Masimo (MASI) – A Timeline of Unfortunate Events

Masimo (MASI) is a global medical technology company that develops and manufactures innovative noninvasive patient monitoring technologies, including medical devices and a wide array of sensors. A key medical technology innovator, Masimo is responsible for the invention of award-winning noninvasive technologies that are revolutionizing patient monitoring, including Masimo SET® pulse oximetry, Masimo Rainbow Pulse CO-Oximetry, and new Masimo noninvasive and continuous total hemoglobin (SpHb™) monitoring technology.

Unfortunately, shares of Masimo are currently down 53% YTD with three talking points needing more clarity:

Sound United

Back on February 15th, in conjunction with their Q4 earnings report, they announced it had acquired Sound United, a consumer technology company that offers a broad portfolio of high-performance home audio products, including speakers, surround sound systems, sound bars, wireless music systems, amplifiers, turntables and headphones. Its products are marketed under several well-known audio brands – Denon, Marantz, Polk Audio, Classé, Definitive Technology, HEOS and Boston Acoustics. This acquisition caused confusion among the masses, with the stock dropping 36% in one day.

UBS would say that the company continues to see strong trends and expects another solid year of shipments, but moving into consumer areas with the acquisition of Sound United also adds risks by drawing in consumer assets that do not have the same moat or garner the same multiple as Masimo’s core franchise.

Meanwhile, Piper Sandler said the company’s acquisition of Sound United brings “too many questions/unknowns” regarding the fit acquisition rationale. The analyst believes “investors faced with the same conundrum will have a hard time stepping in to buy shares even in spite of immediate accretion.”

Then, on July 13th, Masimo made a surprising announcement in an 8-K filing in which they sent Kevin Duffy, President of Masimo’s Consumer Division (previously Sound United), a “notice of termination without cause,” effective August 5th. This just added more uncertainty around the recently closed acquisition.

W1/Apple Litigation

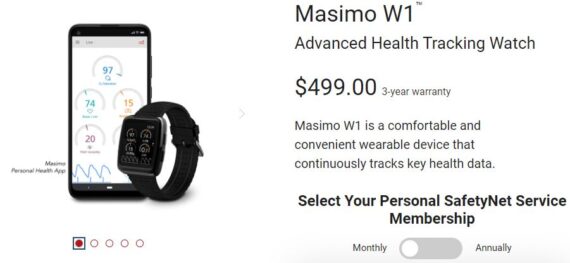

On the company’s last earnings call, CEO Joe Kiani would say, “Our W1 Bio sensing Watch is now in limited market release. We’ve been moving and receiving excellent feedback and expect the full market launch of the W1 to occur this quarter.” Stifel analyst Rick Wise would say that his numbers will remain unchanged for several reasons: (1) W1 manufacturing capacity will take another month to completely ramp, (2) At $500 per watch, their rough math suggests MASI would need to sell, in the next four months, ~25K units to add 100bps to full-year 2022 revenue growth. “While the company is not providing specific W1 guidance, reaching that unit volume level in the first four months post-launch seems challenging.”

However, on Friday, MacDailyNews reported that Apple filed a lawsuit against Masimo in a Delaware federal court. Apple alleges that the W1 watch copies the design and functionality of the Apple Watch. In a note from Piper Sandler, analyst Jason Bednar notes that per the filings, Apple is requesting a jury trial, is seeking to enjoin Masimo from further infringement, and is requesting financial damages for the infringement. The analyst said he “can’t help but look at these suits brought by Apple with a skeptical eye.” He thinks either Apple sees W1 as a more legitimate threat than he initially considered, or that this is could be an attempt to escalate the legal battle between the two companies and distract from the other ongoing cases.

Yes, based on reports from late-summer, Masimo has three other outstanding cases against Apple: one trade-secret case and two patent-infringement cases. Two of the cases will be tried in one District Court and the third with the International Trade Commission.

Activist Investor

Finally, back on August 16th, activist investor Politan Capital Management, founded by veteran activist Quentin Koffey, announced it had a 8.4% stake in Masimo. Politan’s plans were to push the medical device company to take action to improve its stock price following the poorly received acquisition of Sound United.

Then, last Friday, Politan, filed a lawsuit in the Court of Chancery of the State of Delaware against the company and its Board of Directors. Politan would say, “The suit is in response to amendments to Masimo’s bylaws that the Company adopted on September 9, 2022- one week after its only meeting with Politan – at which time the Board also instituted a stockholder rights agreement.”

Wolfe Research would issue a flash note titled, “The Spice Level Here Just Went from Jalapeno to Habanero,” saying that this situation, developing for a couple months, is now decidedly spicier than it was. “The legalese of this matter is dense and on some levels beyond us. But…we will say one thing and conclude with a question.”

“Politan makes a series of reasonable observations…Why not constructively engage with this shareholder?”