JaguarConsumer Weekly Callouts – December 10 (CLX, MCD, MNST, NAPA, OLLI, OSW, PG, POST, SIG, WING)

**PDF Version is also available HERE**

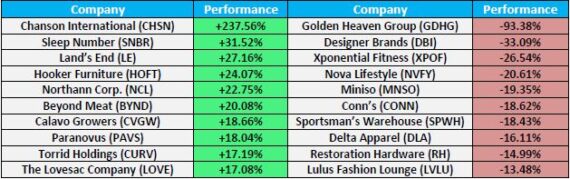

Winners & Losers

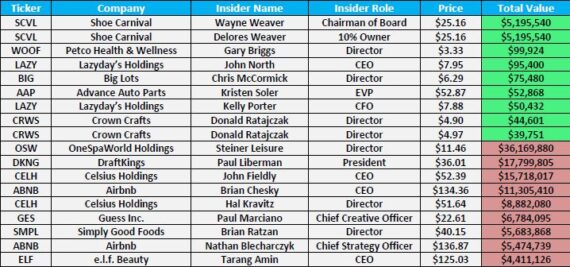

Insider Action

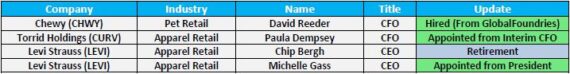

C-Suite Changes

Industry Commentary

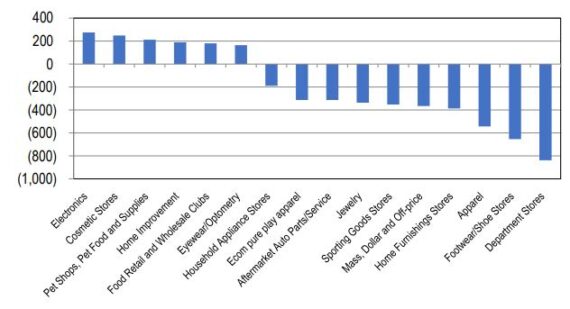

-Citigroup credit card data for the 16 sub-sectors they track show that total spending for December Week 1 (ending 12/2) decreased 7.6%, an acceleration vs November Week 4 (ending 11/25), which was -9.0%. Ex-Food spending was -7.1% in December Week 1 vs -9.1% in November Week 4. “This was the second consecutive week of acceleration. And recall that December Week 1 includes Sunday of Black Friday weekend and Cyber Monday so there was very much a call to action, and consumers showed up. Many retailers expect the holiday lull to start December Week 2 so the next couple weeks will be important to gauge how the holiday season is trending as a whole after a seemingly strong start.” The chart below from Citigroup shows all sectors ranked from best to worst on bps change in December Week 1 vs November Week 4.

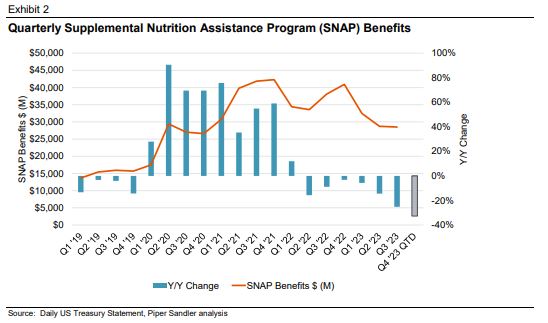

–Piper Sandler’s analysis suggests that SNAP dollars are set to decline approximately -32% Y/Y in Q4 – a much bigger headwind than the -25% decline for the Q3 retail calendar. “As for what could be causing the significant Y/Y drop in SNAP benefit dollars, it appears to be partially attributable to lapping last year’s SNAP Cost of Living Adjustments (COLA). The USDA annually adjusts SNAP maximum allotments, deductions, and income eligibility thresholds at the beginning of each federal fiscal year in accordance with CPI trend and ‘Thrifty Food Plan’ guidelines. Maximum allotments are determined by household size, and the past three years of allowances are outlined below in Exhibit 3. The new amounts are effective starting Oct. 1 through the next 12 months. In tandem with high 2022 inflation levels, the USDA increased SNAP benefit allotments +12.5% Y/Y for FY2023, However, the most recent COLA adjustments only increased SNAP benefits +3.6% Y/Y for the federal FY2024. Given these increases start in October, lapping last year’s sharp increases contributed to the deteriorating Y/Y declines for October & November.”

