JaguarConsumer Weekly Callouts – November 19 (AAP, ARCO, CBRL, CELH, DKNG, GDHG, HD, LOW, LIND, NAPA, VAC)

**PDF Version is also available HERE**

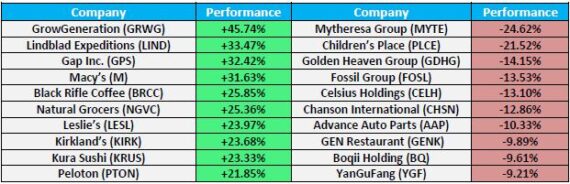

Winners & Losers

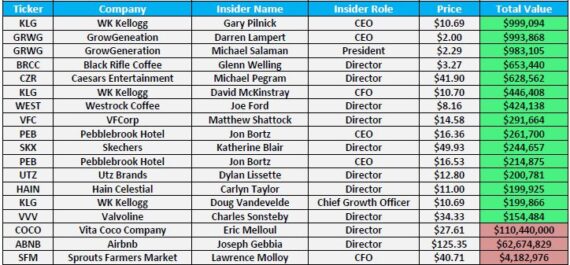

Insider Action

C-Suite Changes

![]()

Industry News

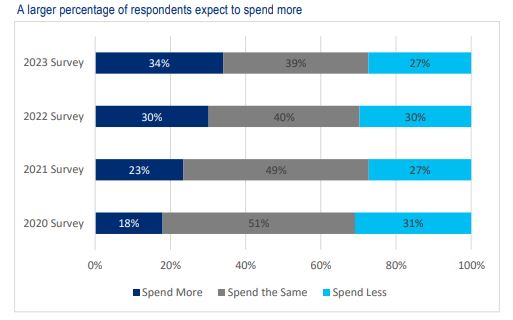

-Citigroup was out this week saying to get a better sense of how the holiday season might shape up in terms of amount of spend, timing of shopping and what and where consumer might purchase, they conducted a survey of 2,800 consumers with Citi’s Research Innovation Lab. Overall, their survey paints a favorable picture for holiday spending. Responses indicated an overall inclination to spend more, with an 11% expected increase in average spend. As to whether consumers are shopping earlier/later than last year, it seems more shopping is expected during December this year vs last year (and within the month of November, respondents planned to shop later in the month), which carries some risk for retailers (because retailers may panic and increase discounts earlier than planned). “However, overall, our survey paints a generally strong outlook for holiday spending.”

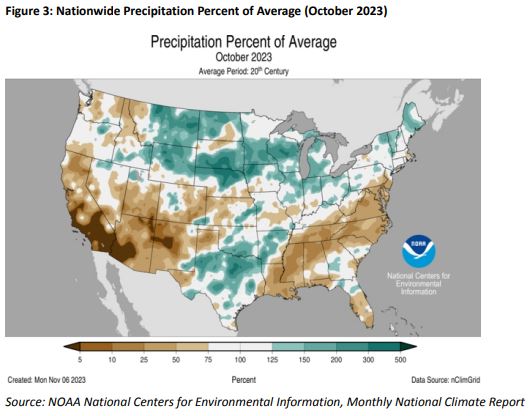

-According to the National Oceanic & Atmospheric Administration (NOAA), the precipitation totals for the month of October were 2.14 inches, or 0.05 inches below average—ranking the month in the middle third of all months over the 129 years of records. In Figure 3 below, precipitation levels were near or lower than average in the Southwest, Midwest, and Southeast (particularly in Florida). B. Riley believes the lower precipitation totals are likely to have played a role in the regional theme parks experiencing positive attendance and spending trends during the important Halloween season toward the latter part of the month. Note that SeaWorld Entertainment (SEAS) management already confirmed that admissions and in-park spending per capita were both positive for the month in the low-single-digit percentage range. “With a storm system forming off the East Coast, there is reported an increased chance of rain and wind gusts throughout the Northeast this coming weekend (November 17-19). According to the NOAA, the Southwest and Northeast are projected to receive above-average precipitation levels during November 22-28 with Florida expected to see an even higher-than-average level of precipitation over the Thanksgiving holiday weekend. Other than that, the major theme park regions in the Southwest and South are expected to have favorable weather conditions during the holiday week.” Recall, on November 2nd, Cedar Fair (FUN) and Six Flags Entertainment (SIX) announced that they had entered into an $8B merger.

