Unlock: Industrials (XLI) Trade Idea

(This XLI Trade Idea was issued on July 23 for $1.15. The September 53 Puts were closed today for $2.00 or +73% gain)

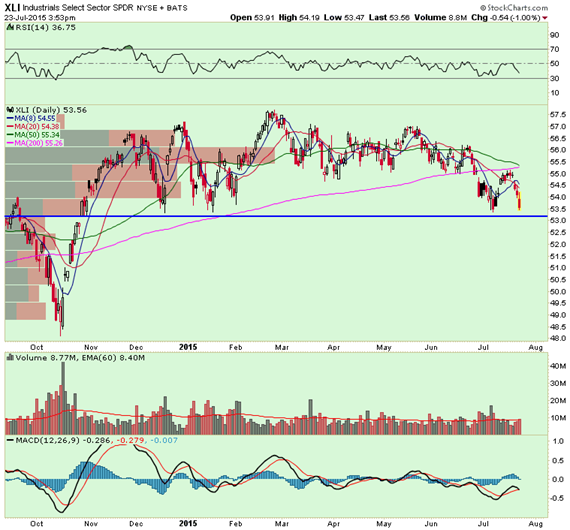

SPDR Industrial Select Sector

Ticker: XLI

Sector: Industrial

Current Price: $53.58

Target: $50.00

Stop Loss: $55.20

Time Duration: 57 Days

Trade Idea: Buy XLI September 53 puts for $1.15 debit or less.

Sometimes option activity is so big that it is not worth fighting. Caterpillar (CAT) is breaking down today through significant $80 support after bad earnings and we believe any rally will be short lived. General Electric (GE) isn’t faring well either, down 1.5% after earnings. 3M (MMM) down 3.9% after earnings. United Tech (UTX) cut guidance twice in one month. Union Pacific (UNP) which is the biggest railroad operator is down 5% after cutting guidance and hitting new 52-week lows. Emerson Electric (EMR) cut its 3-month rolling order book according to 8K SEC filing. With the exception of Boeing (BA) which has a large revenue backlog, all heavy industrial stocks are selling off sharply this week.

One large bear rolled puts down as following in XLI today:

– 80,000 Sept 55 puts closed for $2.10 credit

– 129,000 Sept 4W 53.5 puts bought for $1.09 debit

– 38,000 Sept 50 puts bought for $0.42 debit

Overall XLI is trading 290,000 puts. Put volume is 22 times daily average with over $11 million put premium bought.