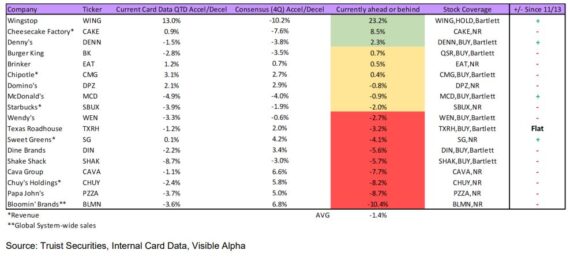

-As discussed in Conversations by Chronicle, Truist was out with a Restaurant note based on their recent card data that highlighted with roughly 2/3’s of Q4 done for this group of restaurants, only 6 out of 18 are above where consensus is for the quarter and 14 of 18 decelerated versus their last update. Wingstop (WING) and Cheesecake Factory (CAKE) were the only 2 companies comfortably ahead of the Street at this point. But the majority of names lost ground over the last almost 3 weeks and the average name is now -1.4% below (versus -.1% on 11/13).

-In a Beverages note this past week, Morgan Stanley said they hosted an expert call with the head buyer from a fast-growing convenience store chain with over 400 locations across the Southwest and Midwest, primarily in suburban and rural markets. The analyst said the energy drink category has been a strong and consistent growth driver for this retailer, with compound annual growth approaching 20% over time. The category is highly developed for this retailer, with its typical store having a four cooler door energy set, with one full door each for Monster Beverage (MNST) and Red Bull, one full door for enhanced/ performance energy, and one door for legacy brands, plus additional coolers at the front-end near the checkout area, as well as ambient displays. Monster and Red Bull are both very strong in this retailer’s markets, each with approximately 41% – 42% share, and Celsius Holdings (CELH) is also a strong #3 at around 6%, up from around 3% prior to the PepsiCo (PEP) distribution. For those that do not know, Monster Beverage acquired and completed the acquisition of Bang Energy back in July. According to Morgan Stanley, this retailer is continuing to allocate one full shelf to Bang into 2024 based upon its confidence in Monster’s ability to revitalize the brand. Monster appears to be positioning Bang with more of a fun vibe targeting Gen-Z, while keeping Reign positioned more towards the hard-core workout consumer. “We believe that most energy brands, including Monster and Celsius, have benefited over the past 2 years from Bang’s declines, and expect that tailwind to dissipate and potentially turn to a headwind if Monster is successful in revitalizing the Bang brand, which should occur to at least some extent, albeit take time to be a Y/Y pressure point until it cycles lower Bang share levels.”

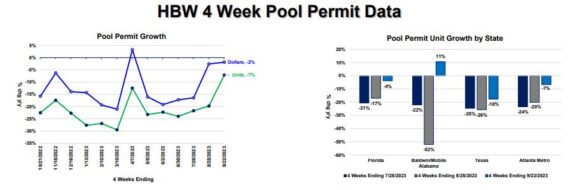

-HBW Weekly provides construction permit data for 93 counties in Alabama, Florida, Georgia, and Texas with the latest data through 9/22/2023. For this latest period, Stifel said that pool permits declined 7% on a unit basis, representing a sustained sequential improvement. Permit dollars declined 2%. “We believe the data is encouraging including not only a moderating rate of unit decline but also positive dollar-per-permit growth, and we note easing comparisons over the next few periods given the hurricane activity in Florida. We believe 2023 has reflected a rightsizing of pulled-forward demand to an appropriate level going forward, and recent trends support our outlook for flat unit growth in 2024.”

-When it comes to the cannabis industry, the hot topic continues to be rescheduling marijuana to a Schedule III under the Federal Controlled Substances Act. This past week, Health and Human Services Department (HHS) released documentation related to its recommendation and the detailed review it undertook on cannabis’s accepted medical value. In an article from Marijuana Moment (See HERE), among the materials newly made public are correspondence from HHS officials to Drug Enforcement Administration (DEA) Administrator Anne Milgram as well explanations of the health agency’s reasoning for the recommended change after conducting a required eight-factor analysis under the CSA. Most pages were heavily redacted, while some were withheld completely.

“Broadly, the documents outline new scientific information that’s come to light in recent years subsequent to an earlier denial of a rescheduling petition, which HHS suggests might now necessitate rescheduling marijuana. The current review is largely focused on modern scientific considerations on whether marijuana has a CAMU [currently accepted medical use] and on new epidemiological data related to the abuse of marijuana in the years since the 2015 HHS evaluation of marijuana under the CSA’s eight-factor analysis. While the Congressional Research Service (CRS) recently concluded that it was “likely” that DEA would follow the HHS recommendation based on past precedent, DEA reserves the right to disregard the health agency’s advice because it has final jurisdiction over the CSA.”

