ChampionX (CHX) – Maximizing Well Production

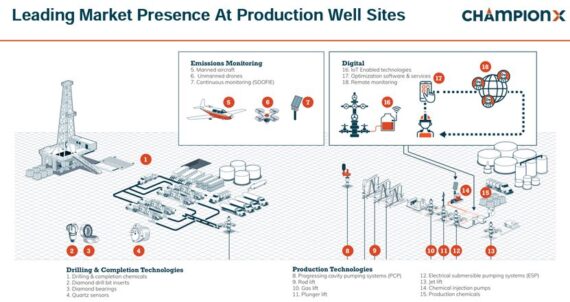

ChampionX (CHX) is a leader in chemistry solutions and highly engineered equipment and technologies that help companies drill for and produce oil and gas safely, efficiently, and sustainably around the world. Their products provide efficient and safe operations throughout the lifecycle of a well with a focus on the production phase of wells.

ChampionX is the result of a June 3rd, 2020 combination of Apergy Corp. and ChampionX (a division of EcoLab). The combined company is roughly 80% production focused, with the remaining 20% of the business focused on drilling and completion activity. The business is currently organized into four reportable segments: Production Chemical Technologies, Production & Automation Technologies, Drilling Technologies, and Reservoir Chemical Technologies.

It was back on April 26th when the company last reported earnings, beating on both the top and bottom line:

-EPS of $0.22 vs $0.20 estimate – Beat

-Revenue of $865.96M vs $824.27M estimate – Beat

-Total Revenues increased 25% Y/Y and 4% Q/Q

-North America Revenue increased 31% Y/Y and 5% Q/Q

-International Revenue increased 19% Y/Y and 6% Q/Q

When looking at its individual segments:

Production Chemical Technologies (59% of Revenue) – Revenue came in at $515M, rising 4% Q/Q and 24.9% Y/Y. Stifel analyst Stephen Gengaro would bring up a recent note titled “CHX Announces Surcharges on Chemicals Business,” pointing out that the company is implementing price surcharges for Chemical Technologies customers that started in mid-April. “We expect these surcharges along with price increases will lead to strong top-line growth and margin expansion for 2Q22 and the remainder of 2022.”

Production & Automation Technologies (25% of Revenue) – Revenue came in at $220.3M, up 9% Q/Q and 32% Y/Y.

Drilling Technologies (7% of Revenue) – Revenue came in at $56.9M, up 14% Q/Q and 63% Y/Y driven by robust drilling activity in both North America and internationally.

Reservoir Chemical Technologies (5% of Revenue) – Revenue came in at $39.9M, flat Q/Q but up 33.5% Y/Y.

In terms of guidance, management said they anticipated strong Q2 growth and guided revenue to $875M – $905M versus consensus at $854.7M. The company reiterated its confidence in achieving a 50% – 60% FCF to EBITDA conversion rate despite elevated working capital investments during 1H22 and expects FCF generation to ramp-up as the year progresses. Consistent with previously stated strategic initiatives, management continues to be open to exploring options for its Reservoir Chemical Technology business and expressed confidence in executing in 2022.

Fast forward to this evening where Stifel is out with a new note following their fireside chat with management at the Stifel Cross Sector Insight Conference. Key takeaways included:

-Activity is excellent and has driven increased demand across the board for CHX’s products and services. Pricing continues to gain momentum, and despite price increases management noted that CHX has not seen any net share losses.

-Expectations for margin expansion through year-end 2022 remain intact with a modest increase in Q2 accelerating into the back half of the year.

-Returning cash to shareholders remains an integral part of the company’s capital allocation strategy. As a reminder, the company recently announced a $250M share repurchase program which they expect to deploy strategically, and initiated a dividend.

-Competitive advantages in production chemical segment include the ability to develop and deploy chemicals rapidly supported by over 2,000 proprietary intellectual property, supply assurance driven by global network of production and distribution centers, and 24/7 problem resolution capabilities with teams in place to address problems at the well site in real time.