-According to a report from Inside Asian Gaming, the Director of Macau’s Civil Aviation Authority (AACM), Pun Wa Kin, said that in the first 10 months of this year, the number of private charter flights to and from the city was 734, which was only 30% of the pre-pandemic level. Speaking to media at the Macau Public Aviation Exhibition, Pun noted that recovery in Macau was well underway although it would take some time before reaching 2019 numbers. “As an international tourist city, the development of Macau’s aviation industry is very important,” he said. Pun added that the aviation industry is moving towards pre-pandemic pace, thanks to the active promotion of the government and the business sector. Related Ticker: Las Vegas Sands (LVS), Melco Resorts (MLCO), Wynn Resorts (WYNN)

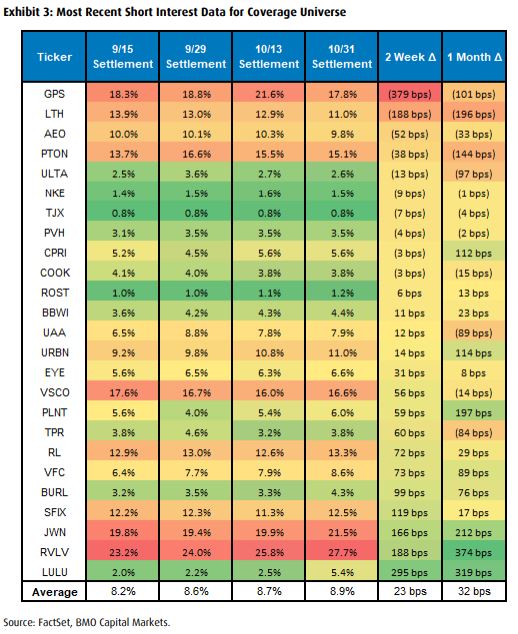

-BMO Capital analyst Simeon Siegel was out on November 14th with his weekly Retail & Services notes where he highlighted short Interest data for the two-week period ending October 31st. Average short interest for their coverage increased approximately 20bps. Per the most recent data from FINRA via FactSet, Gap Inc. (GPS) saw the greatest decrease in short interest across their coverage as a percentage of float (which definitely aligns with their investor discussions), while Lululemon (LULU) saw the greatest increase during this time frame. LULU’s increase in short interest was particularly notable as it marked the greatest period-over-period percentage increase in the nearly six years of data on FINRA’s website. “From our discussions, we believe many investors used the S&P 500 inclusion share price increase as an opportunity to short the stock.” They would also call out Ralph Lauren’s (RL) ~70bps increase in short interest as it marked the greatest percentage increase in over four months, which may have helped explain what appeared a moderate short squeeze post the recent EPS print.

Company Commentary

Advance Auto Parts (AAP) – Shares fell by nearly 5% on Wednesday following the company’s Q3 earnings results. On the conference call, new CEO Shane O’Kelly would stress the urgency to help stabilize the company and return to profitable growth. “Those actions are: Number one, the initiation of a sale process for Worldpac. Number two, the initiation of a separate sales process for our Canadian business.”

Morgan Stanley believes a Worldpac sale would give AAP better financial flexibility to transform its underlying supply chain/merchandising operations, especially in light of its recent credit downgrade.

“That the decision was made so quickly following the appointment of new CEO Shane O’Kelly (who took over in September) further underscores the value and attractiveness of the asset, in our view. We estimate WORLDPAC generated ~$2.2B in sales in 2022 with a high-single-digit EBITDA margin, and per our math could be worth ~$1B-$3B. Possible uses of proceeds could include share repurchases, bolstering of liquidity, and to fund capital investments, or some combination of the above (our theoretical accretion build is available upon request).”