Separately, Governors of six U.S. states—Colorado, Illinois, New York, New Jersey, Maryland and Louisiana—sent a letter to President Joe Biden urging the administration to reschedule marijuana by the end of this year.

Company Commentary

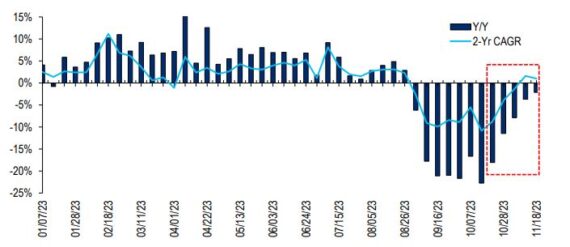

Clorox (CLX) – Citigroup met with Clorox’s CEO Linda Rendle and CFO Kevin Jacobsen at a sell-side meeting in New York City. They came away from the meeting with increased conviction that Clorox should continue to recover shelf-space and market share as the cyberattack impacts are behind them, as evidenced by the sequential improvement in scanner data trends. “Additionally, we continue to think CLX’s FY24 guidance reflects a healthy dose of conservatism both on topline and gross margin, which could lead to earnings upside in FY’24/25 (we are ~3%/7% above consensus, respectively).” The chart from Citigroup below depicts CLX $ Sales Change (Y/Y).

The Duckhorn Portfolio (NAPA) – In their post-earnings note, Evercore ISI would highlight that NAPA noted a weaker consumer environment and lowered its FY24 outlook. Management noted that while it hasn’t seen trade down, the consumer environment has broadly become more pressured, with room bookings in Napa Valley down despite continued strength from the ultra-high end. In the L12W tracked channel data through October, luxury wine was flat, with total wine -1.6% and NAPA’s portfolio -1.7% as it faced difficult compares.

McDonald’s (MCD) – McDonald’s hosted an Investor Day this past week and provided 2024 and long-term guidance, with unit growth above consensus and margins roughly in-line with consensus. Bernstein would highlight two specific takeaways:

• They walked away from the investor day more concerned than before on the state of low-income consumer. While at around 4%. the consensus same store sales estimates are already factoring in moderation in 2024 (vs ~10% SSS for FY23E), their interactions with management on state of consumer indicate further downside risks – with weakness likely showing as early as Q4 2023. Retail read-through across brands operating across low-income households (i.e. WMT) validate management’s apprehension.

• The several initiatives that the company is launching to regain traffic in an increasingly challenging consumer environment reinforce Bernstein’s conviction that scaled players will have disproportionate competitive advantages. They expect that MCD will gain share at the expense of regional competitors even if overall industry slows down, flexing its industry-highest marketing budget, leveraging a revamped loyalty platform, and focusing more on value and digital investment to enhance convenience and customer experience.

Separately, Wolfe Research would mention CosMc’s – the small, beverage led concept that we mentioned in Consumer Callouts last Sunday. CEO Chris Kempczinski highlighted the concept’s global appeal and unit economics. Nevertheless, management emphasized that the company will only roll out 10 test stores in 2024 and evaluate the results over the next year before making any decisions about further expansion.

Ollie’s Bargain Outlet (OLLI) – Last week in Consumer Callouts, we provided a preview of OLLI’s upcoming earnings report. On Wednesday morning, the company reported that its Q3 comp sales increased 7.0%, which was significantly above the guidance of 2-3% growth and above the consensus of +3.4%. This also marked the sixth consecutive quarter of positive comp growth. KeyBanc said that comp growth was driven primarily by transactions and a low single-digit increase in average basket, as well as the benefit from a wider customer base (with growth in both younger and higher income shoppers) and an increase in Ollie’s Army membership base (+4.8% Y/Y).

“During 3Q, over 60% of OLLI’s product categories comped positive, with top performers being candy, sporting goods, housewares, food, and toys. Additionally, management noted that the company is seeing very strong deal flow of brand name merchandise, with customers responding favorably. On a monthly basis, August and September exhibited equally strong performance, while October was softer, as planned, due to the advertising flyer shift. Encouragingly, management noted positive momentum continuing in 4Q. Encouragingly, management noted a continued trend of trade-down in 3Q with continued strength in the $100K-$150K income cohort, which tends to shop more frequently with basket sizes consistent or larger than the average shopper.”

