JaguarConsumer Weekly Callouts – December 3 (CMG, HSY, JILL, MCD, MTN, OLLI, RICK)

**PDF Version is also available HERE**

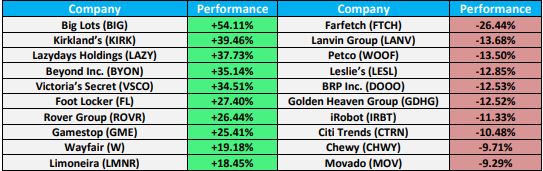

Winners & Losers

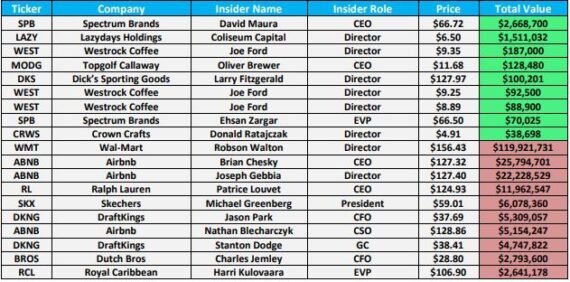

Insider Action

C-Suite Changes

![]()

Industry News

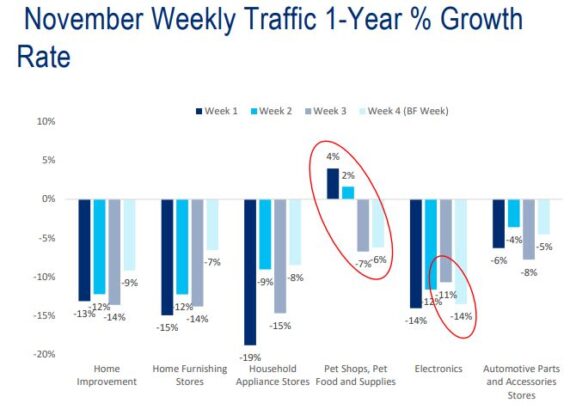

-Citigroup Card Data indicates Hardlines Retail spending declined -10.6% Y/Y in November, which was slightly better than October’s 1-year decline of -11.8% Y/Y. By category, the pace of Y/Y declines improved in November for all categories except pet shops and electronics. In absolute terms, electronics and household appliances saw the largest decline Y/Y in November, while pet turned negative for the first time this year. When looking at weekly cadence, November Week 4 (Black Friday week) saw sequential improvement in all categories except electronics which saw deeper declines than the prior weeks on both a 1-year and 4-year basis. Separately, Citigroup would also cite Placer.ai traffic for November Week 4 (retail week ended 11/25). Placer traffic for the retailers Citigroup tracks was -4.2% vs -5.6% in November Week 3. “We saw the biggest acceleration in traffic in November Week 4 vs November Week 3 at Ralph Lauren (RL), Tractor Supply (TSCO), Levi Strauss (LEVI), Dick’s Sporting Goods (DKS), and Columbia Sportswear (COLM). We saw the biggest deceleration at Five Below (FIVE), Valvoline (VVV), Ulta Beauty (ULTA), Advance Auto Parts (AAP), and National Vision (EYE).”

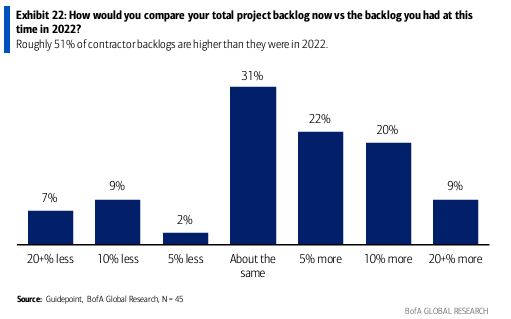

-BofA recently conducted their 10th Paint Contractor Survey as a collaboration between its U.S. Chemicals, Retail-Hardlines, and Building Products teams to assess market share shifts, pricing trends, and contractor backlogs between paint stores, home centers, and independent channels. One striking observation in this survey was the apparent resiliency of contractor backlogs, particularly in residential repaint. Despite a weak housing and construction outlook, 51% of survey respondents have a larger backlog now than they did at this time in 2022, and 29% have a 10+% larger backlog (See Exhibit 22). This supports recent commentary from the coatings producers that backlogs are not far off from normal levels. “The resilience of pro backlogs bodes well for Buy-rated Home Depot (HD) and Lowe’s (LOW), for whom sales to pros comprise about 50% and 30% of their respective totals. These data are also favorable for the near-term outlook for Sherwin Williams (SHW).”