Morgan Stanley would also mention the company’s recent credit downgrade from BBB- to BB+ (mentioned in Consumer Callouts on September 17th). This has not had an impact on its supply chain financing program yet, based on both management’s commentary and AAP’s payables/inventory ratio, which increased to 80% in Q3 vs. 75% in Q2. That said, over time, Morgan Stanley believes the downgrade could have a knock-on effect to AAP’s business, including 1) Higher borrowing costs to vendors, 2) Banks lowering the overall capacity on the vendor financing program (~92% or $3.9b of the $4.3b in total capacity is being utilized as of Q3), or 3) A higher borrowing rate to AAP’s revolver.

Arcos Dorados (ARCO) – Shares were up 8.5% on Thursday following Q3 results that saw the company report EPS of $0.28 vs $0.22 estimate and Revenue of $1.13B vs $1.09B estimate. For those that do not know, Arcos Dorados operates and franchises McDonald’s restaurants in the Latin America region.

Total Comps increased 37.3% Y/Y

Brazil Division Comps increased 10.8% Y/Y

North Latin American Division (NOLAD) Comps increased 11.5% Y/Y

South Latin American Division (SLAD) Comps increased 93.8% Y/Y

Front counter sales, which include self-order kiosks, grew 41% in constant currency versus the prior year and generated 58% of systemwide sales. Third quarter results were also supported by continued outstanding performance in Delivery, which grew 48% in constant currency versus the prior year. Drive-thru sales grew 17% in constant currency, complementing the strong growth of front counter sales. Digital channel sales reached $731.5M and accounted for 50% of systemwide sales in the third quarter. As of the end of September, the Company’s Mobile App had over 107M accumulated downloads, with about 17M average monthly active users, and identified sales representing 20% of consolidated sales in the quarter.

Cracker Barrel (CBRL) – With no signs that the promotional environment has eased (CBRL pointed to this as a driver of F4Q traffic weakness), Citigroup sees little to be excited about in terms of traffic momentum during F1Q24 (ended 10/27/23). They also expect to still be in a holding pattern as it relates to any major strategic/capital allocation shifts with the new CEO (Julie Masino) officially taking the reins on November 1st, and, to the extent CBRL offers more insight into FY24 guidance, they expect a high degree of conservatism biases the headline risk to the downside.

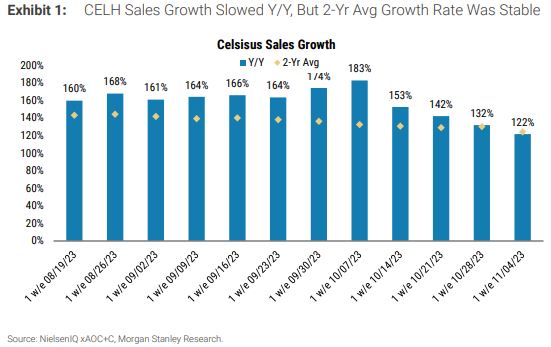

Celsius Holdings (CELH) – Shares fell by just over 13% this week and one of the reasons for this was due to a note that showed “cooling scanner data.” More specifically, Morgan Stanley analyst Eric Serotta would say, “Celsius Y/Y growth cooled in NielsenIQ scanner data for the L2W ended 11/4/23, although 2-year average growth remained robust. Celsius $ share of the energy category declined sequentially to 9.0% for the latest week. While we caution against drawing conclusions from one week of data, we note that Celsius share has been in the 9.0-9.4% range since mid-August. Celsius distribution and velocity growth moderated sequentially but was stable on a 2-yr average basis.” Clients can check out the recent November 14th Webinar where we provided our thoughts on Nielsen as it pertained to another stock.

