Tractor Supply (TSCO) – Q2 Earnings Preview

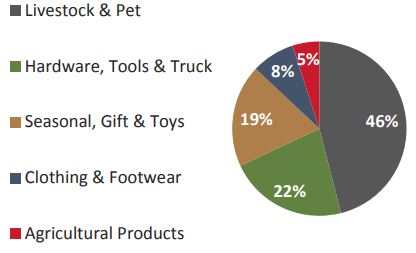

After the close on Wednesday, retail operator Tractor Supply will be releasing its Q2 earnings and Wall Street is expecting the company to report EPS of $1.27 and Revenues of $2.02B. For those that are not familiar with the company, here is how revenues are broken down:

In Q1, the company reported that Net Sales increased 6.6% but Comparable Store Sales decreased 2.2%. The company said the decrease in comp sales was primarily driven by lower sales of seasonal merchandise and the impact of deflation. On a regional basis, sales were most challenged in the Northern regions, where weather had a more pronounced impact on sales for the quarter. The weakness in seasonal categories was partially offset by a positive comparable store sales increase in the Livestock and Pet category.

On the Q1 earnings call, CEO Greg Sandfort would give the following forward-looking statement, “In April, the weather has turned more spring-like and our consumers are responding positively to our assortments, and sales have improved.”

With Q2 in the books, plenty of sell-side firms have now come out with commentary regarding weather trends. Let’s take a look at some examples:

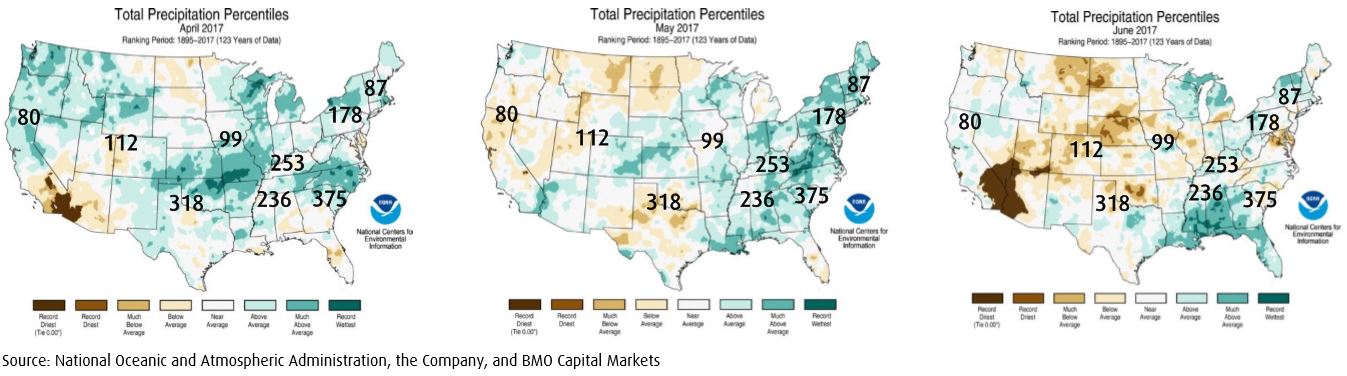

BMO Capital – On July 10th, analyst Wayne Hood said that in April, the eastern half of the U.S., Midwest, and Northwest (~90% of stores) had much higher precipitation than average, but this did not seem to have a material impact on sales as management commented (As Mentioned Above) on the Q1 conference call that seasonal sales were demonstrating a typical acceleration in April. In May, however, higher-than-average precipitation persisted on the East Coast and in the Midwest (~65% of stores), making BMO concerned about potentially below-plan sales in outdoor and seasonal products such as outdoor power equipment, seed, and fencing. That said, sales of certain product categories, such as weed control, tarps, and chain saws, could benefit from wetter conditions.

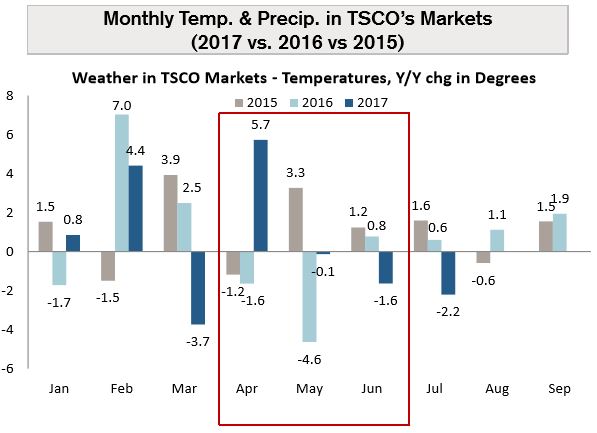

Barclays – On July 20th, analyst Matthew McClintock was out with a preview note saying he expects comp store sales to grow 3%. Although March was weak due to colder weather, April rebounded and was warmer than the prior year across all regions, except the West. May and June were cooler than the previous year across all regions, but weather in these months should be less significant given that they are not transitional periods.

Credit Suisse – On July 21st, analyst Seth Sigman was out saying weather trends were more favorable in April due to warmer weather, but May and June were slightly cooler Y/Y as well as precipitation being noticeable higher (Chart Shown Below).

Robert W. Baird – On July 24th, analyst Peter Benedict said his seasonal checks on Tractor Supply suggest choppy fundamentals driven by pockets of seasonal weather. The analyst expects Q2 to be softer than usual and believes the guidance could be lowered when the company reports on Wednesday.

Finally, it should be pointed out that since last earnings, short interest has moved higher, going from 7.5M shares on April 28th to 11.8M shares as of June 30th. In addition, the following bearish option trades have taken place and remain in open interest:

-Buyers of 970+ January’18 45 Put for up to 1.40 on May 24th

-Buyers of 1,500+ July (28) 51.5 Puts for 1.40 – 1.45 on July 24th