Behind The Numbers – Fluence Energy (FLNC)

Back on June 11th in W/E Research, a bullish outlook was provided for Fluence Energy (FLNC), a a global market leader in energy storage products and services. At the time of the writing, the stock was trading at $25.74. Two months later, on August 10th in Conversations, we mentioned how the company reported a fantastic earnings report. In the end, we recommended clients exit their position and step aside. During the August 10th trading session, it would hit a high of just over $30 before closing at $26. Fast forward to November 13th and shares of Fluence would trade as low as $16.29. Ultimately, it was the right call to exit.

On Wednesday of this week, shares would finish higher by nearly 24% following the company’s Q4 earnings report on November 28th after the close.

-EPS of $0.02 vs ($0.06) estimate – Beat

-Revenue of $673M vs $515.7M estimate – Big Beat

-Sees FY24 Revenue Guidance of $2.7B – $3.3B vs $2.79B estimate – Beat

The company reported record revenue for fiscal year 2023 of $2.2B and revenue for the fourth quarter of $673M, representing an increase of approximately 85% from fiscal year 2022 and an increase of approximately 25% from the third quarter. On the conference call, management said they continue to experience strong demand for their products and services with new orders totaling approximately $737M, highlighted by their solution business contracted 2.1 gigawatt hours, their services business added 1.6 gigawatt hours and their digital business adding 1.8 gigawatts of new contracts. Furthermore, their signed contract backlog as of September 30th remain at $2.9B due to acceleration of select projects ahead of schedule. As JPMorgan would point out, the order intake number was up 30% sequentially and represented a book-to-bill ratio of 1.1x.

CEO Julian Nebreda would add:

“Demand for storage continues to accelerate. In fact, our pipeline now sits at $13 billion, which is an increase of approximately $600 million from the third quarter and a 50% increase compared to this time last year. Additionally, as I mentioned, with our backlog remain consistent at $2.9 billion, even after recognizing almost $675 million during the quarter. Importantly, we had several contracts that were signed to subsequent to quarter end amounted to approximately $400 million, which provides us with strong visibility to achieve our 2024 revenue guidance. This is the eighth consecutive quarter we added more backlog than revenue recognized, further illustrating the growing demand for any stores. Based on the conversations we are having with our customers and potential customers, we’re expecting to see top line year-over-year revenue growth from fiscal ’24 to fiscal ’25 of approximately 35% to 40%, showcasing the robust market for utility and storage.”

The company would also put a spotlight on their recent launches of their Gridstack Pro and OS7. “When you look specifically our Gridstack Pro solution, this is a much larger product that integrates 6 battery racks and is designed for the largest and most complex utility scale projects globally. We expect Pro will lever our customers with leading safety measures, faster deployments, first-class reliability and the flexible modular design that defines our product offerings. More importantly, for the U.S. market, the Fluence battery pack will be available with U.S. manufactured battery cells and modules. This position Gridstack Pro as one of the first store solutions to qualify for the 10% investment tax credit, domestic content bonus under the Inflation Reduction Act. In conjunction with Gridstack Pro, we launched OS7, the next generation of our operating system. This iteration is meant to handle bigger and more complex projects, and can reliably control more than 1 gigawatt hour system and is fully integrated with the Fluence battery management system.”

In their post-earnings note, BMO Capital said they see more positives than negatives in FLNC’s positioning within the broader Energy Transition Sector. In a utility scale equipment market that enters 2024 with a bit more uncertainty and questions than it had for much of last year, strong energy storage demand is not one. FLNC’s FY 2024 guidance and FY 2025 revenue growth outlook bear this out. The company has graduated from a turn-around story in 2023 to positive EBITDA in 2024 and likely positive FCF in 2025.

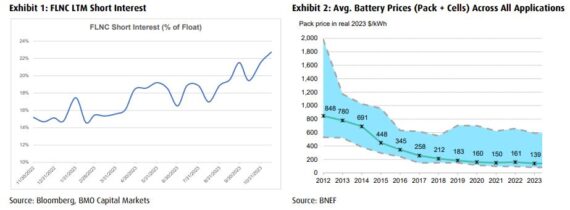

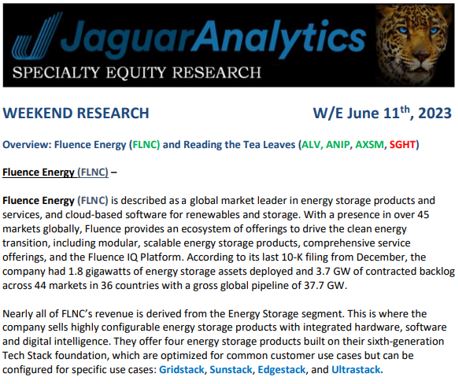

They ascribe this in part due to high short interest around 23% that had risen into earnings. In addition, they think investors were likely concerned that recent declines in battery prices driven largely by lower raw material prices (i.e., lithium) could adversely impact FLNC’s revenue growth outlook. After a brief pause in 2022, battery prices declined in 2023 and declines could accelerate into 2024. “That said, FLNC’s $2.7- 3.3 billion 2024 revenue guidance and rolling forward of its 35% to 40% revenue growth target to 2025 alleviated these concerns for now. In addition, since FLNC utilizes RMI provisions for its contracts, we don’t’ see much risk to FLNC margins from declines in prices of battery cells and packs from declining raw material prices.”