Med-Tech Mash-Up (ATRC, EW, JNJ, NPCE, TMCI, Search Trends)

NeuroPace (NPCE) – In case you missed it, a Home Page article was posted on this medical device company on Monday morning (See HERE). One day later, its worth mentioning that Lake Street would raise their price target to $12 from $10 after having hosted Mark Richardson, a board-certified neurosurgeon and expert in drug-resistant epilepsy and the treatment options, including NeuroPace’s RNS system. Lake Street said the fireside chat with Dr. Richardson, “a well-known thought leader in the space,” strongly reaffirms its thesis that the RNS system can be the standard of care in drug-resistant epilepsy.

AtriCure (ATRC) – Earlier this week, shares of AtriCure came under pressure after Medtronic (MDT) announced the launch of its Penditure Left Atrial Appendage Exclusion System in the United States. The Penditure LAA Exclusion System is an innovative, implantable clip that comes pre-loaded on a single-use delivery system for use in left atrial appendage management during concomitant cardiac surgery procedures. In JaguarLive, we pointed out a note from Needham, who commented on how the Medtronic system competes with AtriCure’s AtriClip, which the firm calls “an important product” that accounts for 34% of its total sales and was previously the only surgical LAA exclusion device on the U.S. market. On the flip side, JMP Securities was out highlighting several important factors that in their view make AtriCure well positioned in the LAA market:

“1) AtriClip has been the market leader in this space for years, with a broad base of physician usership, robust real-world outcomes (~500k patients treated), and several iterations of its product (currently seven generations with another on the way). 2) AtriCure’s dominant position in open ablation provides substantial market share insulation for its LAA device in our opinion. AtriClip is utilized in virtually every ATRC open ablation case, and given that the company maintains ~85% share in these procedures, we feel that it is unlikely that MDT’s new product would make meaningful in roads here. 3) The LAA market is substantial and continues to grow and remains underpenetrated.”

Edwards Lifesciences (EW) – The company is hosting its Analyst Day on Thursday, December 7th. According to JPMorgan, this event is usually of modest importance to investors as management provides guidance for the upcoming year and refreshes timelines on the pipeline. However, this year they feel the analyst day is much more significant for two reasons. First, Edwards’ future sales growth trajectory is less certain today than in the past as the TAVR market has failed to recover its pre-COVID growth momentum like most other MedTech subsectors have, while at the same time the TMTT market is taking somewhat longer to become a meaningful growth driver. Second, 2023 was a rare misstep for Edwards as management raised then lowered guidance, all while the stock’s forward multiple contracted meaningfully as TAVR market growth forecasts ticked lower. “The result is that the 2024 guidance management is set to provide in December is much more a balancing act of providing an organic sales growth range that: (a) Keeps holders interested, (b) Makes the short thesis less enticing, and (c) Leaves room for management to beat and raise over the course of the year.”

Johnson & Johnson (JNJ) – On Thursday morning, Johnson & Johnson announced the acquisition of Laminar, a private medical device company, for $400M with the potential for additional milestone payments as Laminar crosses various clinical/regulatory hurdles. “Laminar’s differentiated left atrial appendage closure technology utilizes a ball-tipped catheter and rotational motion to seal off the left atrial appendage.” Observing Laminar at multiple medical meetings (CRT 2023, TCT 2022), Stifel noted physicians’ positive reactions to the technology. Laminar clearly complements JNJ’s comprehensive Biosense Webster Electrophysiology portfolio (5.5% of 2023E total JNJ sales). Johnson & Johnson highlighted Laminar synergies with their existing Intracardiac Echo technologies. Looking ahead in early 2024, Laminar expects to start U.S. pivotal trial enrollment.

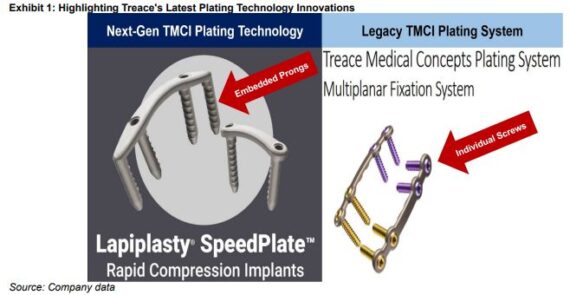

Treace Medical Concepts (TMCI) – Just over a year ago, Culper Research announced that it was short Treace Medical. For those not familiar, TMCI is a medtech company that has developed the Lapiplasty 3D Bunion Correction System. The short call by Culper has worked out great. Shares closed at $20.54 on November 15th, 2022 and closed today at $8.76. That equates to a 57% drop. Is the worst finally over? Only time will tell, but I figured in today’s report, I would call out a November 29th note from Stifel where they point out that over the next year, Treace is set to launch 10 new products…5 in the coming months and another 5 by year-end 2024. According to analyst Rick Wise, the most important of these products appears to be Treace’s new “SpeedPlate Rapid Compression Implant.” Key takeaways from 8 in-depth early-adopting SpeedPlate surgeon discussions:

“(1) Without exception, every doctor repeatedly emphasized that SpeedPlate simplifies the Lapiplasty/Adductoplasty case workflow with fewer procedure steps, meaningfully shortens procedure time…anywhere from 5-15 minutes…and promotes better post-op healing due to SpeedPlate’s incremental compression, (2) Of the 4 surgeons familiar with both SpeedPlate generation-1 and generation-2, these doctors believe the gen-2 enhancements make SpeedPlate “much-better,” with improved ease-of-handling and more-anatomically-correct implant sizes. These improvements in turn are driving physicians’ anticipated SpeedPlate uptake…to likely ~25%-100% of all their TMCI cases.”

Search Trends – Finally, on Thursday, Needham would issue a note regarding Google Search Trends for elective procedures. They found that searches for all 20 medical procedures in the U.S. were up 2% Y/Y over the 90 days through 11/25/23 as compared to an average 1% Y/Y increase over the 90 days through 11/18/23. Compared to last week, 13 of the 20 procedures saw improved Y/Y trailing 90-day growth. Searches for orthopedics and cardiovascular procedures saw improved Y/Y trailing 90-day growth, while general surgery saw stable Y/Y trailing 90-day growth. Searches for the aesthetic procedures in the U.S. were up 3% Y/Y over the 90 days through 11/25/23 as compared to up 1% Y/Y over the 90 days through 11/18/23. Compared to last week, 5 of the 5 procedures saw improved Y/Y trailing 90-day growth.