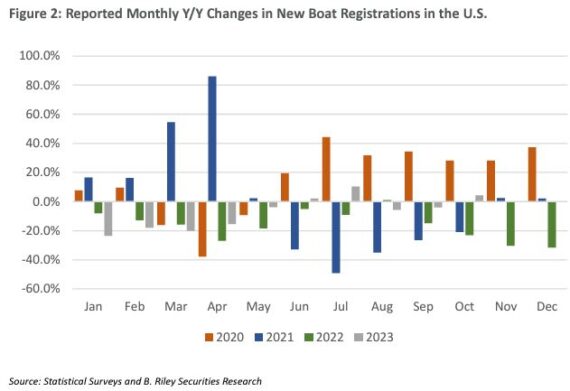

-Statistical Surveys released preliminary October boat registration data this past week. As B. Riley points out, the month of October historically represents around 4% of annual boat industry retail sales. SSI reported a Y/Y increase in registrations for October of 4.3%, with these results slightly improving the YTD decline in registrations to -6.9% as of October from -7.5% as of September (indicating a catch-up from prior month data). In terms of segments, Aluminum Fish was up 6.2%, Pontoon was up 8.5%, Ski Wake was also up 8.5%, Outboard Fiberglass was up 0.3% and Stern/Inboard was up 2.5%. However, when you look at individual companies, the registration data paints a different picture. B. Riley said that for Brunswick (BC), monthly registrations declined by 4.1%. For Malibu Boats (MBUU), registrations declined 2.4%. Lastly, for MasterCraft Boat Holdings (MCFT), registrations declined by 12.3%.

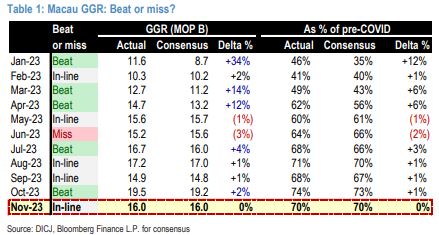

-Macau Gross Gaming Revenue came in at MOP16.0B (+435% Y/Y and -18% M/M), implying MOP535M/day (vs MOP531M in Q3) and representing a 70% recovery vs pre-COVID levels (vs 69% in Q3). JPMorgan We expects Macau to finish the year with the positive note, with GGR recovering around 80% of pre-COVID in December vs low-70%s in Q4TD, thanks to continued ramps in demand and easier comps. They believe this will drive Q4 mass GGR to rise over 10% Q/Q, doubling the historical seasonality of +5-6% Q/Q. Analyst DS Kim would comment, “What’s the catalyst? is probably the most FAQ from investors (when we pitch long ideas in the Macau gaming space), but frankly we don’t have a fancy answer to this question, as our Bullish stock call is predicated on (very) deep valuation with most of our OWs nearing their replacement costs. That said, we (hope to) believe continuously better-than-feared prints and likely steady Street earnings (on an aggregate sector level, notwithstanding divergence across six operators) should help to alleviate fears on a consumption slowdown, amidst a slew of cuts for other names in China leisure/consumer verticals.”