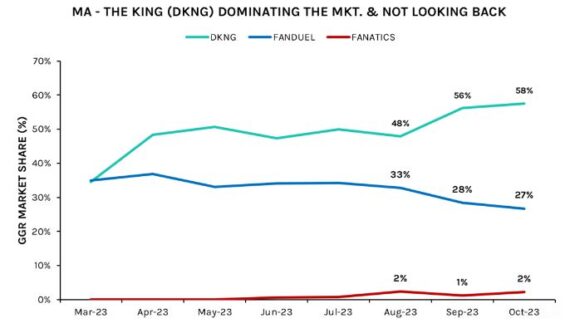

DraftKings (DKNG) – In their Sunday Edge note, Hedgeye GLL analysts Todd Jordan and Sean Jenkins would call out DraftKings and share a specific chart as it relates to the company’s dominance in the state of Massachusetts:

“Recent performance in OH and MA – two marquee state launches in ’23 – suggests that DKNG is making very solid headway went it comes to growing its share of the pie. Though not directly discussed on the Investor Day, DKNG is objectively crushing it in both markets and Q4 Is off to a very good start. In MA, DKNG’s home state, the company is putting up monster share in both handle and GGR terms and controls >55% of the market in terms of hold % and GGR. In OH, DKNG seems to be gaining critical mass and making a lot of progress vs its peers, especially FanDuel. For the seventh consecutive month, DKNG is the #1 market share holder in terms of OSB handle and its GGR share. What’s also noteworthy about MA is that there has been an active push from new entrants but it has not put a dent in DKNG. In fact, as more competition has come to market, DKNG has gained incremental share – another encouraging datapoint for future launches and ahead of new competition (ESPN Bet). DKNG remains a Best Idea Long.”

Golden Heaven Group (GDHG) – This is a China-based theme park operator that saw a volatile swing in its share price this week, ultimately closing the week down 14.15%. On Monday, Hindenburg Research would send out a tweet that said, “NEW FROM US: We Are Short Golden Heaven Group, Another Classic “China Hustle” … $GDHG is a NASDAQ-listed company that operates 6 properties in southern China, consisting of amusement parks, water parks and recreational facilities… $GDHG IPO’d on NASDAQ in April 2023 at $4/share. Its stock has mysteriously rocketed ~493% in 7 months despite little news to justify such a move… $GDHG claimed that in 2022, the company hosted 2.41 million guests across its 6 parks, driving $41.8 million in fiscal 2022 revenue, hardly levels that would justify its ~$1.2 billion market cap as of yesterday’s close.” If one is interested, you can check out the complete thread HERE.

Home Depot (HD) – Shares finished up by 5.4% on Tuesday following Q3 results that show total comp sales declining by -3.1%, driven by transactions -2.7% and ticket -0.3%. By month, comps were -2.1% in August, -3.4% in September, and -3.7% in October (HD U.S. -2.5% in Aug, -3.8% in Sept, and -4.1% in Oct). Of note, management said that comps were relatively consistent throughout the quarter after adjusting for storm-related overlaps and some seasonal shift. The company also shared that Pro sales outpaced DIY, but the performance gap was the narrowest in some time. The team also noted that both internal and external data points to Pro backlogs down from year ago, but still healthy relative to historical norms. As a read-through into Lowe’s (LOW), which will be reporting on Tuesday, November 21st before the open, RBC Capital would mention that over the past 22 quarters, Lowe’s U.S. has on average underperformed HD U.S. on the comp line by approximately 80 bps, which based on HD’s-3.5% comp implies LOW Q3 comp around -4.3%. “We, however, expect the spread to be a bit wider this quarter as HD mgmt shared that Pro sales outpaced DIY – as a reminder, HD is ~55% DIY/~45% Pro vs. LOW ~75% DIY/~25% Pro. It’s also worth noting that HD shared that big ticket comp transactions were worse than the Company average at -5.2%. We note that appliances make up ~14% of LOW sales vs. ~9% for HD. We believe investors are expecting LOW comp sales in the -5% to -7% range (cons. -5.4%).”

