Behind The Numbers – Daktronics (DAKT)

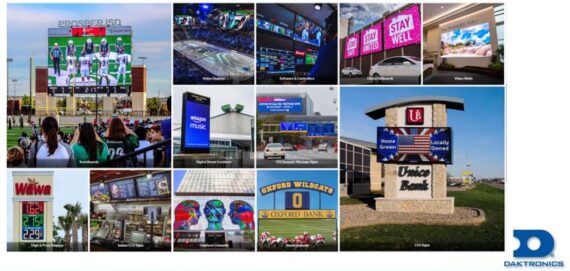

Daktronics (DAKT) is an industry leader in designing and manufacturing electronic scoreboards, programmable display systems and large screen video displays for sporting, commercial, and transportation applications. The company operates through four domestic business units and one international business unit. The four domestic business units consist of Commercial, Live Events, High School Park and Recreation, and Transportation.

Back on September 10th, a bullish write-up was presented in Weekend Research. Heading into this week’s earnings report, the stock had performed well, up around 20%. Unfortunately, those gains were wiped out on Tuesday after the company reported its Q2 earnings.

The company reported sales of $199.4M, an increase of 6.4% compared to $187.4M for the second quarter of fiscal 2023. On the conference call, management would remind investors that generally, in the first half of the year, they have stronger quarters. Q3 is ultimately softer because of the seasonality and reduced work days for the holidays, while Q4 starts to ramp back up for the sports and outdoor deliveries. In terms of its segments:

Commercial – The company said that while in FY24, their orders were down because of market conditions, they still expect growth over the long term. “We are focused on increasing sales channels with audiovisual integrators for end use in government, military, health care and corporate applications, which will create growth in this business area.” They also expect existing and new customers to purchase displays to install in new locations as well as replacement displays for existing locations to capitalize on the effectiveness of digital technologies.

Transportation – Demand is strong as project planning and approval activities resume to more pre-pandemic levels, and customers move forward in purchasing displays used for intelligent transportation systems and for mass transit venues. “Infrastructure spending should continue to benefit this segment as digital signage is often used in these projects, and we are qualified to do business in all U.S. states.”

Live Events – The outlook remains strong due to large stadium renovations, continued replacement cycles and expansion of sales efforts beyond the sports competition areas.

International – The company said it continues to experience a softer market due to macroeconomic and geopolitical factors. “We expect to see these factors to continue to impact sales in the coming year. We are closely watching developments and can adjust resources and commitments accordingly.”

After seeing the earnings press release and reading the conference call transcript, I was disappointed and underwhelmed. Prior to earnings, in Conversations on Monday, I said that I was expecting to see continued growth in Live Events and HSPR (High School Park & Recreation) segments. HSPR Net Sales came in at $48.9M, a increase of 16.5% Y/Y and HSPR Orders came in at $32.8M, an increase of 2.8% Y/Y. However, that sales number declined sequentially because it was $56.3M in Q1. Meanwhile, Live Events Net Sales came in at $68.2M, a decrease of 1.5% Y/Y and a decrease sequentially from $92M in Q1. I was under the impression that a lot of projects were set to convert to sales in Q2. But that clearly did not happen. With Q3 being the weakest in terms of seasonality, I believe it will be a couple of quarters until this company can regain its footing. For that reason, I am going to update the W/E Research Tracker on Sunday and move this to a “C” ranking. For now, there are better opportunities elsewhere.