IPO Watch – Figs Inc. (FIGS)

![]()

Founded in 2013 by Heather Hasson and Trina Spear, Figs is a direct-to-consumer healthcare apparel and lifestyle brand. Co-CEO Heather Hasson, in her investor letter, talks about her experience going into a “scrubs” store to find out and realize that not only were the product offerings depressing, but the experience was even worse.

“Right then, it was clear to me that both the design and distribution of scrubs were antiquated and ripe for disruption, and that healthcare professionals deserved innovative, functional products and an efficient distribution model built around their particular needs.”

Industry Overview

According to the Bureau of Labor Statistics, the healthcare sector is the largest and fastest growing job segment in the United States, employing over 20 million professionals in 2020. Total U.S. employment between 2019 and 2029 is expected to grow by 15% for all healthcare professionals versus just 4% for all occupations. In 2020, the total addressable market of the healthcare apparel industry was an estimated $12B in the United States and $79B globally, according to an April 2021 Frost & Sullivan study. Unlike most other categories in the apparel sector, the healthcare apparel industry is largely non-discretionary, recession resistant and much less susceptible to fashion or fad risk. Hospitals, medical offices, clinics and laboratories routinely require healthcare professionals to wear scrubs, lab coats and other medical apparel during every shift. Over time, healthcare apparel purchasing has shifted from institutions to the individual, with approximately 85% of all medical professionals now purchasing their own uniforms. Due to frequent wear, healthcare apparel continuously needs to be replenished, resulting in highly predictable, recurring demand for such products.

Company Breakdown

The company generates revenue by selling “technically advanced apparel” for the modern healthcare professional. Their offerings include scrubwear, as well as lifestyle apparel and other non-scrub offerings, such as lab coats, outerwear, activewear, loungewear, compression socks, footwear, masks and face shields. They design their products in-house, leverage third-party suppliers and manufacturers to produce the raw materials and finished products, and utilize initial buys and data-driven repurchasing decisions to test new products.

Due to the non-discretionary, replenishment nature of healthcare apparel, it maintains low inventory risk driven by a high volume of repeat purchases and a focus on core scrubs offerings. In 2020, they said they generated 82% of net revenues from their 13 core scrubwear styles, 5% of net revenues from limited edition scrubwear styles, and the remaining 13% from lifestyle apparel and other non-scrub offerings. They market and sell 98% of these products through their digital platform, consisting of their wearfigs.com website and mobile app, to a rapidly growing community of loyal customers.

It should be noted that their innovative products are “designed, sourced and manufactured from the fiber level. Our proprietary FIONx fabric technology is made from what we believe to be the best combination of materials and is core-spun for maximum durability to withstand the demands of a healthcare professional’s work without sacrificing comfort.”

Growing the Brand

International Expansion – While the majority of near-term growth will come from the U.S., the company believes there is a tremendous opportunity over the long term to serve healthcare professionals throughout the rest of the world. According to the Frost & Sullivan study, the number of healthcare professionals and medical students internationally is expected to grow from approximately 118M in 2020 to an estimated 124M in 2025, and the total addressable market for international healthcare apparel is expected to grow from an estimated $67B in 2020 to an estimated $86B in 2025. In 2020, the company noted it successfully piloted international expansion by selling into Australia, Canada and the United Kingdom. In order to offer a more localized experience to customers internationally, Figs plans to launch products that are specific to local markets and digital experiences that are tied to local culture.

Additional Verticals – Outside of the healthcare industry, the company believes they have a compelling long-term opportunity to enter into other uniform-wearing professional markets. In the United States, there are 40M people outside of healthcare in service-based industries that traditionally wear uniforms every day, such as food service, hospitality, construction and transportation. The occupational nature of these professions is generally hands-on, labor-intensive and often requires apparel with technical specifications. Furthermore, they believe the incumbent apparel manufacturers in these markets suffer from limitations similar to those faced by the legacy healthcare apparel manufacturers. “In our view, these markets—similar to the healthcare apparel market—have long been underserved by incumbent apparel manufacturers and are ripe for disruption. We believe we are strategically positioned to leverage our core competencies to expand into these new markets in the future.”

Company Metrics

Finally, per their S-1 filing, the company laid out some specific definitions:

Active Customers = We define an active customer as a unique customer account that has made at least one purchase in the preceding 12-month period.

Average Order Value = We define average order value as the sum of the total net revenues in a given period divided by the total orders placed in that period. Total orders are the summation of all completed individual purchase transactions in a given period. We believe our relatively high average order value demonstrates the premium nature of our product. Average order value may fluctuate as we expand into and increase our presence in additional product categories and price points as well as expand internationally.

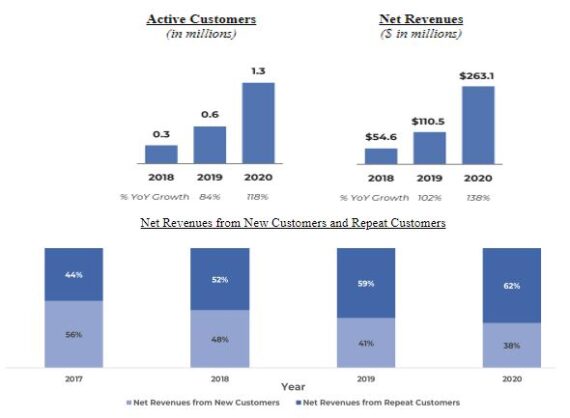

In terms of performance, the company said they expanded their active customers by 118% from 600K to 1.3M from 2019 to 2020. Meanwhile, net revenue saw an increase of 138% in the same period, going from $110.5M to $263.1M.