-NABCA, or the National Alcohol Beverage Control Association, released its control state results for the month of October, tracking data across all channels, including on-premise, in 18 control states. Overall, according to Evercore ISI, tracked U.S. Spirits volumes (9L cases) accelerated sequentially to +0.5% in October vs. -5.8% in September and +0.4% YTD. 2-year average trends also improved sequentially from -2.1% in September to -0.7% in October. Tequila volumes improved sequentially on a Y/Y basis while YTD volume trends for the category remain strong at +10.0% Y/Y and +9.8% on a 2-year average basis. RTD/RTS cocktails continue to lead growth at +15.0% Y/Y, Core spirits ex-cocktails volumes accelerated sequentially from -6.9% Y/Y/-3.3% on a 2-year average basis in September to -0.2%/-1.6% in October, respectively, which is positive for spirits makers like Diageo (DEO), Brown-Forman (BF/B), and Pernod Ricard that are far more exposed to core spirits than RTD cocktails.

-In an industry note on November 28th, Alliance Global Partners would remind investors that federal catalysts remain the primary expected catalysts for the cannabis sector, specifically rescheduling. They expect the DEA’s proposed rule to be for cannabis to be moved to Schedule III from Schedule I, in-line with HHS’ reported recommendation. The exact timing of when the DEA will come out with its interim ruling is unknown, as we are 92 days removed from HHS’ recommendation (on 8/29), with the 110 average timing from HHS recommendation to proposed ruling implying the DEA announcement could come any day – but they don’t put a hard deadline on end of year and note that an initial proposed ruling by end of Q1 2024 would still allow for a final ruling by summer, ahead of the election.

Company Commentary

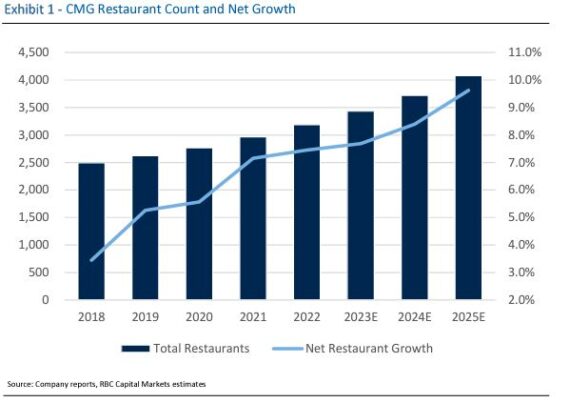

Chipotle Mexican Grill (CMG) – RBC Capital hosted investor meetings in Montreal and Toronto with Anat Davidzon (Managing Director of Chipotle Canada) and Cindy Olsen (Head of Investor Relations and Strategy). One of the topics discussed was that following a brief pause in Canada development in 2016, Chipotle refocused efforts around supply chain, four-wall profitability, and unit economics under the leadership of Anat Davidzon (who joined in 2018). Today, it operates approximately 40 Canada locations, representing growth of +30% in the market this year. “With Canada AUVs, margins and returns roughly in line with CMG’s home market of the US, we expect continued strong growth in Canada, as the company continues to leverage its whitespace opportunities. Furthermore, refinements around balance of marketing (i.e., emphasis on local marketing) and increasing/strong brand awareness should also support expansion into new Canadian markets, demonstrated recently by the company’s recent very strong first opening in the Calgary market.” Plus, with improved Canada returns and accelerating growth, RBC believes investors will increasingly turn their attention to CMG’s other international growth opportunities, including Europe and the Middle East, where in the case of the latter, CMG is partnering with the Alshaya Group to open restaurants in Kuwait and Dubai next year.