OneSpaWorld Holdings (OSW) – For those that do not know, this company operates spas onboard cruise ships and at land-based destination resorts, where its offerings range from traditional salon and skin care retail products to personalized fitness classes and medi-spa services. This past week, Steiner Leisure/L Catterton sold approximately 2.4M shares of OSW in a Rule 144 sale. In addition, Steiner Leisure/L Catterton sold around 800K shares of OSW directly to the company at approximately $11.50. Stifel would note that this now takes Steiner Leisure/L Catterton’s ownership to approximately 4.8M shares and gets them below the 5% threshold. With Steiner Leisure/L Catterton’s ownership now below 5%, they are free to sell their remaining shares without restrictions in an open window period. Given the fact that Steiner Leisure/L Catterton still has a board seat, they still must adhere to selling their remaining shares in an open window unless they decide to relinquish their board seat.

“We view this sale/purchase as a positive for a couple of reasons. First, the biggest overhang on the OSW story has been the heavy ownership of Steiner Leisure/L Catterton and the fear around when would they sell their remaining stake. We have heard from numerous investors who were waiting for this clearing event to take place before they would look to buy OSW shares. Post this recent sale, Steiner Leisure/L Catteron now own ~4.8M shares, or ~4.85% of outstanding shares. While we have no idea if/when they will sell out of their remaining position, we believe the recent sale was another key step in this process. Most important is that the recent sale should start to improve the liquidity, increase the float, and reduce this overhang, which has been around since OSW came public. Second, it can’t be overlooked that OSW bought back ~800K shares. This makes us believe they view their shares as undervalued in the $11/$12 range. OSW had made it very clear that if they had the opportunity to get Steiner Leisure/L Catterton under 5% ownership, they would jump on it. Those ~800K shares are now retired and OSW’s share count should be reduced or at least be maintained. Buying back ~800K shares should offset OSW’s stock comp expense for at least two years.”

Procter & Gamble (PG) – Morgan Stanley hosted a fireside chat with Procter’ CFO Andre Schulten and Senior VP of Investor Relations John Chevalier at the Morgan Stanley Consumer and Retail Conference. Procter was highly confident it has created structural competitive advantage in the U.S. and Europe, which it expects to continue longer-term, with a focus on product superiority, backed by robust innovation, and higher, as well as more effective marketing, which is driving category growth, alongside PG share gains. However, the company did acknowledge clear weakness in China, its second largest country at 8% – 9% of sales, particularly on the beauty side with a weak 11/11 holiday, exacerbated by Japan sea-water issues for the SK-II brand, and the impact of broader China macro weakness on other PG categories. Latin America has been a source of strong momentum for the company in recent quarters, although it sounded the pace will moderate going forward with tougher comparisons, along with recent higher category promotional levels.

Post Holdings (POST) – The company provided an update to its business this week and A.I. was in focus. No, not Artificial Intelligence…Avian Influenza. The company announced that 10% of its controlled supply has been impacted by Avian Influenza. The company did not update its guidance range for the A.I. impact with the view that the impact falls within the existing guidance range. It does not expect to provide additional A.I. updates unless incremental events impact greater than 5% of its controlled supply. Stifel would say, “We believe Post is well balanced between grain-based and supply-based contracts blunting the impact from its current supply disruption. Last year, we estimate Post’s egg supply had a mid-single digit disruption from A.I., far lower than the disruption to the overall egg supply, and the business earned over an extra $110 million in EBITDA benefiting from A.I. escalators in its contracts.”

Signet Jewelers (SIG) – Shares of Signet finished the week higher by nearly 14%. On Tuesday morning, the company reported its Q3 earnings and BofA would call out that over the last three weeks, there has been a greater than 300bp improvement to engagement trends from the Q3 exit rate. Management maintained expectations for a gradual recovery over the next three years and expects Q4 engagements to decline mid-HSD vs down mid-teens YTD. Late-stage relationship milestones have progressed over the past few months; couples moving in together is up 9% from early 2022 and search trends for engagement rings are up 10% Y/Y. “While we are encouraged by recent trends, we remain concerned that some of the rebound will be offset by lower ticket from a stretched consumer.” Elsewhere, BofA would say that elevated promotional activity among over-stocked independent jewelry retailers has driven diamond prices down to pre-pandemic levels in recent months. While the company has participated in promos to stay competitive, ATVs were stable in Q3, driven by product innovation and more strategic promos. The oversupply of diamonds is abating as independents are now buying less and jewelry manufacturers suspended mining activities. “We expect promotional activity will be high industry wide in the near-term, especially through holidays, as retailers continue to correct inventories.”