Monster Beverage (MNST) – Energy Efficient

Monster Beverage (MNST) needs no introduction. It is a name we have been bullish on for quite some time. In 2021 alone, we have covered the name in JaguarLive numerous times, as well as in JaguarWebinar and Jaguar Conversations.

We are several weeks away from the company’s Q1 results (date not confirmed), but we have started to get channel checks. Last night, Stifel analyst Mark Astrachan would raise his price target to $110 from $105 highlighting that U.S. scanner data via IRI has been solid, with Monster’s Q1 sales increasing 14% Y/Y in tracked channels. They anticipate U.S. sales will accelerate through the first half of 2021, with low-double-digit growth expected to continue through at least Q4. “Strong growth will be driven by favorable Y/Y comparisons, generally healthy category trends, and innovation. Notably, Fall 2020 and Spring 2021 innovation (Ultra Watermelon, Gold and juice brands Khaotic, Papillon) have performed very well, accounting for greater than 5pts of incremental sales growth since late October.”

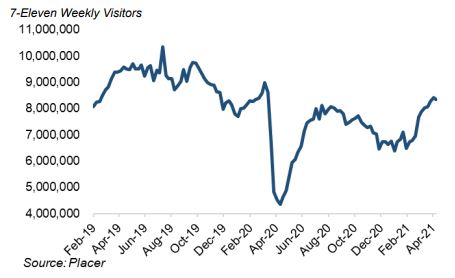

In addition, Stifel points out that C-store channel foot traffic is improving. This is certainly favorable for the stock and the energy drink category as it accounts for ~2/3 of U.S. category sales (45% of total Monster sales). “We expect increased fuel demand and miles driven to drive c-store traffic as we enter a more normal U.S. summer driving season, boosted by increasing vaccination levels and a higher skew to domestic travel.” They view 7-Eleven as a proxy for U.S. convenience store foot traffic, as it is the largest U.S. chain by store count. Notably, any improvement in c-store sales trends is favorable to Monster’s gross margin given it is a higher margin channel reflecting largely single-serve sales.

New Products

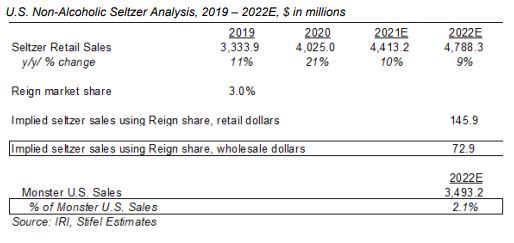

For several months, when we’ve brought up MNST, we kept reminding clients that the company was still contemplating the idea of a hard seltzer launch. Last quarter, the company said they are reviewing options but noted that the alcoholic side is becoming very crowded. In Stifel’s note last night, they believe it is unlikely Monster introduces an alcoholic beverage in 2021, potentially deferring an announcement to September or later for introduction in 2022. They think this reflects not wanting to distract from strong growth and successful innovation in its legacy U.S. energy drink business. They also think delaying an introduction could provide an opportunity for Monster to assess the market following a likely shakeout given the significant increase in offerings from late 2020 through 2021.

However, Stifel believes Monster is likely to announce a non-alcoholic, caffeinated seltzer, under a new brand name, by its June shareholder meeting, with an introduction as soon as mid-to-late summer 2021. They view the product/brand as likely to have a “cleaner” label with fewer, more natural ingredients, possibly without sugar/sweetener, and geared towards consumers of products like Celsius Holdings (CELH) and even Dwayne Johnson’s Zoa Energy product. “Based on trademark filings, we think the new brand could be named “North” or a derivative, with flavors including Watermelon Mist.”