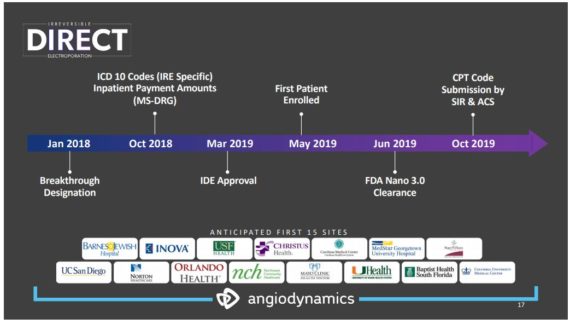

With regards to their PATHFINDER and DIRECT studies, they are still a primary focus but require a certain level of flexibility in the current environment. “CMS and hospitals throughout the country prioritized critical care procedures and preserving treatment capacity, additional site initiation activities and patient enrollment efforts in both PATHFINDER, our atherectomy registry; and DIRECT, our NanoKnife, pancreatic cancer IDE, were paused. However, as hospitals are now gradually opening back up, we are seeing activity around these initiatives begin once again.” As of today, 21 DIRECT study sites have secured IRB approval as the company has added two additional sites since the last quarterly call, providing further evidence that these activities are indeed beginning to occur again.

Analyst Commentary

KeyBanc analyst Matthew Mishan was out with a post-earnings note saying they believe the decline was an overreaction and ANGO actually managed through the worst of the crisis very well. They added that they believed Street estimates were too high coming in, as the full extent of COVID-19 headwinds were not fully known when last they reported in early April. Given the March-May timing of its fiscal quarter, they actually viewed sales of $58M (vs. KBCM $65M) as slightly better than they should have expected, with no major surprises across product areas.

Finally, the analyst added that there were already some positive signs of a recovery into the second half including:

1) An increase of NanoKnife capital sales in 4Q20, despite softness in procedural volumes.

2) A record month for AngioVac sales and procedures in June, which likely reflected some degree of pent-up demand.

3) A material one-time contract in Vascular Access with NHS as part of its pandemic preparedness response.