Healthcare Pulse – Week of December 4th (LIVN, MDT, NTRA, PODD, SIBN)

LivaNova (LIVN) – As we pointed out recently, LivaNova disclosed in a regulatory filing that it detected a cybersecurity incident that resuled in a disruption of portion of its information technology systems. Yesterday, Wolfe Research analyst Mike Polark issued a note titled “Wounds Already Healing from Cyber Attack.” He noted that after approximately 2 weeks of downtime, systems are now back on. The U.S. is essentially humming again which really means Neuromodulation production is back up. There were no reports of missed cases or delays in the high-margin epilepsy business. Meanwhile, in Europe, the ramp back up at two key sites (Italyoxygenators and Germany-HLMs) started but pace will be slower than U.S.

“So…net…what’s our take on potential cyber snafu impact? Some 1x costs in 4Q to remediate no doubt – seem like costs that would be excluded from adjusted EPS. On 4Q revenue, sounds like no disruption in epilepsy and HLM. Oxygenators probably but impact not quantified. How about we take a conservative-leaning stab? Oxys are like half of half of revenue or 25% of total company. Let’s conservatively say a full two weeks of revenue got pushed out/missed. There are ~13 weeks in quarter. Multiply that through and it’s about $10M of ‘deferred’ revenue in 4Q or 4% impact in quarter. Feels like a worst case? Thematically…overall…message was – this is a short-term issue that is in large part already fixed/sorted. Did not sound like something that is, at this stage, expected to have notable operational impact beyond 4Q.”

Medtronic (MDT) – On Wednesday afternoon, Medtronic announced termination of its agreement to acquire the South Korean patch pump maker EOFlow. Stifel thinks it was due to IP/trade secret infringement. Recall, prior to MDT’s announcement of the takeout, Insulet (PODD) and EOFlow were already involved in European litigation. After the May Medtronic acquisition, in August, PODD filed a U.S. lawsuit and in October, was granted a preliminary injunction prohibiting EOFlow from manufacturing/ marketing/selling any product using PODD trade secrets. Key takeaways according to Stifel:

“(1) MDT: This represents a negative for MDT’s competitive positioning, and creates uncertainty around timelines for MDT to bring a patch to market and the trajectory of the Diabetes franchise, (2) PODD: Undeniably positive, although investor skepticism regarding EOPatch commercialization was already quite high. MDT was likely to come sometime in 2025 or 2026, and now Tandem Diabetes (TNDM) with Sigi in 2026/2027 represents the first real competitive threat to PODD. We make no model changes as we hadn’t yet layered in MDT’s entry, but directionally, PODD’s upside could sustain for 1-2 more years than expected, (3) TNDM: Sigi is a 2026/2027 launch and TNDM is likely to be second-to-market, albeit still several years away. While not a direct threat, no EOFlow could ease future TNDM new patient (and switcher) competitive intensity, driving some potential upside.”

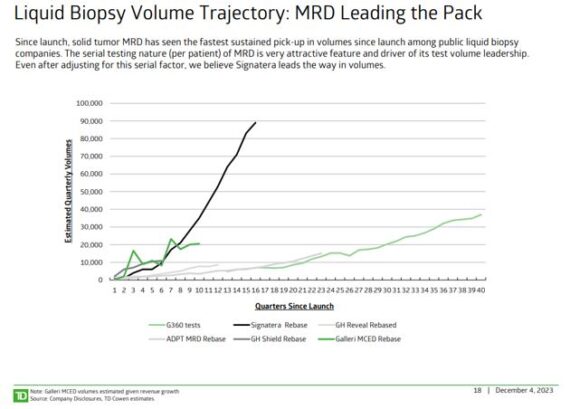

Natera (NTRA) – This is a global leader in cell-free DNA testing, dedicated to oncology, women’s health, and organ health. The company has leveraged this platform to develop the most accurate non-invasive prenatal test on the market (Panorama™), the first tumor-specific assay for truly individualized cancer care (Signatera™), and best-in-class rejection assessment for kidney transplantation (Prospera™). Two notes surfaced this week that speak positively for the stock. First up is a Liquid Biopsy note from TD Cowen. The team says they are most bullish on the Measurable Residual Disease (MRD) market, with a $20B+ TAM, with rapid growth occurring and expected to persist (their recent oncologist survey pointed to 55%+ volume growth). Doctors see strong utility for the test and testing is serial (can be ~10 tests over 6 years), with solid reimbursement already secured, and pivotal interventional outcomes studies on the horizon. In terms of specific stock callouts, they said Natera looks very well positioned to benefit from the rapid growth in the MRD market. “NTRA’s leadership in clinical evidence (publications, trials), forthcoming NCCN inclusion and breadth of products should help the company sustain its lead. This strong position combined with upside to MRD forecasts (with NCCN guideline inclusion and biomarker bill progress other favorable levers) support our Outperform. Beyond Signatera, guideline inclusions in reproductive health represent material revenue and margin drivers.”