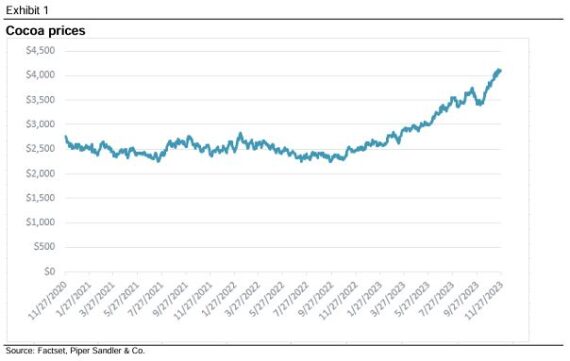

Hershey (HSY) – On Wednesday, Piper Sandler analyst Michael Lavery downgraded shares to Neutral from Overweight as a result of cocoa prices. As he explains, cocoa costs are up approximately 60% in Q4-to date (See Exhibit 1), driven by supply shortages, with pressure likely to remain in place for the foreseeable future. “Heavy rain hit Ivory Coast just as the cocoa plant was flowering, knocking flowers from trees, and high humidity rotted some remaining cocoa pods. In Ghana, cocoa swollen shoot virus has led to a significant reduction in supply. HSY has locked in fewer supply contracts for 2024 than historically typical due weak visibility on market outlook.” Piper estimates 12-15% of HSY’s COGS is cocoa (~60% is raw materials and packaging), with a potential $500M potential hit to 2025 COGS if current cocoa pricing holds. Productivity (through reformulation) can help on some products (e.g. complex, multi-ingredient ones), though this offset is likely modest, and some products are off-limits from reformulation.

J. Jill (JILL) – A name that we rarely ever talk about in Jaguar, J. Jill is a women’s clothing company that is currently up 23% YTD. They will be reporting their Q3 earnings on Tuesday, December 5th before the open. Last earnings, the company guided Q3 sales to be down LSD%. In a preview note from B. Riley, analyst Jeff Lick says his estimates are to be down 3%. Is there an element of upside surprise here? I say that because the analyst also says that they have been monitoring, analyzing, and back testing Bloomberg’s new ALTD function/data for numerous consumer companies. This data has predicted JILL’s quarterly sales +/- ~2% in the last 2 quarters and estimates JILL’s Q3 sales growth to be up 4.3%. Elsewhere, the company has been conducting a substantial IT-enhancing initiative/investment in the areas of point of sale (POS) and order management systems (OMS). B. Riley believes these initiatives should boost JILL’s transaction volume and efficiency/margin potential. They are looking for an update on the conference call.

Kenvue (KVUE) – For those that do not know, Kenvue is the recent consumer health spin-off from Johnson & Johnson (JNJ). JPMorgan had the opportunity to host Kenvue CEO Thibaut Mongon, CFO Paul Ruh, and VP IR Tina Romani at their inaugural Fast Moving Consumer & Wellness Forum. One takeaway that I’ll be keeping an eye on has to do with the acetaminophen litigation. As a quick recap, lawsuits had been filed throughout the U.S. alleging the manufacturer and retailers of Tylenol and generic equivalents failed to warn that acetaminophen use during pregnancy may increase the risk of autism in children. This ongoing litigation was a key topic across the meetings, but management didn’t have much to add beyond what it said during its Q3 earnings call. The judge presiding over the multi-district litigation, Judge Denise Cote, ordered a Daubert hearing for December 7th, which will be a one-day hearing of three hours with no expert witnesses present (only counsel). According to JPMorgan, “Management continues to portray confidence in its position based on the scientific evidence and emphasized the importance of the FDA’s non-response response (e.g., “new to world” March 2023 review of epidemiological data did not change conclusions from previous reviews that were unable to support a determination of causality). Given the speed at which the litigation has moved, it’s possible that Judge Cote issues a ruling before the end of the year, although the timeline could potentially stretch further to around 90 days post-hearing (our view based on our discussions with a litigation expert).”

McDonald’s (MCD) – Social media was buzzing this past week when Iman Jalali’s X account (See HERE) commented on the company’s new CosMc’s concept. He was able to grab several images of the new menu (See snapshot below). Once this news caught on, shares of Dutch Bros (BROS) came under pressure after people started discussing the menu similarities between the two. It should be noted that McDonald’s is hosting an Investor Day on Tuesday, December 6th. In a preview note, Oppenheimer believes they could follow a similar playbook to 2020’s Investor Day by providing a ’24/’25 outlook for: 1) Mid-single-digit system sales growth, 2) EBIT margins of high-40s, 3) G&A at 2.2% of system-sales, and 4) Strategies to accelerate unit growth. A capex update and formal capital return targets also appear likely.