Lindblad Expeditions (LIND) – For those that do not know, Lindblad is an expedition travel company that focuses on ship-based voyages as well as on land-based travel. Shares had a monster week, up over 33%, after it announced their partnership with National Geographic is going to be extended by 17 years (was set to expire in 2025) to 2040. This new agreement not only extends the relationship between the two parties but expands the relationship as well. Under this new agreement LIND will now be able to sell their products and have access to The Walt Disney Company’s (DIS) sales channels and marketing tools. The current relationship revolved around just the National Geographic brands but under the new relationship, LIND will have access to Disney, Disney +, Disney Cruise Lines and Disney Vacation Club. Stifel analyst Steven Wieczynski would issue a note saying:

“It’s simple, this news is extremely positive. We believe the uncertainty around the long-term opportunity/relationship with National Geographic was a massive investor overhang. This morning’s news removes this overhang on the LIND story. While we still have a lot of questions about the new relationship, we believe the biggest positive revolves around LIND’s ability to now tap into Disney’s sales channels. LIND now has the ability to cross-sell their products to Disney Cruise Lines and Disney Vacation Club Guests. LIND also will now be included in Disney’s travel trade portfolio and LIND will have access to Disney/National Geographic’s marketing lists. This new exclusive relationship with Disney is for expedition ships.”

The Duckhorn Portfolio (NAPA) – After the close on November 16th, the company announced that it has entered into a definitive agreement to acquire Sonoma-Cutrer Vineyards, one of the largest luxury Chardonnay wineries in the U.S., from Brown-Forman (BF/A), for approximately $400M to be paid in a combination of company stock and cash. BMO Capital would say, “Sonoma-Cutrer aligns with NAPA’s portfolio as it participates in the higher-growth luxury wine segment (retail prices $20-$50/bottle), fills a portfolio gap (NAPA is underrepresented in Chardonnay, which accounts for 97% of Sonoma-Cutrer retail sales), and realizes growth at least consistent with if not better than NAPA’s high-single-digit long-term sales growth target based on Circana data (11% four-year CAGR, including 9% growth in latest 52 weeks). There should be ample opportunity for Sonoma-Cutrer growth over the long term given its measured channel ACV of ~40 relative to NAPA’s ~50, which itself leaves meaningful room for distribution growth.”

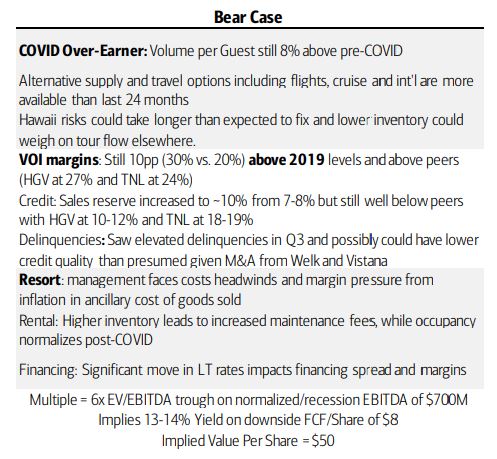

Marriott Vacations (VAC) – Back on August 17th in Conversations, we presented the bear case for VAC following the Maui wildfires. Shares have been on a steady downtrend trend since, going from around $112 to $80. On Friday, BofA would downgrade the stock from Neutral to Underperform saying they see multiple risks from here:

• Margin pressure across all ancillary lines of business. This includes financing (higher interest rates/lower spread) rental (higher maintenance fees on inventory), resort management (higher costs of goods sold for operated outlets), and exchange (structural usage issues of points relative to fixed weeks).

• Rising delinquencies. This was a unique and idiosyncratic call out relative to peers who both have both higher loan loss provisions 8.4%/16.9% for HGV and TNL vs. 8.2% for VAC and/or a higher allowance at 30.1% for HGV and 18.6% for TNL vs. 17.8% for VAC. We think the issue is, in part, lower credit quality of acquired customers (Sheraton/Vistana in particular) but it also seems like a new behavior relative to expectation and we haven’t experienced any real consumer stress (yet).

• Elevated VOI margins. VOI margins are still well above peers and above pre-COVID. This is largely to VAC’s high inventory cushioning its development margin, but we also think benefits from a lower sales reserve and existing vs. new owner mix. Higher sales mix to either new owners or to drive tours could pressure these margins. We estimate full normalization to pre-COVID VOI margins would equate to an incremental $157M of EBITDA hit versus our current below Street EBITDA.