Separately, Piper Sandler was out following their Healthcare Conference saying that Natera is one of the most catalyst rich companies in their space. Gross margins are expected to improve as more Signatera tests move from the initial exome to follow up PCR tests, meaning significant COGS reductions from the lower priced PCR. They expect that eventually, PCR tests may account for 80%+ of Signatera tests, and while they are seeing high followup rates from clients who did initial tests previously, they are still in early days. They also have been surprised at the lack of competitive offerings and data generation by competitors to Signatera. They believe MRD represents a significant unmet need, and that there will be competition in the future, which is why they are putting in effort to develop an edge now.

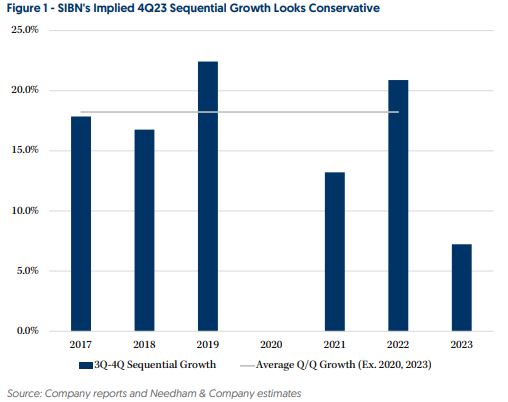

Si-Bone (SIBN) – Needham recently hosted investor meetings with SIBN’s CEO Laura Francis and CFO Anshul Maheshwar. According to analyst David Saxon, the company is seeing encouraging active surgeon growth, which reached >1,000 in Q3. This compares to around 1,000 for all of 2021. “SIBN’s target physician population is 7,500 which could allow for durable revenue growth driven by further adoption by new surgeons and increasing utilization by existing active surgeons.” To the latter point, quarterly cases per active surgeon were 3.8 in Q3 but doctors who fully incorporate SI joint dysfunction diagnosis into their practices regularly do around 9 per quarter, implying significant upside potential from increasing utilization. Separately, the company’s iFuse-Granite pelvic fixation device has seen solid traction and addresses a 30K annual case opportunity in the U.S. SIBN is using third party agencies to cover iFuse-Granite cases (which can be six hours or longer) which frees up its direct reps’ time to either engage with new/ramping doctors or cover SIJF procedures (<60 minute procedure). Management believes iFuse-Granite can become standard of care and replace S2AI screws. It also expects to launch a short construct version sometime in 2024, which can open up a ~100K annual case opportunity in the U.S. and represents $700M of TAM.

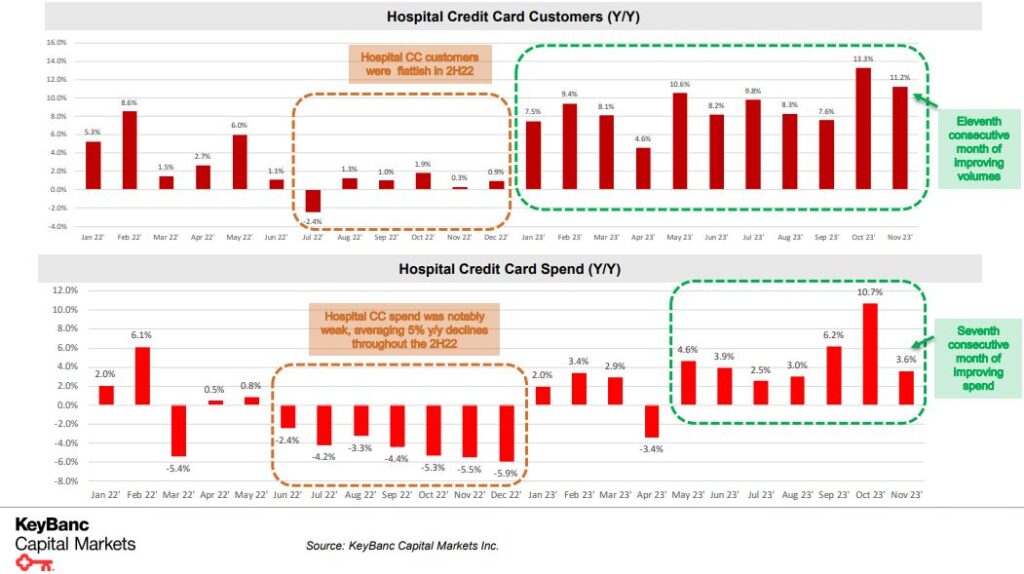

Healthcare IT – This week, KeyBanc published their proprietary KeyBank Healthcare Credit Card Transaction Tracker updated for November data to get a better sense of volumes and spending at hospital systems + physician offices across the U.S. from 1.8M KeyBank credit/debit cardholders. “In this month’s report, total hospital customers were up (+11.2%) Y/Y and hospital spend was up 3.6% Y/Y. On the physician side, physician customers were up 4.6% Y/Y, but physician spend was down 3.2% Y/Y. We view this hospital credit card data as a positive, with the eleventh consecutive month of improving hospital customers and the seventh consecutive month of improving hospital spend.” They see this proprietary transaction data as insightful for any HCIT company exposed to the provider end markets in our coverage list (HCAT, MDRX, OMCL, PHR, RCM).