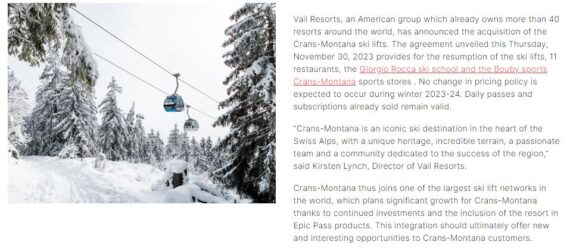

Vail Resorts (MTN) – This past week, the company announced it was acquiring Crans-Montana Mountain Resort in Switzerland from CPI Property Group. According to the press release, Crans-Montana Mountain Resort spans over 1,400 meters of skiable vertical terrain, and 140 kilometers of trails. Accessible from five airports and by train, Crans-Montana Mountain Resort is located in the Valais canton of Switzerland, approximately two and a half hours from Geneva and less than four hours from Milan and Zurich. Stifel would issue a note saying that financially, the transaction provides modest incremental adj. EBITDA, though symbolically they are encouraged to see MTN execute its second acquisition in the massive European market – especially given the historically infrequent nature of ski resort transactions. Including Andermatt-Sedrun, Vail’s two Swiss ski resorts combined for approximately 1M annual skier visits during the 2022/23 season, with partner resorts averaging around 12M annual skier visits per their checks. “While it will likely take time and further network scale for European consumer behavior to begin favoring multi-resort discounted passes (and conversely tolerate more expensive window tickets without switching to competitor resorts), we see a more near-term pass sales opportunity providing international optionality to N.A. skiers & targeting European skiers conversely interested in adding a N.A. trip. Otherwise, lack of vertical integration for European resorts is a pushback we hear often from investors, as MTN’s advance commitment strategy is partly dependent on incremental visitation and related ancillary revenue capture. Hence, we are encouraged to see the transaction include on-mountain F&B, as well as some retail/rental and ski school operations.”

Ollie’s Bargain Outlet (OLLI) – Ollie’s will be reporting their Q3 results on Wednesday, December 6th before the open. In their preview note on November 28th, BofA would raise their Q3 EPS estimates to $0.44 on 3.5% comps which is in-line with consensus and above the high-end of OLLI’s 2.0-3.0% comp guidance range. BofA continues to be impressed by the quality of merchandise that Ollie’s has been getting including a recent Coleman camping gear buyout, home goods from the Bed Bath & Beyond and Christmas Tree Shops bankruptcies, and Hasbro toys including Star Wars, Marvel, and Nerf. They were encouraged to see that OLLI ran fewer seasonal markdowns in August/September and did not run a 15% off entire purchase fall savings coupon that was run in early October last year. In addition, they hosted an expert call with a wholesaler and were encouraged to hear that closeout supply remains plentiful. “The best availability is in apparel, footwear, toys, tools/hardware, school/office supplies, and kitchen/home. Health and beauty aid closeouts have been most scarce given strong demand for the category. The sourcing environment is expected to remain favorable for at least the next six months.”

RCI Hospitality (RICK) – H.C. Wainwright recently toured RCI Hospitality’s new gaming properties in Central City, Colorado. Central City, which sits approximately 45 minutes west of Denver, is one of only three cities in Colorado that allow casino gambling. In calendar 2024 RCI Hospitality plans to open two gaming and restaurant properties, totaling almost 50,000 square feet in historic Central City. The properties, which are expected to be open 24 hours, a differentiator in Central City, could hold as many as 500 gaming machines over time, each generating between $150 and $300 per day. Assuming 330 days of use, excluding major holidays and weather events, suggests as much as $25M to $50M of annual gaming revenue. At a 40% margin, we believe the company could be generating an additional $10M to $20M of adj. EBITDA annually. Including the restaurant and night club operations, we believe these properties could yield even more. “These updated gaming and entertainment properties, in our view, should serve as an attractive alternative to legacy casinos and attract a growing younger and affluent demographic.”